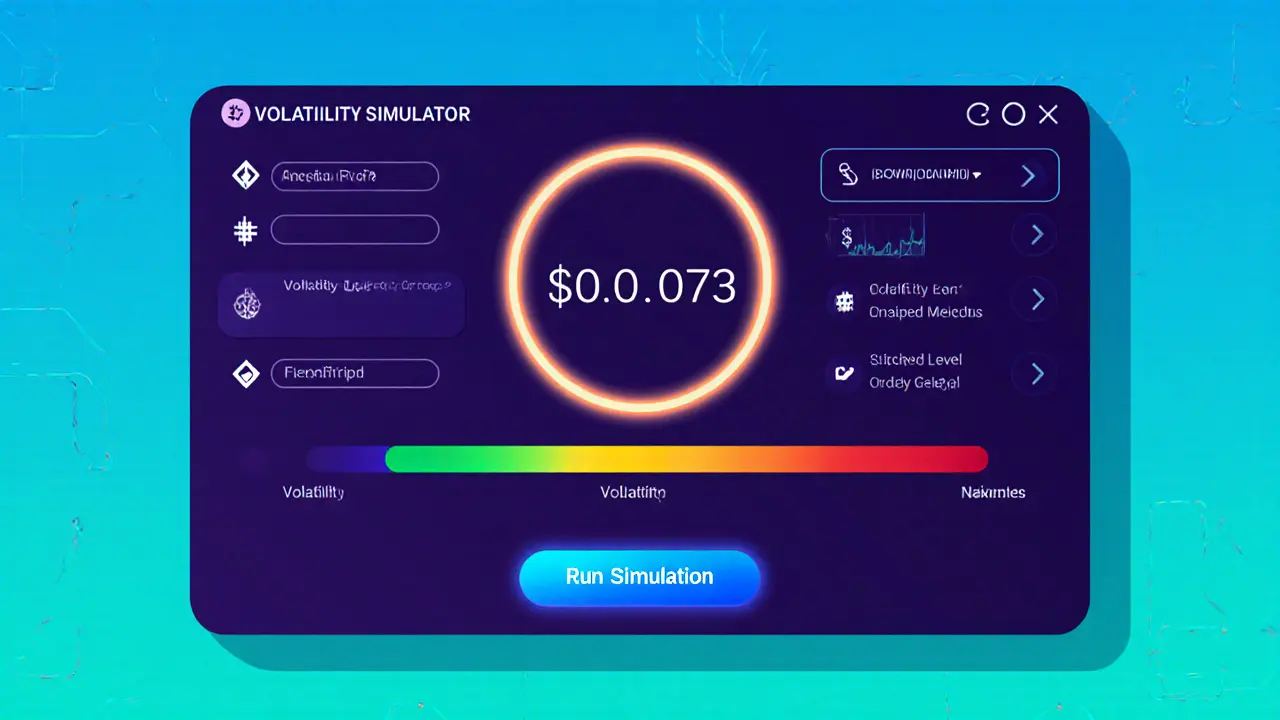

USDUT Volatility Simulator

Simulation Results

Run a simulation to see price fluctuations and volatility patterns.

Unstable Tether (USDUT) is an experimental meme cryptocurrency that deliberately shuns price stability in favor of extreme volatility. It mimics the naming of the well‑known stablecoin Tether (USDT) but flips the concept on its head, offering traders a satirical “unstable dollar peg.” The token lives on two major smart‑contract platforms: Ethereum as an ERC‑20 token and Solana as a native SPL token.

Quick Takeaways

- USDUT is a meme‑coin parody of stablecoins, designed to be volatile.

- It has a fixed supply of 1billion tokens across Ethereum (ERC‑20) and Solana (SPL).

- Current price hovers around $0.00073 with >$300k 24‑hr trading volume.

- Most activity happens on Solana‑based DEXes like PumpSwap and Orca.

- Liquidity is thin; large trades can swing the price dramatically.

What Problem Does USDUT Claim to Solve?

Traditional stablecoins such as USDT, USDC, or DAI aim to keep a $1 peg through collateral or algorithms. USDUT flips that narrative. Its “unstable dollar peg” is a tongue‑in‑cheek commentary on the hype around stablecoins, pointing out that many of them have faced de‑pegging crises. By embracing volatility, USDUT markets itself as pure speculation and meme‑driven entertainment, not a store of value.

Technical Blueprint

On Ethereum, USDUT follows the ERC‑20 standard. The smart contract enforces a hard cap of 1billion tokens, a common practice for meme projects that want a large, round number to facilitate price‑per‑token calculations.

On Solana, the token is an SPL asset. Solana’s low fees (often <$0.00001) and high throughput (up to 65,000TPS) make it ideal for rapid, cheap swaps-a perfect fit for a coin that expects traders to churn positions frequently.

Market Snapshot (Oct2025)

According to the latest CoinMarketCap data, USDUT trades at roughly $0.000728 with a 24‑hour volume of $310,375.47. The token’s 24‑hour price swing hit a 19.10% gain, underscoring the volatility baked into its design. It sits around rank #2382 on CoinMarketCap, reflecting modest but real interest among meme‑coin hunters.

Where Can You Trade USDUT?

USDUT is listed on several decentralized exchanges (DEXes) and a handful of centralized platforms. The most active markets are on Solana:

- PumpSwap - primary entry point for newcomers.

- Orca - offers a USDUT/SOL pair with modest volume.

- Meteora DLMM - shows the highest USDUT/SOL volume ($20.46K, ~94.81% of total USDUT activity).

- Additional pair: USDUT/WLFI on Meteora DLMM (≈$778 24‑hr volume).

Because liquidity pools are shallow, a single large order can move the price several percent. This is intentional; the token’s ecosystem thrives on rapid, speculative trades rather than deep order‑book stability.

USDUT vs. Traditional Stablecoins: A Side‑by‑Side Look

| Aspect | USDUT (Unstable Tether) | USDT (Tether) |

|---|---|---|

| Core Goal | Deliberate price volatility for meme speculation | Maintain a $1 stable peg |

| Supply | Fixed 1billion tokens | Variable, tied to reserves |

| Primary Blockchains | Ethereum (ERC‑20) & Solana (SPL) | Ethereum, Tron, Solana, Algorand, others |

| Typical Use‑Case | Speculation, meme culture, satire | Payments, trading, DeFi collateral |

| Liquidity | Thin, price easily swings | Deep, institutional participation |

Risks & Considerations

Because USDUT is built for volatility, it comes with a distinct risk profile:

- Price swings: Expect double‑digit moves in a single day.

- Low liquidity: Large orders can cause slippage, making exits pricey.

- Regulatory scrutiny: Meme coins often attract attention for potential scams; however, USDUT’s satirical premise lessens the chance of formal enforcement, but nothing is guaranteed.

- No intrinsic utility: Unlike USDT, USDUT does not aim to be a medium of exchange or a collateral asset.

Investors should only allocate money they can afford to lose and treat USDUT as a high‑risk, entertainment‑driven asset.

Future Outlook

The longevity of USDUT hinges on meme‑coin culture. If community chatter, viral memes, or influencer shout‑outs keep the token in the spotlight, trading volume may stay healthy despite thin liquidity. Conversely, a shift in market sentiment away from speculative memes could push the token into obscurity. No roadmap promises technical upgrades; the focus remains on narrative and social media buzz.

How to Get Started (Step‑by‑Step)

- Set up a wallet that supports both Ethereum and Solana (e.g., MetaMask for ERC‑20, Phantom for SPL).

- Acquire a modest amount of ETH or SOL to cover transaction fees.

- Visit PumpSwap or Orca and connect your wallet.

- Swap a small portion of ETH or SOL for USDUT. Start with a tiny amount (e.g., $10) to gauge price impact.

- Monitor price on CoinMarketCap or a Solana DEX aggregator; be ready to exit quickly if volatility spikes.

Remember: the goal is fun, not long‑term holding.

Frequently Asked Questions

Is USDUT a real stablecoin?

No. Despite its name, USDUT is intentionally unstable. It’s a meme token that satirizes stablecoins by embracing volatility.

Where can I buy USDUT?

The token trades on Solana‑based DEXes such as PumpSwap, Orca, and Meteora DLMM. You’ll need a Solana‑compatible wallet (e.g., Phantom) and some SOL for gas.

What is the total supply of USDUT?

USDUT has a fixed supply of 1billion tokens across both Ethereum and Solana implementations.

How volatile is USDUT compared to other meme coins?

USDUT was built for volatility. A 24‑hour price swing of around 19% is common, which is higher than many established meme coins that see 5‑10% moves.

Is it safe to keep USDUT as a long‑term investment?

Because the token’s purpose is speculation and its liquidity is shallow, it’s risky for long‑term holding. Treat it as a short‑term play or a novelty.

5 Responses

It is, quite frankly, an affront to the very principles of financial engineering that a token bearing the nomenclature of a stablecoin would deliberately eschew stability. The conceptual inversion here is not clever-it is reckless. One might argue that such an instrument is merely a vehicle for speculative gambling, but even gambling at least acknowledges its own risk profile. This, by contrast, masquerades as a parody while actively enabling systemic irrationality in retail markets.

It is disturbing to see how casually the financial literacy of the average investor is being exploited under the guise of 'meme culture.' USDUT is not satire-it is predation. The token's design, with its thin liquidity and massive price swings, is engineered to extract wealth from those who lack the technical acumen to understand its mechanics. There is no humor in this; there is only harm.

I think it's kind of brilliant in a weird way. People are tired of being told what to believe about money. If you want to trade chaos, why not have a coin that openly admits it's chaos? It's like a mirror held up to the whole crypto space-some people see a masterpiece, others see a mess. But at least it's honest about what it is.

Oh, so now we’re celebrating financial nihilism as 'satire'? Brilliant. A token named 'Unstable Tether'-with a fixed supply of 1 billion tokens, no yield, no utility, no backing, and a liquidity pool thinner than a politician’s excuse-is somehow a 'commentary' on stablecoins? Let me guess: the devs are also running a Patreon called 'I Told You So.' The fact that this has $300k in volume means someone, somewhere, still believes that 'meme' is a strategy. And yet, here we are: watching the same circus, just with a new clown holding a sign that says 'I’m not a stablecoin, I’m a joke!'-and somehow, people are still buying tickets.

This isn't innovation. It's exploitation dressed up as irony. The fact that you're calling this 'meme entertainment' doesn't absolve you of the moral responsibility to not target vulnerable investors with instruments designed to be manipulated. The trading volume isn't proof of demand-it's proof of desperation. And the people losing money here? They're not 'in on the joke.' They're just confused.