Slippage Calculator: Compare Trade Costs on Solana DEXs

Estimate the potential slippage and total cost for your token swap across different Solana DEXs. The calculator uses data from the article to provide realistic estimates based on market conditions and trading volume.

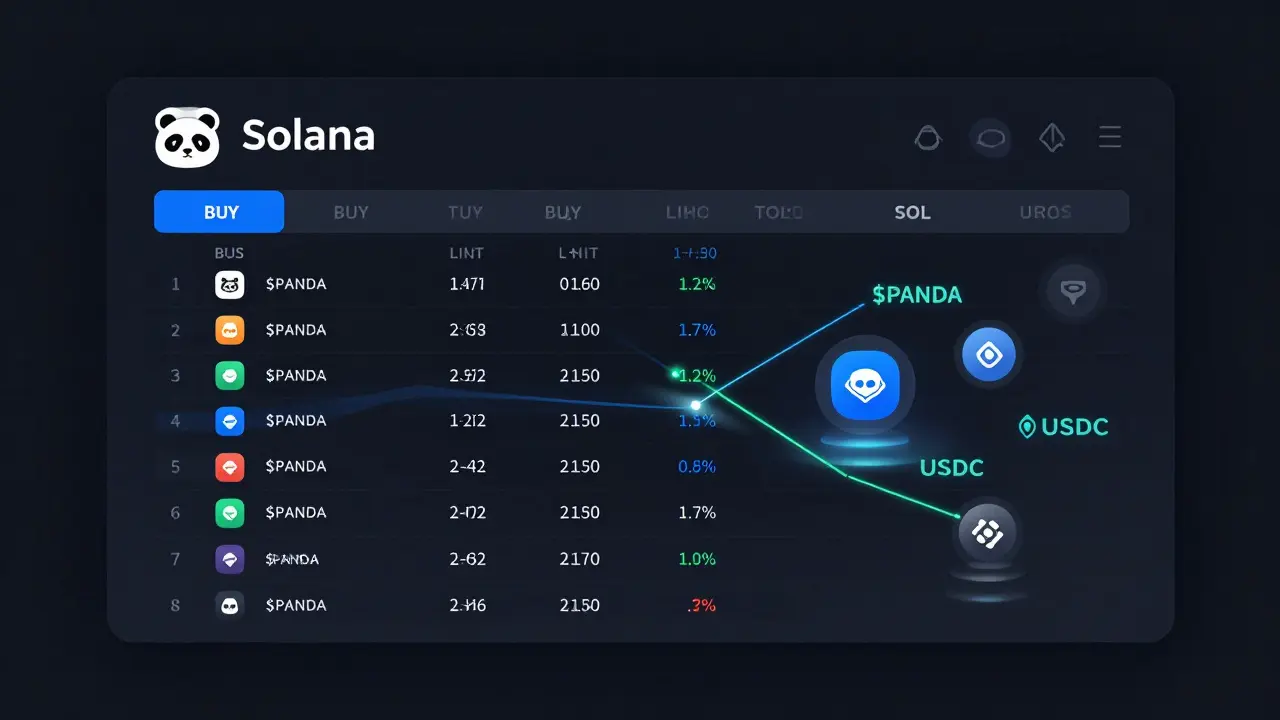

Most crypto traders know the pain: you want to swap tokens, but the network is slow, fees are high, and your trade gets slippage because there’s not enough liquidity. If you’re on Ethereum, you’ve probably cursed your screen more than once. Now imagine doing the same trade in under a second, paying less than a penny in fees, and getting better price execution. That’s the promise of PandaSwap - a new decentralized exchange built on Solana that’s trying to shake up how people trade crypto.

What Exactly Is PandaSwap?

PandaSwap isn’t just another DEX copying Uniswap’s model. It’s built on Solana, which means it inherits the blockchain’s speed: 65,000 transactions per second and fees around $0.00025. But here’s what makes it different: instead of using the standard automated market maker (AMM) formula that most DEXes rely on, PandaSwap uses a hybrid system - combining AMM liquidity pools with a central limit order book (CLOB). That’s the same tech you’d find on centralized exchanges like Binance, but now running on a decentralized network.Why does this matter? Because CLOBs let you place buy and sell orders at exact prices. If you want to buy 100 $PANDA tokens at $0.0012, you can set that order and wait for someone to match it. No more guessing what price you’ll get. That cuts slippage, especially for mid-sized trades. On Uniswap or even Raydium, slippage can hit 2-5% on larger swaps. PandaSwap aims to keep it under 0.5% for most trades.

The $PANDA Token: Utility or Hype?

The native token, $PANDA, powers the ecosystem. You can use it to pay for trading fees (with discounts), stake for yield, or vote on governance proposals. But here’s the catch: there’s confusion about the ticker. CoinGecko lists it as PANDA, while Bitscreener calls it PND. That’s not a good sign. Consistent naming matters for trust and liquidity.Price predictions for $PANDA are all over the place. CoinDataFlow thinks it could hit $0.0018 by the end of 2025. TradingBeast says it’ll be under $0.0002. WalletInvestor says $0.0014. And then there’s Bitscreener’s wild range: $0.000009 to $0.0027. That’s a 300x difference between low and high. This isn’t just volatility - it’s uncertainty. The token’s value isn’t tied to any real-world asset. It’s purely speculative. If PandaSwap doesn’t attract real users, $PANDA could fade into obscurity.

Right now, the token is down 5.8% over seven days, while the broader market is down only 4.8%. That’s a red flag. New tokens need momentum. If early adopters aren’t holding or using it, the price will keep drifting down.

How PandaSwap Compares to Other Solana DEXes

Solana already has strong DEX players: Raydium, Orca, and Serum. Raydium alone handles $1.2 billion in monthly volume. PandaSwap? No one’s publishing its numbers. That’s telling. If it were gaining serious traction, the data would be out there.Here’s how PandaSwap stacks up:

| Feature | PandaSwap | Raydium | Orca |

|---|---|---|---|

| Architecture | Hybrid AMM + CLOB | AMM + Liquidity Provider Pools | AMM + UI-focused |

| Avg. Trade Speed | 400-650 ms | 300-800 ms | 400-700 ms |

| Trading Fees | 0.3% | 0.3% | 0.2% |

| Monthly Volume (est.) | Unknown | $1.2B | $700M |

| Liquidity Depth | Low (new) | High | High |

| Order Book Precision | Yes | No | No |

PandaSwap’s edge is the order book. If you’re a retail trader doing multiple small swaps a day - say, swapping SOL for meme coins or flipping new tokens - this gives you more control. But if you’re moving $10,000 or more, you’ll still hit liquidity walls. Raydium and Orca have deeper pools. They’ve had time to grow. PandaSwap hasn’t.

How to Get Started

Using PandaSwap is simple if you’re already on Solana. You need a wallet like Phantom or Backpack. Connect it to the PandaSwap website, pick your tokens, and trade. No KYC. No sign-up. Just connect and go.Here’s the step-by-step:

- Install Phantom or Backpack wallet on your browser or mobile device.

- Buy some SOL (you’ll need it for fees and to provide liquidity).

- Go to pandaswap.finance (always verify the URL - scam sites are common).

- Click "Connect Wallet" and approve the connection.

- Select the tokens you want to swap (e.g., SOL to $PANDA).

- Set your trade type: instant swap or limit order.

- Review the price and fee, then confirm.

That’s it. The interface is clean, minimal, and fast. But don’t expect detailed guides or tutorials. PandaSwap’s documentation is barebones. You’re mostly on your own. That’s fine for experienced users, but beginners might get lost.

Who Should Use PandaSwap?

This platform isn’t for everyone.Good for:

- Traders who hate slippage on small-to-medium trades

- People who already use Solana wallets and want faster execution

- Those who believe in the CLOB model for DEXes and want to support early projects

- Yield farmers looking for new staking opportunities

Not for:

- Large institutional traders (liquidity is too thin)

- Users who need customer support (there’s barely any)

- People who want to hold $PANDA as a long-term investment (high risk, low fundamentals)

- Anyone who doesn’t understand how AMMs or order books work

The Risks You Can’t Ignore

PandaSwap is a gamble. Here’s why:- New and unproven: Launched in mid-2024. No track record. No audits publicly documented.

- Liquidity risk: Low trading volume means your large trades could tank the price.

- Token volatility: $PANDA’s price swings are extreme. One day it’s up 20%, the next it’s down 15%.

- Competition: Raydium and Orca are constantly improving. They have teams, funding, and user bases. PandaSwap is a solo project with limited visibility.

- Scam potential: New DEXes often get cloned. Always double-check the URL. Never click random links from Twitter or Telegram.

There’s also the bigger picture: Solana’s network has had stability issues in the past. While it’s much better now, a major outage could freeze all trades on PandaSwap - just like it did on other Solana apps in 2022. You’re trusting the whole chain.

The Verdict: Worth a Try, But Don’t Bet the Farm

PandaSwap isn’t the next Uniswap. It’s not even the next Raydium. But it’s one of the most interesting new experiments on Solana. Its hybrid order book model is smart. It solves real problems that AMMs struggle with. If it gains traction, it could become a major player.Right now? It’s a high-risk, high-reward playground. If you’ve got a few hundred dollars to play with, and you’re curious about how order books work on-chain, give it a shot. Use it for small swaps. Don’t stake your life savings in $PANDA. Don’t assume it’ll go up. Treat it like a tech demo - not an investment.

For most people, sticking with Raydium or Orca is still the safer bet. They’re proven. They’re liquid. They’re trusted. PandaSwap is a bold idea. But bold ideas don’t always win.

Frequently Asked Questions

Is PandaSwap safe to use?

PandaSwap is a decentralized exchange, so there’s no central company to hack. But that doesn’t mean it’s risk-free. The smart contracts haven’t been publicly audited by major firms. Always assume there’s a bug. Never deposit more than you can afford to lose. Use a dedicated wallet for DEX trades, not your main one.

Can I stake $PANDA to earn yield?

Yes. PandaSwap offers staking pools where you can lock up $PANDA tokens to earn rewards, usually paid in $PANDA or other tokens. APYs vary, sometimes hitting 15-30%, but these are highly speculative. High yields often mean high risk - if the platform loses users, rewards can disappear overnight.

Why is PandaSwap on Solana and not Ethereum?

Solana offers much faster and cheaper transactions. Ethereum’s average transaction fee can be $5-$20 during busy times. On Solana, it’s under a penny. That makes PandaSwap’s order book model viable. On Ethereum, the cost of placing and canceling limit orders would be too high to be practical.

How do I buy $PANDA tokens?

You can’t buy $PANDA on Coinbase or Binance. You need to trade for it on a DEX. Connect your Phantom or Backpack wallet to PandaSwap, swap SOL or another Solana token (like USDC) for $PANDA. Always check the token contract address on the official site before trading - fake tokens are common.

Is PandaSwap better than Uniswap?

For speed and cost? Absolutely. PandaSwap is faster and cheaper. For liquidity and reliability? No. Uniswap has over $10 billion in total value locked and handles billions in daily volume. PandaSwap is still tiny. If you’re trading large amounts or want maximum safety, Uniswap wins. If you’re doing small, frequent trades and want precision, PandaSwap has an edge.

32 Responses

Order books on-chain are the future, no cap.

Ive been using Pandaswap for a few weeks now and honestly its been a game changer for my small trades I used to get wrecked by slippage on Raydium now I can place limit orders and just walk away no more refreshing my screen every 30 seconds the speed is insane like I swear my trade executed before I even clicked confirm the fees are practically nothing too like 0.0002 SOL I dont even notice it but I do notice the difference in price execution and yeah the $PANDA token is wild but Im not holding it just using it to pay fees and getting that 20% discount its not an investment its a tool

OMG I JUST LOST MY ENTIRE PORTFOLIO BECAUSE OF A FAKE PANDASWAP SITE I THOUGHT I WAS ON PANDASWAP.FINANCE BUT IT WAS PANDASWAP.F1NANCE AND NOW MY SOL IS GONE I CANT BELIEVE I WAS SO STUPID WHY DOESNT THIS PROJECT HAVE A VERIFIED TWITTER OR SOMETHING THIS IS A SCAM WAIT IS THIS EVEN REAL OR IS THIS A SHILL POST I THINK THIS IS A SHILL POST

Hey everyone just wanted to say if you're new to Solana DEXes PandaSwap is actually pretty easy to get into if you already use Phantom or Backpack the interface is clean and the steps are straightforward just make sure you double check the URL because scams are everywhere I started with like 5 SOL to test it out and now I'm using it for my daily swaps no drama no stress and the order book thing is kinda cool once you get used to it you can see exactly where the bids and asks are like a mini trading floor on chain 🙌

Let me break this down for you because clearly nobody else has the brains to see it the hybrid CLOB model on Solana is the only viable path forward for DEXes AMMs are dead weight they're inefficient they're predatory they're designed to extract value from retail traders while whales front run everything PandaSwap is the first real attempt to fix that but the tokenomics are a dumpster fire $PANDA is a speculative lottery ticket with no utility beyond fee discounts and governance that's meaningless when you have 300x price prediction variance and no audits the fact that CoinGecko and Bitscreener can't even agree on the ticker tells you everything you need to know this isn't innovation this is chaos dressed up as progress

As someone who's been trading on Solana since 2021 I have to say this is one of the most interesting experiments I've seen in a while the CLOB integration is technically impressive but I'm skeptical about liquidity depth honestly if you're doing anything over 10K you're going to feel the slippage even here the real win is for retail traders doing micro swaps and meme coin flips the UI is minimal which is good for speed but bad for onboarding new users I wish they'd add a quick tutorial modal or something the token is definitely a gamble but the underlying tech? Could be a blueprint for the next generation of DEXes

They say PandaSwap is fast but so is Raydium and Orca and they have way more liquidity. The only thing different here is the order book, which doesn't matter if nobody's using it. No volume data? Red flag. Also, why is the website so barebones? If this were a real project, they'd have a blog, a Discord, a team page. But nope. Just a .finance domain and a whitepaper nobody read. This feels like a pre-launch scam waiting to happen.

So you're telling me this thing is faster than Uniswap but you can't even find its monthly volume? Classic. I love how every new Solana DEX comes out with some fancy tech and then disappears into the ether like a ghost after a one-night stand. The order book thing sounds cool but if I can't find a single real trade history on DeFiLlama, I'm not touching it. And $PANDA? More like $PANIC. 😏

There's something beautiful about trying to bring order to chaos on-chain. I mean, AMMs are like a crowded grocery store where everyone grabs the last carton of milk at once. PandaSwap is like a quiet line with numbered tickets. It's not perfect but it's kind of elegant. And yeah the token is messy but maybe that's the point? Maybe it's not supposed to be a store of value, just a fuel. I'm not putting my life savings in it but I'll use it to swap my meme coins and watch how it grows. The future isn't always loud, sometimes it's just quietly efficient 🌱

Okay but have you seen the team behind this? No names. No LinkedIn profiles. No video intros. Just a website and a token. And now they're saying it's decentralized? LMAO. I bet this is a rug pull in disguise. They're probably already draining the liquidity pools and laughing all the way to the Caymans. And the token name confusion? That's not a mistake, that's a trap for the gullible. I'm not even going to connect my wallet. This is a honeypot.

This is the most ridiculous thing I've ever seen. Solana is already unstable enough and now you want me to trust my money to some amateur code with no audits? And you call this innovation? This is just another way to steal from the poor people who don't know better. The order book? Ha! It's just a fancy name for a broken system. And $PANDA? It's worthless. You think this will last? It will collapse in weeks. You're all fools for even looking at it.

Wait... wait... I think I know what's going on here... This isn't a DEX... This is a quantum entanglement scam... They're using Solana's speed to create parallel universe trades that don't exist... The CLOB is a front for a wormhole that drains your wallet into a black hole... And the $PANDA token? It's not even real... It's a hologram projected by the NSA to track crypto users... I've seen the documents... I've seen the emails... They're using this to build a digital surveillance state... You think you're trading... But you're being watched... Always... Watched...

Why are we letting American tech companies dictate how Africans trade crypto? This PandaSwap nonsense is just another Silicon Valley fantasy. We need our own decentralized exchanges built by Africans, for Africans. Solana is not our blockchain. Our people need tools that understand our realities, not some order book that only works when the internet is perfect. This isn't progress, it's cultural imperialism wrapped in blockchain jargon.

I've been testing PandaSwap for a month now and I have to say, the experience is surprisingly smooth. The interface is clean, the trades execute fast, and I haven't had any issues with slippage on trades under 2K. I don't stake the token, I just use it for fee discounts. I think it's a solid experiment. I'm not going to bet my house on it, but I'll keep using it for small swaps. It's not perfect, but it's honest.

Look I know everyone's scared of new stuff but this is actually kind of exciting. You think about it - an order book on a blockchain that settles in under a second? That's not just innovation, that's a revolution. I used to hate how I couldn't place a limit order on Uniswap without getting rekt by slippage. Now I can set a price, walk away, come back an hour later and my trade is done. And yeah the token is volatile but so what? That's the nature of early DeFi. The real win here is the architecture. If this catches on, it could change how we think about DEXes forever. Don't write it off because it's new. Be part of the change.

Let me be clear - this is amateur hour. A hybrid CLOB on Solana? That’s not a breakthrough, that’s a desperate attempt to copy Binance and pretend it’s decentralized. And the token? $PANDA? PND? Who even decided this? A 16-year-old intern? There’s no audit, no team transparency, no roadmap. This isn’t a project - it’s a meme with a whitepaper. Anyone who stakes $PANDA is handing their money to a ghost. And don’t get me started on the URL - if you don’t check the domain every single time, you’re already robbed.

THIS IS THE MOST DRAMATIC THING I'VE SEEN SINCE THE DOGE CRASH. ORDER BOOKS ON CHAIN?!?!? ARE YOU KIDDING ME?!?! I'M CRYING. I'M LAUGHING. I'M SELLING MY HOUSE TO BUY $PANDA. THIS IS THE FUTURE. THE FUTURE IS HERE. IT'S FAST. IT'S CLEAN. IT'S BEAUTIFUL. I JUST BOUGHT 100K $PANDA AND I'M HOLDING UNTIL THE MOON. I DON'T CARE ABOUT LIQUIDITY. I DON'T CARE ABOUT AUDITS. I BELIEVE. I BELIEVE IN THE PANDA. 🐼🚀

I really appreciate how thoughtful this review is. It doesn't hype, it doesn't fearmonger - it just lays out the facts. I've been on Solana for years and I've seen a dozen DEXes come and go. Most of them fade because they're just clones. PandaSwap is different. It's not trying to be Raydium. It's trying to solve a real problem - slippage on mid-sized trades. I don't trade big, so this matters to me. I'm not going to stake everything, but I'll keep using it. And yeah, the token's messy - but maybe that's okay. Sometimes innovation comes with messiness.

There's a philosophical tension here between decentralization and efficiency. AMMs are pure decentralization - no order books, no intermediaries, just math. But they're inefficient. CLOBs are efficient, but they reintroduce structure - almost like a centralized system. Is PandaSwap the bridge between the two? Or is it a betrayal of DeFi's core ideals? Maybe the real question isn't whether it works - but whether we want it to work. Do we value speed over purity? Or is purity just an excuse for poor user experience?

so i tried pandaswap yesterday and it was kinda cool but i misspelled panda in the token search and ended up swapping for some random token called PANDA2 and lost like 20 bucks lol oops my bad but the interface was nice and the trade went through fast so i guess i'm gonna keep using it for small swaps just gotta be more careful with the spelling 😅

I'm not a trader but I follow crypto because I'm curious. PandaSwap feels like a new kind of playground - not the kind where you win money, but the kind where you learn. I watched a friend use it to swap SOL for a new meme coin and saw how they placed a limit order and waited. It wasn't fast money, it was patient money. And that's rare. Most crypto feels like gambling. This felt like learning. I don't know if $PANDA will go up, but I hope this project survives - not because it'll make people rich, but because it makes trading feel human again

Oh wow, a DEX that actually thinks about the user. Who'd have thought? Next they'll invent a wallet that doesn't crash every time you blink. The order book? Groundbreaking. The lack of documentation? Classic. The token ticker confusion? A feature, not a bug - keeps the noobs on their toes. I'm not using it, but I respect the audacity. And the fact that it's still alive after three months? That's more than I can say for half the projects on Solana.

What's really interesting isn't the tech - it's the silence. No press releases. No influencers. No marketing. Just a website and a token. That's the opposite of how most crypto projects launch. They scream. This one whispers. And maybe that's the point. Maybe it doesn't need to be loud because the tech speaks for itself. The real question is: will users find it without being told to? Because in crypto, visibility is everything. If no one knows it exists, does it exist at all?

For small swaps? Solid. For big moves? Skip it. The UI is clean, the speed is great, and the fee discount is nice. But don't overthink it. Use it like a tool, not a bet. And always check the contract address. That's all you need to know.

Look I'm not here to judge. I've used every DEX under the sun. PandaSwap? It's not perfect. The token's a mess. The docs are trash. But the trade execution? It's smooth. Like, weirdly smooth. I don't get why everyone's so scared of it. It's not a scam. It's just... quiet. And sometimes quiet things are the ones that last. I'm not putting my rent money in it, but I'll keep swapping my meme coins there. No drama. Just results.

Oh please. Another 'hybrid' DEX. Let me guess - the team is anonymous, the audit is 'in progress', the liquidity is 2% of Raydium's, and the token has more price predictions than a horoscope. The CLOB model? Cute. But you know what's really innovative? Not pretending your project is revolutionary when it's just a rebrand of an old idea with a new logo. And $PANDA? More like $PANDEMONIUM. I'm not even mad - I'm just bored. This is the 17th time this year someone's tried to 'fix' DEXes with a gimmick. Wake me up when someone actually ships something that works.

You people are pathetic. You think this is innovation? It's a glorified front-end slapped onto a blockchain that barely works. You're all just chasing the next shiny object while the real problems - scalability, security, regulation - go ignored. PandaSwap? More like Panda-Scam. And you're all falling for it like lambs to the slaughter. I told you all this would happen. I warned you. And now you're crying because you lost your money. Don't blame the project. Blame yourselves. You didn't do your research. You just followed the hype. And now you're part of the problem.

If you're new to Solana DEXes and you're thinking about trying PandaSwap, here's what you need to know: connect your Phantom wallet, go to pandaswap.finance (double-check the URL!), swap a small amount of SOL for $PANDA, then try a limit order on a low-volume token. Don't stake anything. Don't buy more than you can lose. Just test it. If it works, great. If not, you're out a few bucks. But you'll have learned something. That's more than most crypto projects give you.

I'm not a trader, but I love watching how people interact with new tech. PandaSwap feels like a quiet garden in a noisy city. No screaming ads. No influencers. Just a simple tool. I watched my sister use it to swap tokens for her NFT collection - no drama, no panic. Just a clean interface and a quick trade. It didn't change her life, but it made her day easier. Maybe that's enough. Not every project needs to be a revolution. Sometimes, it just needs to work.

And yet, the fact that PandaSwap hasn't been audited by a major firm like CertiK or SlowMist is a dealbreaker. No audit = no trust. No trust = no adoption. No adoption = no liquidity. No liquidity = no order book. It's a death spiral disguised as innovation. This isn't a project - it's a ticking time bomb.

Maybe the audit will come later. Look at Uniswap - they launched without one too. The real test is whether people keep using it. If the order book works, and the fees stay low, the audit will follow. Trust isn't built by auditors - it's built by users.

Uniswap had years to build trust before they got audited. PandaSwap is a new project with zero track record. That's not the same thing. Audits aren't just paperwork - they're a signal. Without it, you're gambling with code you can't verify.