When you're trading crypto and want to go beyond simple buys and sells, BTSE gives you serious tools - but only if you know what you're doing. It's not for beginners. It's not for casual investors. If you're looking to trade BTC with 100x leverage, use SOL as collateral for ETH futures, or set up complex stop-loss triggers on perpetual contracts, BTSE is one of the few exchanges built for that. But here's the catch: if you're new to margin trading or need live customer support when the market crashes, you'll hit walls fast.

What BTSE Actually Offers

BTSE stands for Buy, Trade, Sell, Earn. It launched in 2018 and operates out of the British Virgin Islands, with teams in Singapore, Dubai, Taipei, and Hong Kong. It doesn't have a banking license anywhere, which means no FDIC insurance, no government oversight, and no protection if things go wrong. But it does have a trading engine that handles over 1 million orders per second. That’s not marketing fluff - it’s a technical spec that matters when volatility spikes and every millisecond counts.

There are over 300 cryptocurrencies supported, including all the big ones: Bitcoin, Ethereum, Solana, XRP, Dogecoin, and even smaller altcoins like APT and TIA. You can trade them in spot markets or use them as collateral for futures contracts. The real differentiator? The Multi-Asset Futures Collateral system. On most exchanges, you need to lock up BTC to trade BTC futures. On BTSE, you can use ETH, SOL, or even USDT as collateral for a BTC perpetual contract. That’s a game-changer for traders who want to keep their capital flexible.

Trading Fees and Leverage

Trading fees start at 0.2% for both makers and takers. That’s not the cheapest out there - BTCC and Bybit sometimes offer 0.1% or lower for high-volume traders. But BTSE makes up for it with its VIP system. The more you trade, the lower your fees go. At VIP 6, you can drop to 0.02% for makers and 0.06% for takers. That’s competitive with institutional platforms.

Leverage is where BTSE shines - and scares people. You can go up to 100x on BTC and ETH perpetuals. That means with $1,000, you can control $100,000 worth of Bitcoin. Sounds powerful? It is. But it’s also dangerous. A 1% move against you wipes out your entire position. Most retail traders lose money with leverage this high. Experts warn against using max leverage unless you're a professional with strict risk controls. For altcoins, leverage caps at 20x, which is still aggressive compared to Coinbase’s 5x or Kraken’s 10x.

Security and Withdrawals

BTSE claims 99.9% of user funds are stored in cold wallets. That’s standard for serious exchanges. They also use 2FA, anti-phishing codes, and real-time account monitoring. No major hacks have been reported since launch. That’s a good sign.

Withdrawals? No limits on over 150 cryptocurrencies and 12 fiat currencies. That’s rare. Most exchanges cap withdrawals unless you complete enhanced KYC. BTSE doesn’t. You can pull out $500,000 in ETH in one go - if you can get the transaction approved. But here’s the problem: you can’t deposit fiat directly. No bank transfers, no PayPal, no credit cards. You need to buy crypto elsewhere, send it to BTSE, then trade. That’s a dealbreaker for many.

Mobile App and User Experience

The mobile app looks clean. The interface is modern. Charts are detailed. But users report crashes during high-volume events - like when Bitcoin drops 10% in 10 minutes. That’s not acceptable. If your app goes down when you need to exit a leveraged position, you lose money. Some traders say the desktop version is more stable, but if you’re on the move, that’s not always an option.

Beginners will find the platform overwhelming. There are too many tabs: Spot, Futures, Margin, Copy Trading, AutoTrader, Earn. Each has its own settings. The AutoTrader tool lets you follow other traders’ strategies, but there are only about 50 masters to choose from - far fewer than on eToro or NAGA. And the copy trading feature doesn’t let you adjust risk settings per trade. You just follow blindly.

Customer Support: The Weak Spot

BTSE has no live chat. No phone number. No email address you can directly reach. All support goes through a ticket system. Response times vary from 6 hours to 3 days. Users on Trustpilot and Reviews.io complain about being stuck for days when trying to fix a withdrawal delay or reset 2FA. One trader reported waiting 72 hours to get help after a failed withdrawal - and lost $2,300 in slippage because he couldn’t close his position in time.

There’s a help center with guides, but they’re written for people who already understand terms like “funding rate” and “liquidation price.” If you’re learning, you’re on your own.

Who Is BTSE Really For?

BTSE isn’t for everyone. It’s not for people who want to buy $50 of Bitcoin and hold it. It’s not for those who need quick customer help. It’s not for users in the U.S., Canada, Singapore, or Taiwan - those regions are blocked.

But if you’re an experienced trader who:

- Uses leverage regularly

- Trades multiple crypto assets as collateral

- Needs high-speed execution during volatile markets

- Doesn’t mind managing your own risk

- Has a separate wallet to deposit crypto from other exchanges

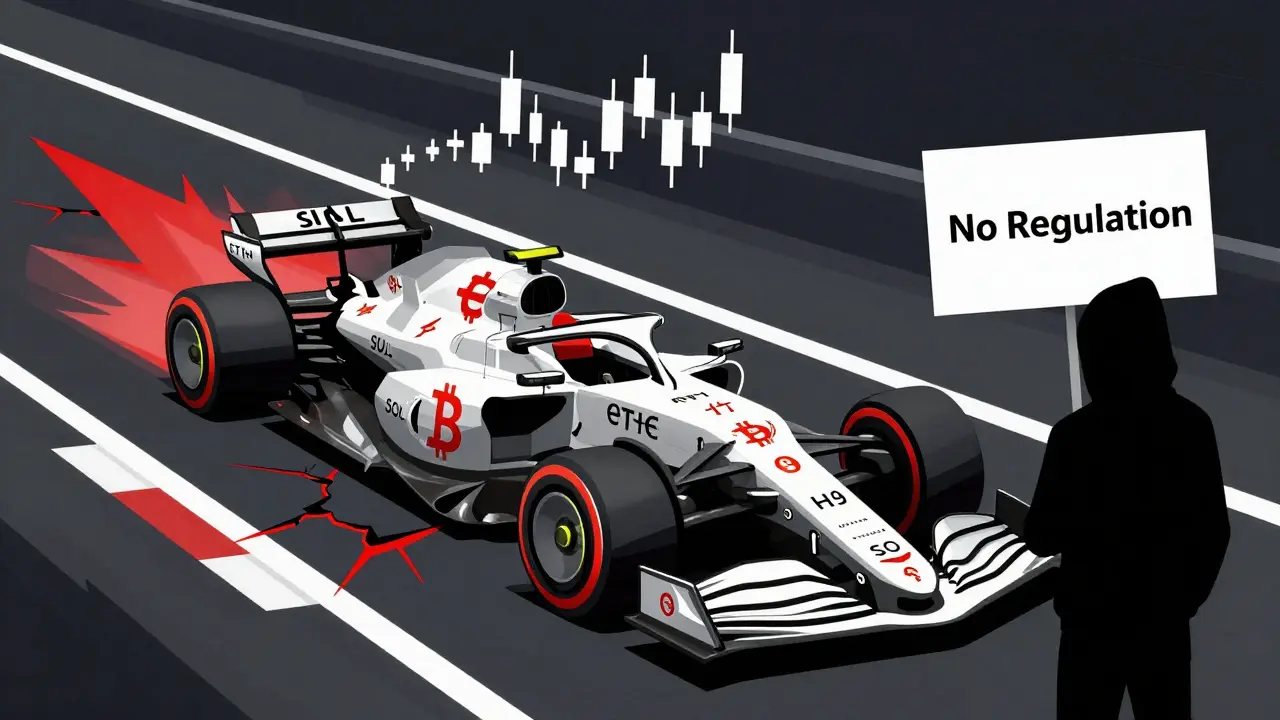

…then BTSE is one of the best platforms available. It’s like a Formula 1 car - no airbags, no cruise control, no backup camera. But if you know how to drive it, it’s faster than anything else on the road.

How BTSE Compares to the Big Players

Here’s how BTSE stacks up against the top three exchanges:

| Feature | BTSE | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Max Leverage (BTC) | 100x | 125x | 5x | 10x |

| Supported Coins | 300+ | 500+ | 200+ | 250+ |

| Fiat Deposits | No | Yes (limited) | Yes | Yes |

| Multi-Asset Collateral | Yes | No | No | No |

| Live Chat Support | No | Yes | Yes | Yes |

| Regulated | No | No (global) | Yes (US) | Yes (US, EU) |

| Best For | Advanced derivatives traders | High-volume traders | Beginners | Security-focused traders |

BTSE doesn’t win on size, regulation, or ease of use. It wins on flexibility and speed for those who know how to use it. If you’re trading large positions with leverage, and you need to switch collateral on the fly, BTSE is one of the only places that lets you do that without jumping between platforms.

The Risks You Can’t Ignore

BTSE isn’t regulated. That means if the exchange gets hacked, goes bankrupt, or decides to freeze withdrawals, you have no legal recourse. No government will step in. No insurance fund will pay you back. You’re trusting a private company with no oversight.

Also, the platform blocks users from major markets. If you’re in the U.S., you can’t sign up. If you’re in Singapore, you’re out. That’s a red flag. Most legitimate exchanges either get licensed or leave those markets entirely. BTSE just blocks them. That suggests they’re avoiding compliance - not because they’re unethical, but because they don’t want the cost or complexity.

And while the platform adds new tokens weekly, that doesn’t mean they’re vetted. Some low-cap coins listed on BTSE have no real use case. Trading them is pure speculation. Don’t assume listing = legitimacy.

Final Verdict: Should You Use BTSE?

Yes - if you’re an experienced trader with a solid risk strategy and a backup plan for support delays.

No - if you’re new, need help fast, or want to deposit fiat directly.

BTSE is a niche tool. It’s not a general-purpose exchange. It’s a professional-grade derivatives engine wrapped in a clean interface. If you’re serious about leveraged trading and want maximum flexibility with collateral, it’s worth a look. But don’t treat it like Coinbase. Don’t deposit your life savings. Keep only what you’re willing to lose. And always have a second exchange for withdrawals in case BTSE goes quiet.

For most people, Binance or Kraken are safer bets. But for those who trade like professionals - BTSE gives you the tools they use.

Is BTSE safe to use?

BTSE has strong technical security - cold storage, 2FA, and no major breaches. But it’s not regulated, so there’s no legal protection if something goes wrong. Treat it like a high-risk trading platform, not a bank.

Can I deposit USD or EUR directly on BTSE?

No. BTSE doesn’t support direct fiat deposits. You must buy crypto on another exchange like Coinbase or Kraken, then send it to your BTSE wallet.

Does BTSE have a mobile app?

Yes, BTSE has iOS and Android apps. But users report crashes during high volatility. For critical trades, use the desktop version.

What’s the best way to use BTSE’s 100x leverage?

Don’t. Even experienced traders avoid max leverage. Use 5x-10x max, set tight stop-losses, and never risk more than 2% of your capital on one trade. Leverage amplifies both gains and losses - and losses can wipe you out instantly.

Is BTSE better than Binance?

For derivatives with multi-asset collateral? Yes. For overall usability, support, and coin selection? No. Binance has more coins, live chat, fiat deposits, and better liquidity. BTSE wins only in niche areas for advanced traders.

Can I use BTSE if I live in the U.S.?

No. BTSE blocks users from the U.S., Canada, Singapore, Taiwan, Russia, and Venezuela. If you’re in one of these regions, you cannot sign up.

How long do withdrawals take on BTSE?

Most crypto withdrawals process in under 30 minutes. Fiat withdrawals aren’t available. Withdrawal speed depends on blockchain congestion, not BTSE’s system.

Does BTSE offer staking or earning interest?

Yes. BTSE has an "Earn" section where you can stake certain coins and earn interest, typically between 3% and 15% APY. But rates vary and are not guaranteed. Treat it as speculative yield, not a savings account.

26 Responses

BTSE is for pros who don’t need hand-holding. If you’re still asking if it’s safe, you’re not ready.

OMG I tried BTSE once and my position got liquidated in 3 seconds 😭 I swear the platform hates me. Like why does it even exist??

They block the US? Classic. They’re dodging regulation because they’re a front for some offshore hedge fund laundering crypto. I told you this was a scam from day one.

Look, I come from Johannesburg and I’ve seen exchanges rise and fall. BTSE isn’t perfect, but if you’re serious about trading, this is one of the few places where your capital doesn’t get stuck in bureaucratic mud. The multi-collateral system? That’s innovation. Most people don’t get it because they’re too scared to learn. You want safety? Go to a bank. You want growth? Get comfortable with risk.

100x leverage is just gambling with a fancy name and I’m tired of people acting like it’s a skill. You’re not a trader, you’re a roulette player with a spreadsheet

The multi-asset collateral architecture is a structural innovation in DeFi infrastructure. It decouples collateral liquidity from underlying asset exposure, enabling dynamic portfolio hedging at the protocol layer. This is institutional-grade UX disguised as retail tooling.

I’ve been trading on BTSE for 2 years. The speed is insane. When BTC drops 8% in 20 seconds, you need that engine. But yeah, support is garbage. I once had a withdrawal stuck for 48 hours. Had to post on Twitter to get it moved. The system works, the people behind it don’t.

What’s the point of having 300 coins if half of them are pump-and-dumps? I traded APT on BTSE last month and it vanished from the chart after 3 days. No announcement, no warning. Just gone. I’m not saying don’t use it, but do your own research - don’t trust listings.

If you’re new, start small. Use 5x leverage, not 100x. Set stop-losses before you even open the trade. BTSE isn’t the enemy - overconfidence is. I lost my first 2K on this platform, but I learned more in 2 weeks than I did in 6 months on Coinbase. It’s a gym, not a babysitter.

Of course it’s ‘for experienced traders.’ That’s just code for ‘we don’t care if you lose money.’ The fact that they block the US isn’t a feature - it’s a confession. They know they’re too risky to be legal.

There’s a philosophical tension here - freedom vs. safety. BTSE offers radical freedom. No oversight, no limits, no safety nets. But that’s the point, isn’t it? Capitalism stripped bare. If you want comfort, you’re already dead in this game.

Why are Americans even talking about this? We have Coinbase. We have Kraken. We have regulation. This is some third-world exchange trying to lure dumb money. Stay away. Keep your money in America.

I love BTSE but I also love my sleep 😴 so I only trade when the market’s calm. And I keep 90% of my crypto on Ledger. BTSE is just my trading lab. Don’t put your life savings here. Put your curiosity here. 💸

100x leverage is a trap. I watched a guy turn $500 into $50,000 in 3 days. Then he lost it all in 10 minutes. I cried for him. Not because I cared - because I saw myself in him.

From Nigeria to the world, I appreciate BTSE for letting me trade without needing a bank. But please, always double-check your withdrawal address. I once sent ETH to the wrong wallet and lost $800. The platform didn’t help. I had to learn the hard way. Be careful.

Every tool has its purpose. A scalpel isn’t bad because it can cut you. It’s bad when you use it to open a can of beans. BTSE is a scalpel. Most people are trying to use it as a hammer.

They don’t have live chat because they don’t want to talk to losers. If you’re asking how to use 100x, you’re already a statistic. This isn’t a platform, it’s a filter.

Let’s be real - BTSE is the Ferrari of crypto exchanges. But you need a racing license to drive it. Most people just want a Prius that gets them to the grocery store. Stop pretending you need a Ferrari. You don’t.

Used BTSE for 6 months. The app crashes every time volatility spikes. I missed 3 exits because of it. Lost over $12K. I don’t blame the market - I blame the dev team. If you’re serious, use desktop. Mobile is a death trap.

BTSE is a casino with a trading interface. They don’t care if you win or lose. They just want your trading volume. The VIP system? That’s how they incentivize you to gamble more. Don’t be fooled.

Block the US? Good. I’m glad they did. I don’t want Americans on my exchange. They all think they’re day traders. They’re not. They’re just rich people who don’t know how to invest. Let them stay on Coinbase.

BTSE isn’t for everyone - but it’s perfect for the quiet ones. The ones who don’t need hand-holding, who study charts for hours, who set limits and walk away. If that’s you, this place is a gift. If you’re screaming at your screen every time the price moves… maybe try something else.

Multi-asset collateral? That’s just a fancy way of saying ‘you can use anything as collateral even if it’s worthless.’ I traded Dogecoin as collateral for BTC futures once. Lost everything. Don’t be fooled by buzzwords.

100x leverage is suicide. I’ve seen it happen too many times. One bad tweet, one FOMO pump, and you’re wiped. BTSE doesn’t care. They make money whether you win or lose. Don’t be the next headline.

Let me tell you something about BTSE. They don’t have regulation because they don’t want to be audited. They don’t have live support because they don’t want to be questioned. They don’t allow fiat deposits because they don’t want to trace your money. This isn’t a trading platform - it’s a black box for hedge funds to move money without scrutiny. And you’re just the fuel.

BTSE is like a desert highway - no gas stations, no signs, no mercy. But if you know your route, you’ll reach your destination faster than anyone on the interstate. Don’t blame the road for being harsh. Blame yourself for not preparing.