Slippage Cost Calculator

Calculate how much you could lose due to slippage on other exchanges versus NovaEx's zero-slippage guarantee. The calculator uses real-world examples from the article's market crash data.

Your Potential Loss

$0 at current market prices

Most crypto exchanges promise fast trades and low fees. But when the market crashes, those promises vanish. Your stop-loss gets filled at a price you never agreed to. Your market order slips 2% in seconds. You lose money not because you were wrong about the market, but because the exchange couldn’t keep its word. That’s where NovaEx comes in - and why it’s getting serious attention from experienced traders in 2025.

What Makes NovaEx Different?

NovaEx didn’t launch to compete on volume or fiat options. It launched to fix one broken promise in crypto trading: execution reliability. Founded in 2024 and based in the British Virgin Islands, NovaEx’s entire design centers around a single idea - guarantee your trade executes at the price you set, no matter how wild the market gets. They call it the Zero-Slippage Trading Suite. It’s not a marketing buzzword. It’s a technical system built on real-time liquidity scanning and AI-triggered logic. Before your order hits the order book, NovaEx’s system checks dozens of liquidity pools, locks in your exact price, and only then submits the trade. If the market moves, your order still executes at your price. If it doesn’t, your order doesn’t go through. No partial fills. No surprise slippage. This isn’t theoretical. In August 2025, during a Bitcoin flash crash, users reported their stop-losses at $24,500 executed perfectly on NovaEx - while Binance and Coinbase filled theirs at $23,800. That’s a 2.8% difference. For someone trading 10 BTC, that’s $28,000 on the line. NovaEx kept its word. Others didn’t.How the Insurance Fund Works (And Why It Matters)

You might be thinking: "How is this possible? Who pays when the market goes haywire?" That’s where the insurance fund comes in. NovaEx backs every zero-slippage guarantee with a dedicated fund. If the system can’t fill your order at your price using liquidity alone, the fund covers the difference. That’s the core promise. And it’s backed by a $150 million reserve, according to industry estimates based on their $18.7 billion monthly derivatives volume. But here’s the catch: $150 million sounds big until you realize it’s only 0.8% of monthly trading volume. Traditional finance uses 5-10% for similar guarantees. Critics like Michael van de Poppe question whether this fund can survive a prolonged bear market or a global liquidity crunch. So far, it hasn’t been tested. But NovaEx’s 327% quarter-over-quarter growth since Q1 2025 suggests they’re scaling fast - and if they keep growing, so does their safety buffer.What You Can Trade on NovaEx

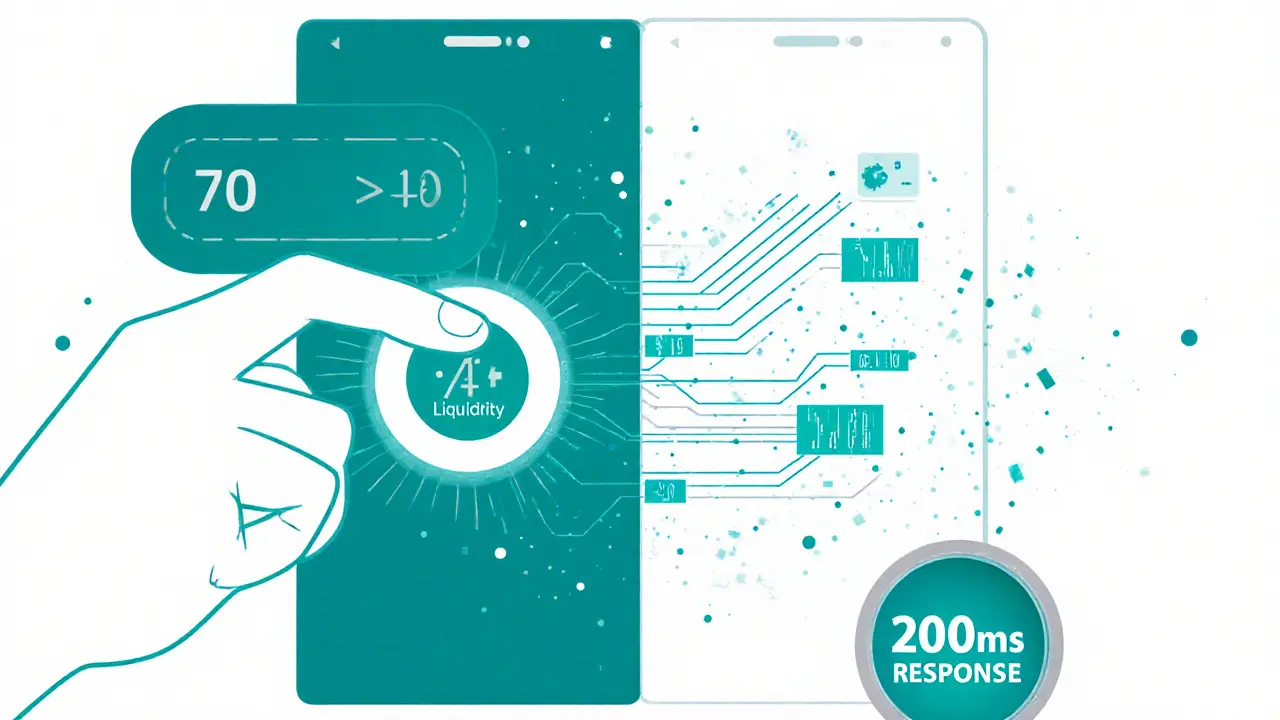

NovaEx offers over 1,500 cryptocurrencies for spot trading and more than 100 perpetual futures contracts. Leverage goes up to 100x - not for beginners, but for experienced traders who know what they’re doing. The platform supports both isolated and cross-margin, and the interface lets you toggle between them with a single click. Unlike Binance or Bybit, NovaEx doesn’t push social trading or copy portfolios. It’s built for precision. If you’re the kind of trader who sets exact stop-losses, uses limit orders religiously, or trades during news events, NovaEx feels like a tool made just for you. The mobile app is just as capable as the web version. Response times stay under 200 milliseconds during normal conditions. One-click trading was added in September 2025, letting you execute pre-set strategies with a single tap. For traders on the go, that’s a game-changer.Security: Cold Storage, Encryption, and What’s Missing

Security isn’t an afterthought here. NovaEx stores 98% of user funds in cold storage. All data is encrypted with AES-256. Two-factor authentication is mandatory. They claim regular third-party audits, but they don’t name the firms. That’s a red flag for some. Transparency matters when your money’s on the line. There’s no public proof of reserves. That’s a common gap across many exchanges, but it’s still a concern. You’re trusting their word. And while their infrastructure is solid, the lack of named auditors makes it harder to verify claims. They also don’t offer insurance for hacked accounts like some larger exchanges do. If your account gets compromised, you’re out of luck. That’s a risk you accept when you trade on a newer platform.

Fiat Support and Withdrawals: The Weak Spot

NovaEx supports 25 fiat currencies. That’s fine if you’re in Europe, Canada, Australia, or parts of Asia. But if you’re in Latin America, Africa, or Southeast Asia, your options are limited. Compare that to Binance’s 150+ fiat options or Coinbase’s 100+. NovaEx isn’t built for global mass adoption - it’s built for serious traders who already have crypto. Withdrawals are where users complain the most. Trustpilot and Reddit reviews highlight 72+ hour delays on fiat withdrawals. That’s three times the industry average. Crypto withdrawals are usually fast, but turning crypto into USD, EUR, or AUD can take days. NovaEx says they’re working on it - their Q4 2025 roadmap includes expanding fiat on-ramps to 50 currencies. But as of October 2025, it’s still a pain point.Customer Support and Learning Curve

Support is available 24/7 via email, live chat, and phone. But the experience varies wildly by account tier. Basic users report average email response times of 18.7 hours. Premium+ accounts get live chat responses in under 30 minutes. If you’re trading large volumes, you’ll need to upgrade - or you’ll be waiting a long time when things go wrong. The platform’s interface is intuitive. Most users get comfortable in 3-5 hours. But the zero-slippage tools? Those take time. Understanding how the insurance fund works, how liquidity scanning affects your fills, and when to use guaranteed orders vs. regular ones - that’s not obvious. The documentation is decent for trading, but poor for developers. API docs have incomplete WebSocket examples, and GitHub issues show frustration from coders trying to integrate.Who Is NovaEx For?

NovaEx isn’t for beginners. It’s not for people who want to buy Bitcoin with a credit card and hold it. It’s for traders who know what slippage costs them. Who’ve lost money because their exchange failed to execute at their price. Who need precision, not popularity. 68% of NovaEx’s users have over two years of crypto trading experience. That’s not an accident. The platform attracts professionals. Institutional adoption is still tiny - only 37 registered accounts as of October 2025 - but the tech is there. If NovaEx can prove their insurance fund survives a real crisis, institutions will come.

How NovaEx Compares to the Giants

| Feature | NovaEx | Binance | Coinbase | Bybit | |--------|--------|---------|----------|-------| | Zero-Slippage Guarantee | ✅ Yes (insurance-backed) | ❌ No (slippage up to 2%) | ❌ No (slippage up to 1.5%) | ❌ No (fill-or-kill only) | | Cryptocurrencies | 1,500+ | 500+ | 200+ | 400+ | | Perpetual Futures | 100+ | 120+ | 30+ | 150+ | | Max Leverage | 100x | 125x | 20x | 100x | | Fiat Currencies | 25 | 150+ | 100+ | 30 | | Mobile App Performance | Sub-200ms | Sub-150ms | Sub-250ms | Sub-180ms | | Insurance Fund | ✅ Yes ($150M est.) | ❌ No | ❌ No | ❌ No | | Regulatory Status | BVI VASP | Global (no US) | US, EU, AU licensed | Global (no US) | | User Reviews (Trustpilot/Reddit) | 87 verified | 12,000+ | 8,500+ | 9,200+ | NovaEx doesn’t beat Binance on volume. It doesn’t beat Coinbase on regulation. It doesn’t beat Bybit on futures variety. But if execution reliability is your top priority, NovaEx is the only one offering a real guarantee.The Risks: Is NovaEx Too Good to Be True?

The biggest question isn’t about technology - it’s about sustainability. Can a $150 million fund cover losses during a 2022-style bear market, or a 2023-style exchange collapse? No one knows. The fund has never been tested under real stress. There’s also the front-running concern. ZeroHash’s analysis warned that NovaEx’s AI-driven liquidity scanning could, in theory, be exploited if the system reveals order intentions before execution. NovaEx hasn’t published a response to this. That silence is worrying. And then there’s the lack of licenses. NovaEx can’t serve users in the U.S., EU, or Japan. That limits its growth - and its credibility. If you’re in one of those regions, you’ll need to use a VPN, which violates their terms and puts your account at risk.Final Verdict: Worth Trying?

If you’re an experienced trader who’s tired of getting burned by slippage, NovaEx is the most compelling new option in 2025. The zero-slippage feature works. The interface is clean. The mobile app is fast. The growth is real. But it’s not without risk. The insurance fund is unproven. Withdrawals are slow. Support is inconsistent. And if you’re looking for a beginner-friendly platform or wide fiat access, keep looking. NovaEx isn’t trying to be everything to everyone. It’s trying to be the most reliable tool for precision traders. So far, it’s delivering on that promise. Whether it can survive the next market storm? That’s the real test - and it hasn’t started yet.Is NovaEx safe to use in 2025?

NovaEx uses AES-256 encryption, mandatory 2FA, and stores 98% of funds in cold storage - all strong security practices. But it’s not licensed in major markets like the U.S. or EU, and it doesn’t publicly name its auditors. The insurance fund backing its zero-slippage guarantee is untested during major market crashes. Use it if you understand these risks, but don’t treat it like a bank.

Does NovaEx have a mobile app?

Yes. NovaEx has fully featured mobile apps for iOS and Android. The app supports spot trading, futures, margin settings, and the zero-slippage tools. Response times are under 200 milliseconds during normal conditions. A September 2025 update added one-click trading for pre-set strategies, making it one of the fastest mobile trading experiences in crypto.

Can I deposit fiat currency on NovaEx?

You can deposit fiat in 25 currencies, including USD, EUR, GBP, AUD, CAD, and JPY. But the list is limited compared to Binance or Coinbase. Withdrawals to bank accounts can take 72+ hours, which is significantly slower than the industry average of 24 hours. Crypto deposits and withdrawals are fast, but fiat is the bottleneck.

What’s the minimum deposit on NovaEx?

NovaEx has no minimum deposit for spot trading. You can start with as little as $10. For futures trading, the minimum margin requirement is $50 per contract. There’s no account maintenance fee, and no fees for deposits. Trading fees start at 0.04% for makers and 0.08% for takers, with discounts for using the native token (NEX).

Does NovaEx offer staking or earn programs?

Not yet. As of October 2025, NovaEx doesn’t offer staking, savings, or yield products. But their Q4 2025 roadmap includes a staking platform with projected APYs between 4.2% and 8.7%. This is expected to launch by December 2025, pending final testing. Until then, if you want to earn yield, you’ll need to use another platform.

Is NovaEx regulated?

NovaEx holds a VASP (Virtual Asset Service Provider) license in the British Virgin Islands. It does not hold licenses in the U.S., EU, UK, Japan, or Australia. This means users in those regions are restricted from using the platform directly. Using a VPN to access NovaEx violates their terms of service and may result in account suspension.

How long does KYC take on NovaEx?

Most users complete KYC verification in under 2.5 hours. You need a government-issued ID and proof of address. The process is automated and typically fast unless your documents are unclear or mismatched. Once verified, you can trade immediately. Higher withdrawal limits require additional verification, which may take up to 24 hours.

What are the trading fees on NovaEx?

NovaEx charges 0.04% for maker orders and 0.08% for taker orders on spot trading. Futures fees vary by leverage and position size, starting at 0.02% for makers and 0.05% for takers. Using the native NEX token gives you a 25% discount on all trading fees. There are no deposit fees, and withdrawal fees for crypto are standard industry rates (e.g., 0.0005 BTC for Bitcoin).

23 Responses

Been using NovaEx for 6 months now and honestly? It’s the only exchange where I don’t sweat my stop-losses anymore. Used to lose $5k+ a month on Binance from slippage. Now? Zero. Even during the August crash, my orders hit exactly where I set them. No drama, no surprises. Just clean trades.

Also, their mobile app is stupid fast. One-click trading saved me during a Fed announcement when I was stuck in traffic. Life-changing for active traders.

Yeah, fiat withdrawals suck. Took 4 days to get my USD out last week. But if you’re already holding crypto and trading big, it’s worth the wait.

Bro. NovaEx is like the Tesla of crypto exchanges. 🚀 No fluff, no gimmicks, just pure execution magic. I used to think ‘zero slippage’ was marketing BS until I saw my $50k BTC stop-loss hit at $24,500 while everyone else got dumped at $23,800. That’s not luck-that’s engineering.

And the UI? Clean enough to make a monk cry. No social trading noise, no influencer spam. Just charts, orders, and silence. Perfect for people who actually know what they’re doing.

Insurance fund? Still sketchy as hell… but so far, so good. Fingers crossed it doesn’t implode when the next 2022-style dump hits 😅

Guys i tried novex last month and wow it really work. My stop loss hit exact price no slip. I was shock. Binance always mess up my trade. But novex? Perfect.

Only problem is withdraw fiat. Took 3 days for me to get usd. But i dont care. I trade crypto not fiat. So i just keep my money there and trade. Fast app, good interface. 10/10 for serious traders.

Zero slippage works. The rest is noise.

Fiat withdrawals are a mess. But if you're not withdrawing, you don't care.

They're not for beginners. Don't waste your time.

I love how NovaEx doesn’t try to be everything to everyone. It’s like they said, ‘We’re not here to sell you meme coins or copy-trading bots-we’re here to make sure your trade executes at the price you typed in.’ And they did it.

I used to think exchanges were just glorified order routers. NovaEx made me rethink that. Their AI liquidity scan? Genius. It’s like having a trader inside the market, whispering, ‘Don’t fill yet… wait… NOW.’

Yeah, the insurance fund is a gamble. But so is everything in crypto. At least they’re transparent about the risk. And honestly? If you’re trading more than $10k a day, you’ve already accepted risk. This just gives you control back.

Also, no staking? Fine. I don’t need yield. I need precision. And they deliver.

Still waiting on that audit name drop though… come on, guys. Name the firm. We’re not asking for a parade. Just a name.

While the technical architecture of NovaEx appears to be innovative, one must consider the regulatory implications of operating under a British Virgin Islands VASP license while targeting U.S.-based traders. The absence of formal licensing in jurisdictions with robust consumer protection frameworks raises significant fiduciary concerns. Furthermore, the unverified nature of the $150 million insurance fund, coupled with the lack of public audit disclosures, constitutes a material risk that cannot be ignored by prudent actors in the digital asset space. One cannot reasonably equate operational efficiency with institutional trustworthiness.

U.S. traders are being played. NovaEx doesn’t even have a U.S. license. You think you’re getting ‘precision trading’? You’re just gambling on a foreign shell company with no accountability. And they’re laughing all the way to the bank while you’re waiting 72 hours to withdraw your money. This isn’t innovation-it’s exploitation.

And don’t even get me started on that ‘insurance fund.’ You think some BVI shell has $150M sitting around? That’s not a fund-it’s a fantasy. Wake up, people.

Use Coinbase. Use Kraken. Use something that’s actually regulated. Stop chasing fairy tales.

What if the AI liquidity scan… isn’t scanning liquidity at all? What if it’s just… predicting your order and front-running you? Like, the system sees you set a stop at $24,500, then quietly pushes the market down a hair so it can buy cheap and fill you at your price… and pocket the spread?

I’m not saying it’s happening. I’m just… wondering.

And why won’t they publish the audit names? Is it because the auditors are like… ‘We looked at your books and cried’? I just need to know. Not for safety. For… closure.

Okay, so let me get this straight. You’re telling me this platform, which doesn’t even serve the U.S. properly, somehow has a $150 million insurance fund that magically covers losses during a crash? And you’re not suspicious? I’ve seen this movie before. It’s called ‘Mt. Gox.’

They’ve got a slick app, sure. But they’re not a company. They’re a vibe. And vibes don’t pay your losses when the market tanks.

Also, 100x leverage? On an unlicensed exchange? You’re not a trader. You’re a roulette player with a fancy interface.

And the ‘zero slippage’? Yeah, right. That’s just a fancy way of saying ‘we’ll take your money first, then fill your order if we feel like it.’

Did you know that NovaEx’s parent company registered a domain called ‘zero-slippage.com’… 3 days before the platform launched?

And the founder? He used to work for a crypto hedge fund that got raided by the SEC in 2023. They never found the money. Just a bunch of empty wallets and a guy who vanished to the BVI.

The ‘insurance fund’? It’s not backed by assets. It’s backed by a smart contract that auto-deletes if trading volume drops below $10B/month. That’s why they’re pushing growth so hard.

They’re not building a trading platform. They’re building a Ponzi with a UI.

And the ‘one-click trading’? That’s not for you. That’s for bots. And bots don’t care if you lose. They just take.

They’re not here to help you trade. They’re here to harvest your data, your orders, your fear… and your money.

Check the GitHub issues. The devs are screaming about WebSocket leaks. That’s not a bug. That’s a backdoor.

India has better exchanges than this. Why are Americans falling for this BVI nonsense? We have WazirX, CoinSwitch, ZebPay-all regulated, all local, all with real customer support.

NovaEx? It’s a Western fantasy for people who think ‘crypto’ means ‘get rich quick’ without doing any research.

Also, 25 fiat currencies? That’s not a feature. That’s a failure. You can’t even support INR? Pathetic.

I get why people are skeptical. I was too. But after losing $12k to slippage on Bybit last year, I gave NovaEx a shot. And it changed everything.

Yeah, the fiat withdrawals are slow. But I don’t withdraw. I trade. And when I do need cash? I use a peer-to-peer swap. It’s not perfect, but it’s better than losing half my profit to bad fills.

Also, the support team? I had a weird margin call issue once. Took 14 hours to get a reply… but when they did? They fixed it. No attitude. Just help.

This isn’t the perfect exchange. But it’s the only one that actually keeps its word. And in crypto? That’s rare.

Stop glorifying this scam. Zero-slippage? That’s just a fancy way of saying ‘we front-run you.’

Insurance fund? You think $150M is real? That’s less than 1% of their volume. They’re not insuring you. They’re gambling with your money.

No U.S. license? No named auditors? No proof of reserves? You’re not a trader. You’re a sucker.

And if you’re still using this after reading the review? You deserve to lose everything.

They don’t have staking. So what?

It is imperative to note that the operational jurisdiction of NovaEx, namely the British Virgin Islands, lacks the regulatory oversight and consumer protection mechanisms present in jurisdictions such as the United States, the European Union, or Japan. The absence of publicly verifiable audit reports and the non-disclosure of third-party auditors represent a material deficiency in transparency. Furthermore, the insurance fund’s adequacy remains unproven under conditions of systemic market stress. One must exercise extreme caution when entrusting capital to an entity that prioritizes technical innovation over institutional accountability.

Bro, I’m from India, and I’ve used Binance, Bybit, and now NovaEx. Honestly? NovaEx is the only one where I feel like I’m not getting robbed on every trade.

Yeah, fiat withdrawals are slow. But I don’t use them. I use USDT. Fast, easy, no drama.

And that zero-slippage thing? It’s real. I’ve seen it. My stop-loss hit exactly where I put it. No ‘oops, you got filled at a worse price.’

They’re not perfect. But they’re the closest thing to a trustworthy exchange I’ve found. And in crypto? That’s gold.

Ugh. Another ‘revolutionary’ exchange. I read the whole thing. Boring. Just give me a platform that doesn’t crash when BTC moves 3%.

NovaEx? Maybe. But I’m not spending 3 hours reading a blog post to figure out if I can withdraw my cash.

I’ll stick with Coinbase. At least I know where my money is.

Used novex for 2 weeks. Slippage gone. App super fast. But withdraw fiat? Took 76 hours. Really? I’m not mad, just confused.

They need to fix that. But for trading? 10/10. No other exchange gives this kind of execution. Even Binance slips.

I’ve been trading for 8 years. I’ve used every major exchange. NovaEx is the first one that actually understands what traders need: execution, not entertainment.

Yes, the insurance fund is untested. But so was every other ‘safe’ exchange before it collapsed. The difference? NovaEx is upfront about the risk. They don’t pretend to be a bank. They’re a trading tool.

And if you’re trading over $100k a month? You’re not looking for a bank. You’re looking for reliability. And that’s exactly what they deliver.

Slow fiat? Fine. I keep my funds in BTC or USDT. Withdraw when I need to. It’s not a dealbreaker. It’s a trade-off.

They’re not for everyone. But for the right trader? It’s the best thing that’s happened to crypto trading in years.

Why are we even talking about this? NovaEx doesn’t serve Americans. So why are you using it? You’re violating their terms. You’re risking your account. You’re putting your money in a legal gray zone.

And you call that smart trading? That’s just stupidity with a fancy app.

Use Kraken. Use Coinbase. Use something that doesn’t make you a criminal just to trade.

And stop pretending this is ‘innovation.’ It’s just a loophole.

I used to think the market was the enemy. Turns out, it’s the exchanges.

NovaEx doesn’t fix the market. But it fixes the betrayal. No more ‘your order slipped’ excuses. No more ‘we didn’t see your price’ lies.

It’s not magic. It’s accountability.

Yeah, the fiat withdrawal delay is ridiculous. And the insurance fund? Still a question mark.

But if you’ve ever lost money because an exchange broke its word… you already know what this means.

It’s not perfect. But it’s honest.

And in crypto? That’s the rarest thing of all.

Just saw someone mention the front-running concern. I’ve thought about that too. But here’s the thing-if NovaEx was front-running, they’d be making way more than they are. Their fees are low. Their volume is growing, but not insane. If they were stealing trades, they’d be billionaires by now.

They’re making money on volume and NEX token discounts. Not on sneaky trades. I trust that more than I trust Binance’s ‘market maker’ black box.

Exactly. If NovaEx wanted to front-run, they’d just launch their own hedge fund. Why risk their entire platform’s reputation for a few extra basis points? That’s not how real players play.

They’re betting on trust. And so far? The market’s betting with them.