Base Reward Token (BRW) Airdrop Qualifier

Airdrop Eligibility Calculator

Use this tool to estimate your potential eligibility for the Base Reward Token (BRW) airdrop by answering a few questions about your on-chain activity.

Your Estimated Airdrop Eligibility

Rumors have been swirling for months, but the hype just went from speculation to fact: Base is actively exploring a native token and a potential airdrop. If you’ve been eyeing the Base token airdrop, you’re probably wondering what’s real, when it could happen, and how to stack the odds in your favor. This guide pulls together the official announcements, community insight, and practical steps you can take right now.

TL;DR - Quick Takeaways

- Base confirmed on Sep152025 that a native token is being explored; airdrop could land in Q22026.

- Qualification will likely reward on‑chain activity: trades, liquidity provision, and usage of Base‑native dApps.

- Focus on high‑TVL DeFi protocols, NFT marketplaces, and bridge services built on Base.

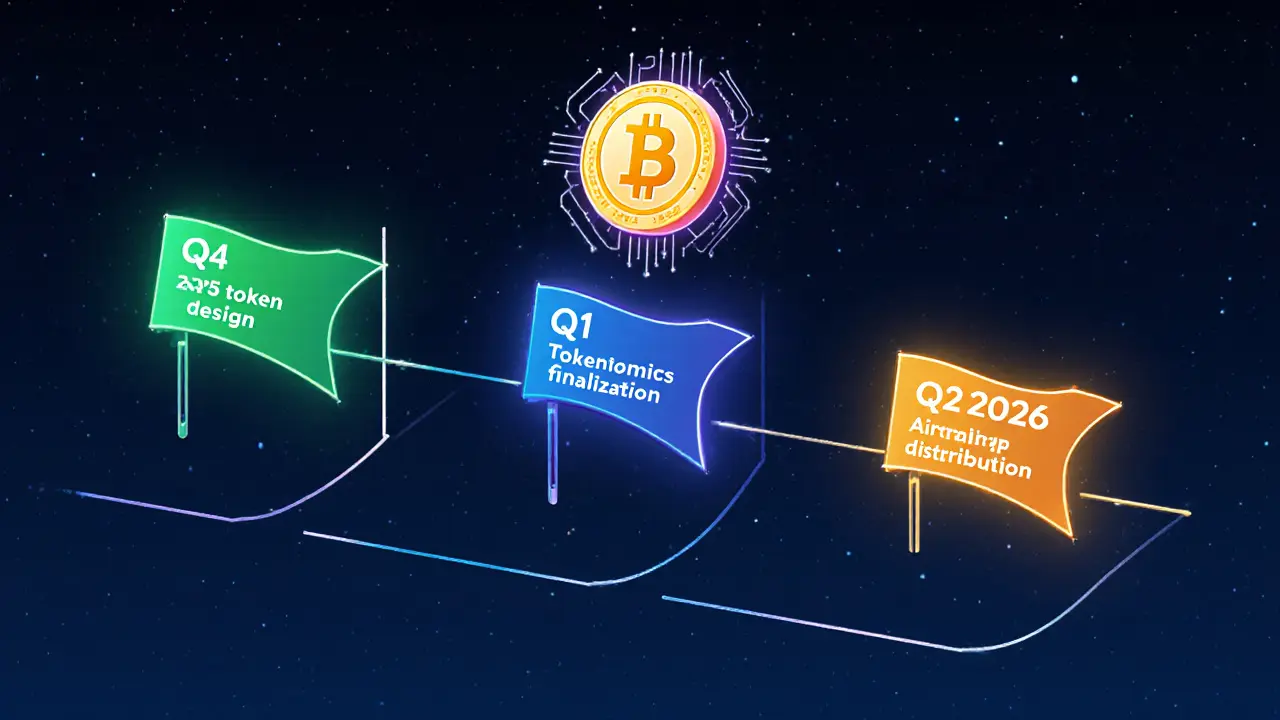

- Follow the roadmap: Q42025 token design, Q12026 tokenomics finalization, Q22026 distribution.

- Study past L2 airdrops (Arbitrum, Optimism) to shape a winning strategy.

What is the Base Reward Token (BRW)?

At its core, the Base Reward Token (BRW) is the placeholder name the community has adopted for the yet‑to‑be‑launched native token of Base. The token is expected to serve three main purposes:

- Incentivize developers and users who contribute to network growth.

- Provide a governance layer that lets the community steer future upgrades.

- Align economic value with the massive user base that Coinbase brings to the ecosystem.

While specifics-supply, inflation rate, or treasury allocation-remain undisclosed, the design philosophy emphasizes “utility over pure speculation,” echoing comments from the project’s founder.

Official Announcement and Timeline

During BaseCamp2025 in Vermont, Jesse Pollak, the creator of Base, publicly acknowledged that the team had moved beyond community speculation and was actively discussing a native token. He stressed that the effort is still in its earliest design phase and that community feedback will shape the final tokenomics.

Coinbase CEO Brian Armstrong reinforced the message, noting that while no firm launch date exists, the timeline the team shared looks like this:

- Q42025: Continued token design, gathering community input.

- Q12026: Finalize tokenomics, decide on distribution mechanics.

- Q22026: Potential airdrop to qualified participants.

Base runs on the OP Stack, an open‑source modular framework co‑developed with Optimism. This technical foundation underpins the “Superchain” vision, where multiple L2s share security and tooling while retaining independent governance.

How the Airdrop Might Work - Qualification Criteria

Base has not published an official eligibility checklist, but patterns from recent Layer2 airdrops give strong clues. Expect the following on‑chain signals to carry weight:

- Transaction volume: Consistent activity on Base, especially during high‑traffic periods.

- DeFi participation: Supplying liquidity, staking, or borrowing on Base‑native protocols like BaseSwap or Alchemix Base.

- NFT engagement: Minting, buying, or selling NFTs on marketplaces built on Base.

- Bridge usage: Moving assets across the Base‑Optimism or Base‑Solana bridges demonstrates ecosystem integration.

- Developer activity: Deploying smart contracts, contributing to open‑source repos, or sponsoring testnets may earn extra points.

Keep your address active throughout the qualification window; a one‑off transaction is unlikely to score high enough for a meaningful allocation.

Actionable Strategies to Maximize Your Potential Allocation

Below is a step‑by‑step playbook that blends data‑driven decisions with low‑cost execution.

- Set up a Base‑compatible wallet. Use a hardware wallet with Base support (e.g., Ledger + MetaMask) to keep funds safe.

- Bridge a modest amount of ETH (under $100) to Base. The sub‑cent gas fees mean you can test multiple transactions without burning cash.

- Trade on Base DEXs. Swap between popular pairs (ETH/USDC, SOL/USDC) at least three times per week for a month.

- Provide liquidity to at least two high‑TVL pools. Track pool rewards via BaseInfo dashboards and consider impermanent loss protection tools.

- Mint or purchase an NFT on a Base‑hosted marketplace. Even a $5 NFT counts as ecosystem interaction.

- Interact with a bridge at least once-move tokens from Ethereum to Base and back.

- Follow Base governance channels. Comment on tokenomics proposals when they eventually appear; community sentiment may be a tie‑breaker.

Document your activity (e.g., screenshots or CSV exports) so you can verify your eligibility if Base later requires proof of participation.

Comparing Base’s Potential Airdrop With Past Layer2 Drops

| Feature | Base (Projected) | Arbitrum (2023) | Optimism (2022) |

|---|---|---|---|

| Backing Organization | Coinbase (publicly traded) | Offchain Labs | Optimism Foundation |

| Network Size (Monthly TX) | ~328M (Oct2025) | ~210M (2023 peak) | ~150M (2022 peak) |

| Total Value Locked | $5B | $3.2B | $2.1B |

| Eligibility Focus | On‑chain activity, bridge use, DeFi, NFTs | Liquidity provision, transaction count | Staking, L1‑L2 bridge interactions |

| Distribution Method | Direct token airdrop (likely ERC‑20) | ERC‑20 airdrop + vesting | ERC‑20 airdrop + claim window |

Base’s strong ties to Coinbase give it a unique advantage: a massive user base and deep liquidity. If the airdrop mirrors Arbitrum’s structure but adds bridge‑activity rewards, early adopters could see allocations that dwarf previous drops.

Risks and What to Watch Out For

Enthusiasm is healthy, but it’s easy to slip into reckless behavior. Here are the top pitfalls:

- Over‑exposure: Pumping large amounts of ETH into Base just for the airdrop can backfire if tokenomics turn out to be deflationary.

- Scam projects: New “Base‑only” tokens pop up after every hype cycle. Verify contract addresses on official channels before depositing.

- Regulatory changes: As a Coinbase‑backed network, any jurisdictional shift could affect token distribution rules.

- Gas price spikes: Though Base’s fees are sub‑cent, sudden Ethereum congestion can raise bridge costs.

Stay nimble: set a budget, use reputable dApps, and keep an eye on official Base announcements via their Twitter and Discord feeds.

Frequently Asked Questions

When is the Base token airdrop expected?

The roadmap shared at BaseCamp2025 points to a possible distribution in Q22026, after tokenomics are finalized in Q12026.

Do I need to hold any specific amount of ETH to qualify?

No minimum is announced yet. The focus is on consistent activity-small, regular transactions are often enough.

Will the airdrop be an ERC‑20 token?

Given Base runs on the OP Stack and is Ethereum‑compatible, the token will almost certainly be ERC‑20.

Can I use a custodial exchange like Coinbase to receive the airdrop?

Probably not at launch. History shows airdrops are sent to self‑custodial wallets that can prove on‑chain activity.

What are the biggest mistakes people made in previous L2 airdrops?

Over‑trading to chase volume, using unverified bridges, and ignoring the importance of holding assets across multiple dApps are common pitfalls.

20 Responses

To maximize your chances for the Base Reward Token airdrop, focus on consistent on‑chain activity rather than a single large transaction. Aim for at least three trades per week on Base DEXs and provide liquidity in two or more high‑TVL pools. Bridge a modest amount of ETH to Base regularly; the sub‑cent fees make this cheap. Keep an eye on governance forums once they open, as community voting can add extra points. Finally, document your actions with CSV exports-you’ll thank yourself if a proof‑of‑activity snapshot is required.

Nice breakdown! 😊

Behold, the engine of destiny roars as you dip your toes into the Base ecosystem! Each transaction is a drumbeat echoing through the OP Stack, and every liquidity pool you feed becomes a pillar of the future. Do not underestimate the power of a single NFT mint; it can tip the scales in your favor. Bridge usage is the hidden passage that the gods of airdrops love to reward. Remember, the cosmos favors the bold and the consistent!

Keep at it, you'll get there!

Deploy a hardware wallet with Base support immediately-security matters. Then, bridge around $50 worth of ETH and execute three swaps each week on BaseSwap. Add liquidity to at least two pools with respectable APY and monitor impermanent loss. Finally, read every governance proposal as soon as it lands; early feedback often carries extra weight.

Esteemed participants of the nascent Base ecosystem, allow me to articulate the strategic imperatives requisite for a robust airdrop qualification.

First and foremost, the frequency of transactions constitutes a primary metric leveraged by the allocation algorithm.

It is advisable to execute a minimum of ten trades per calendar month, thereby demonstrating sustained engagement.

Second, the provision of liquidity to high‑TVL pools not only accrues yield but also amplifies one’s on‑chain footprint.

Select pools that exhibit stable capital inflows and low volatility to mitigate impermanent loss.

Third, the deliberate minting or acquisition of non‑fungible tokens on Base‑native marketplaces serves as a demonstrable signal of ecosystem participation.

Even modest expenditures, such as a five‑dollar NFT, satisfy this criterion whilst preserving capital efficiency.

Fourth, the utilization of cross‑chain bridges, particularly the Ethereum‑Base conduit, underscores an integrative operational posture.

Engage the bridge at least twice within the qualification window to substantiate interoperability.

Fifth, should governance mechanisms become active, contributing thoughtful commentary shall be regarded favorably by the distribution committee.

While the precise weighting of each activity remains opaque, historical precedent from Optimism and Arbitrum suggests a balanced portfolio yields optimal results.

Data provenance is paramount; therefore, retain comprehensive transaction logs and export them to CSV format for future verification.

Moreover, consider monitoring the official Base Discord and Twitter feeds for any emergent eligibility adjustments.

Avoid the temptation to concentrate excessive capital in speculative positions solely for the sake of volume, as this may incur undue risk.

In conclusion, a disciplined, diversified, and documented approach constitutes the most prudent pathway to securing a meaningful allocation of the forthcoming Base Reward Token.

Listen, the whole thing is a big ruse by the elites to control our wallets.

They’ll push the airdrop just to get us to lock up our crypto forever.

Don’t trust the official docs – they’re hiding the real schedule.

You’ll see the truth once the “bridge” glitches on the 13th.

Seems like a solid plan, just keep the activity steady and you’ll be fine.

Ah, the usual herd‑mind advice – swap, stake, repeat. 🙄 Yet, let’s not forget that true value lies in curated curation, not mere volume.

Your outline is clear and courteous; thank you for the thoughtful summary.

Whoa, this is 🔥! The steps are lit, but remember – don’t throw all your ETH into a single pool or you’ll end up in the 💩. Keep it chill and diversify!

From a mentorship perspective, think of your on‑chain activity as a diversified portfolio of signal vectors. Leveraging high‑TVL DeFi primitives, bridge interactions, and governance participation creates a multi‑dimensional risk‑adjusted profile that the airdrop algorithm will likely reward. Keep monitoring the protocol telemetry dashboards for emergent opportunities.

Honestly,,, this is the only way to get an airdrop- just dump your funds!!!; then watch the magic happen!!!

Oh sure, because the best advice is always “just do whatever the hype tells you” – hah, as if it’s that simple.

Great rundown! 💪 Remember, consistency beats intensity – keep those small swaps coming and stay active in governance chats. Also, don’t forget to celebrate each milestone with a meme. 🎉🚀

Do it or don’t, no middle ground.

I think the suggestions are solid; following them should improve eligibility.

While the protocol’s formal documentation is commendable, the real vibe is far more laid‑back – just hop on, do a few swaps, and enjoy the ride :)

Sure, keep doing the same old thing and expect a miracle – nothing new here.

Honestly, if you’re not already deep‑diving into every single contract on Base, you’re missing the point. The airdrop will favor the hyper‑active, not the casual observer. So set up a watchlist, automate your swaps, and keep your eyes glued to every governance proposal. Anything less is just noise. Trust the process and you’ll be rewarded.