Where Coinbase Works and Where It Doesn’t

If you’re trying to buy Bitcoin or Ethereum with your bank account using Coinbase, and it won’t let you, you’re not alone. Millions of people around the world hit a wall when they try to sign up - not because they’re doing anything wrong, but because Coinbase blocks access based on where they live. This isn’t a glitch. It’s policy. And it’s changing all the time.

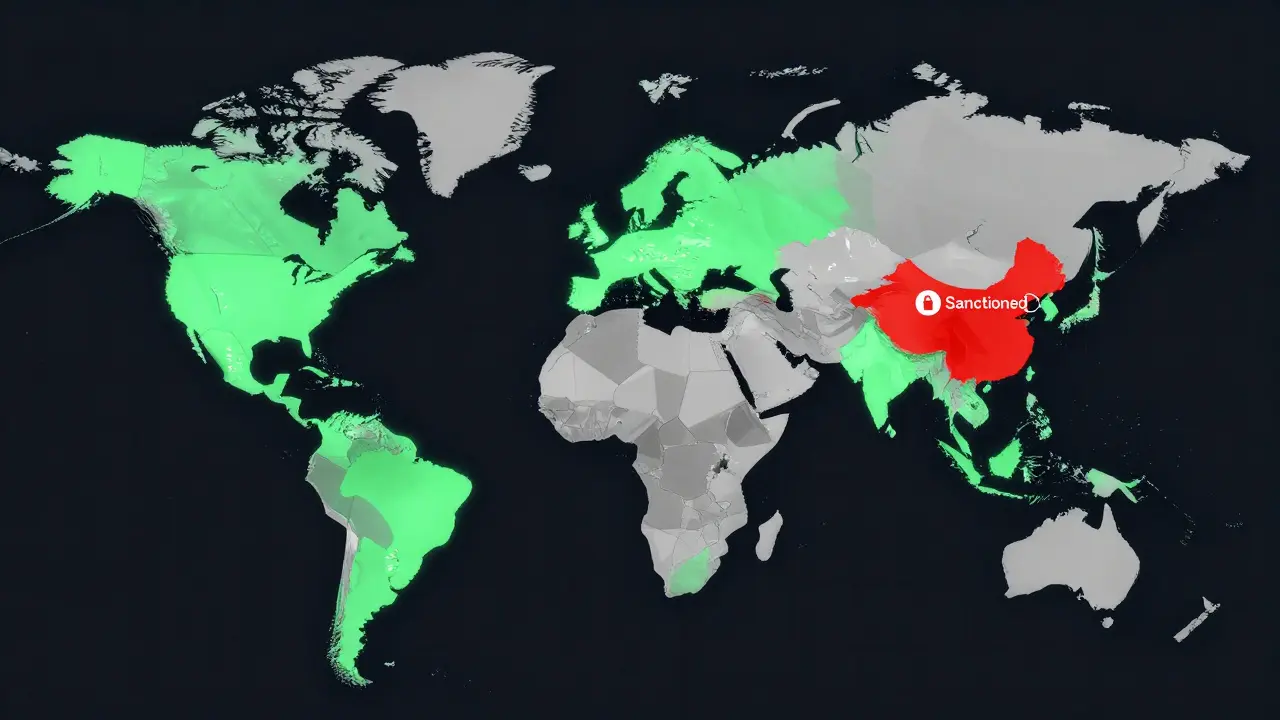

Coinbase doesn’t operate everywhere. Even though it claims to serve over 100 countries, only 48 of them can use the full app with bank transfers, credit cards, and PayPal. The rest? You might get access to Coinbase Wallet - a self-custody tool that lets you hold crypto - but you can’t buy or sell with real money. That’s a huge difference. One lets you trade. The other just lets you store.

Why Does Coinbase Block Countries?

It’s not about technology. It’s about legal risk. Coinbase is a U.S.-based company, publicly traded on NASDAQ, and answers to regulators like the SEC and the U.S. Treasury’s Office of Foreign Assets Control (OFAC). If they let someone in a sanctioned country - like Russia, Iran, or Syria - trade fiat for crypto, they could face fines in the millions or even criminal charges.

OFAC’s sanctions list is the main driver. Any country on that list gets locked out of fiat services immediately. That’s why Russia has been blocked since early 2022. But it’s not just sanctions. Some countries have their own crypto bans or heavy restrictions. Nigeria and Egypt added crypto trading limits in early 2025, and Coinbase pulled its services there too. It’s easier to exit a market than fight a legal battle.

Even in places without sanctions, Coinbase plays it safe. Bangladesh isn’t on OFAC’s list, but Coinbase still blocks it. Why? Because local banking rules make compliance too messy. The same goes for Pakistan - Wallet works, but you can’t deposit rupees. That’s not a technical issue. It’s a business decision.

Which Countries Can You Use Coinbase Fully?

If you’re in one of these places, you can deposit and withdraw fiat currency: the United States, United Kingdom, Germany, France, Canada, Australia, Japan, Singapore, and most of the European Union. These countries have clear crypto regulations, banking partnerships, and legal frameworks that Coinbase can work within.

In the EU, the Markets in Crypto-Assets (MiCA) regulation, which took full effect in 2025, forced Coinbase to restructure its operations. Now, users in Malta, Iceland, Liechtenstein, and Hungary are served by Coinbase Luxembourg S.A. instead of the old European entity. That’s not a marketing change - it’s a legal necessity. Each country’s rules are different, and Coinbase has to match them.

What can you do in these countries? Deposit via bank transfer (ACH, SEPA), debit/credit card, Apple Pay, Google Pay, or PayPal. Verified users can send up to $50,000 per day. Unverified users? $500 daily. That’s a big gap - but it’s standard across regulated exchanges.

What About Coinbase Wallet? Is It Really Global?

Yes - but with a catch. Coinbase Wallet is a non-custodial wallet. That means you hold your own keys. It doesn’t store your crypto. It doesn’t handle fiat. It’s just a bridge to decentralized apps (dApps) on Ethereum and other blockchains.

Wallet works in 195+ countries - except for the same OFAC-sanctioned zones: Iran, Syria, North Korea, Cuba, Crimea, and a few others. So if you’re in India, Colombia, or the Philippines, you can download the Wallet app, connect to Uniswap or Aave, and trade tokens. But you can’t buy those tokens with your local bank account. You’ll need to use a peer-to-peer exchange like Binance P2P or a local platform like PDAX in the Philippines - which charges 3.5% fees versus Coinbase’s 0.5%.

That’s the real problem. Wallet gives you access to crypto, but not the easiest way to get into it. For people in developing countries, that’s a barrier. MIT’s Digital Currency Initiative found that 12.7 million unbanked users in restricted countries are locked out of the fiat on-ramp entirely. They can hold crypto, but not easily buy it.

What Happens If You Use a VPN?

Some users try to bypass restrictions using a VPN. It sounds simple: change your IP address, pretend you’re in Germany, and start trading. But Coinbase checks more than just your IP. It asks for government ID, proof of address, and links to your phone number and bank account. All of those must match your claimed location.

If you’re caught using a VPN, your account gets flagged. Some users report temporary holds. Others get permanently banned. One Reddit user from the UAE lost $2,300 after using a VPN to access the app. Coinbase doesn’t refund. They don’t explain. They just shut it down.

And it’s not worth the risk. Even if you get in, your transactions will be monitored. If you try to withdraw to a bank account in your real country, the system will catch the mismatch. It’s not a loophole. It’s a trap.

How Does Coinbase Compare to Other Exchanges?

Compared to other platforms, Coinbase is the most restricted. Binance operates in 160+ countries with fiat access in over 80. Kraken supports fiat in 55 countries. Both are more flexible.

But here’s the trade-off: Coinbase is the only major exchange registered with the SEC in the U.S. That’s why 56% of American crypto traders use it. It’s also the only one fully compliant with MiCA in Europe. That gives it trust - and limits.

Decentralized wallets like MetaMask work everywhere. No ID. No location check. But they don’t offer fiat on-ramps either. You still need a third-party service to buy crypto with cash. So while MetaMask is global, it doesn’t solve the core problem: how do you turn your local currency into crypto without a local exchange?

What’s Changing in 2025?

India is watching closely. Coinbase tried to register with the Reserve Bank of India in early 2025 after being blocked for years. If they succeed, India could become a major market. But if the RBI says no again, Coinbase will likely stay out.

Same with the U.S. SEC lawsuit. If the court rules that Coinbase’s trading platform is an unregistered securities exchange, the company might have to pull services from even more countries to stay compliant. That’s not speculation - it’s a legal reality.

Meanwhile, MiCA is still rolling out. Some EU countries are still adjusting. Cardano staking, for example, is blocked in 12 EU nations because of transitional rules. That’s not a bug. It’s a compliance delay.

What Should You Do If You’re Blocked?

If you’re in a restricted country and want to buy crypto:

- Use Coinbase Wallet to store crypto you already own.

- Try peer-to-peer platforms like Binance P2P, Paxful, or LocalCryptos - these let you trade directly with people using local payment methods.

- Look for local exchanges. In the Philippines, PDAX is popular. In Nigeria, Binance P2P dominates. In Colombia, Bitso works well.

- Don’t use a VPN to access Coinbase. You’ll lose your funds.

- Check Coinbase’s Help Center daily - they update country access without notice.

There’s no perfect solution. But there are options. The key is understanding what you can and can’t do - and not risking your money trying to break the rules.

Why This Matters Beyond Just Access

Coinbase’s geographic restrictions aren’t just about compliance. They’re a reflection of how global finance is being reshaped. Crypto was supposed to be borderless. But in practice, it’s being sliced up by laws, banks, and politics.

People in developing countries want to use crypto to protect savings, send remittances, or start businesses. But if the only easy way to buy it is through a U.S.-regulated exchange that won’t serve them, they’re left with expensive, risky alternatives.

That’s not innovation. That’s exclusion. And until exchanges like Coinbase find a way to serve these markets safely - without risking their licenses - the dream of open, global crypto will remain incomplete.

Can I use Coinbase if I live in Russia?

No. Coinbase fully blocks all fiat services in Russia due to U.S. sanctions imposed after February 2022. You can still download Coinbase Wallet, but you cannot deposit or withdraw rubles, use bank transfers, or buy crypto with a Russian card. Any attempt to bypass this with a VPN will result in account termination.

Why does Coinbase work in Germany but not in Pakistan?

Germany has clear crypto regulations, full banking integration, and licenses from BaFin, making it safe for Coinbase to operate. Pakistan has no formal crypto ban, but banks don’t support crypto transactions, and local compliance is too complex. Coinbase chose to block fiat access there to avoid legal risk - even though the Wallet app still works.

Is Coinbase Wallet safe to use in restricted countries?

Yes, as long as you don’t try to link it to a bank account or use fiat services. Coinbase Wallet is non-custodial - meaning you control your keys. It’s safe to use in any country except those on OFAC’s sanctions list (like Iran or Syria). But remember: it doesn’t let you buy crypto with local money. You’ll need another service for that.

Can I transfer crypto from Coinbase to a wallet in a blocked country?

Yes. Once you buy crypto on Coinbase in a supported country, you can send it to any wallet address worldwide - even in Russia or Pakistan. The restriction only applies to buying or selling fiat. Transferring crypto between wallets is not blocked.

Does Coinbase plan to expand to more countries in 2025?

Possibly - but slowly. India is the biggest potential market they’re trying to re-enter. If the RBI approves registration, Coinbase could return. But in most other countries, expansion depends on local laws. In places like Nigeria and Egypt, where crypto is being restricted, Coinbase is more likely to pull back than expand.

What’s the difference between the Coinbase App and Coinbase Wallet?

The Coinbase App lets you buy, sell, and trade crypto with fiat money - but only in 48 countries. Coinbase Wallet is a self-custody app that lets you store and send crypto anywhere in the world (except sanctioned countries), but you can’t use bank transfers or cards. Wallet is for holding. App is for trading.

Why can’t I use PayPal to deposit on Coinbase in some countries?

PayPal integration depends on local banking agreements and regulatory approval. Even if PayPal is available in your country, Coinbase may not have signed the legal agreement needed to connect it. For example, PayPal works in Germany and Canada but not in the UAE, even though PayPal operates there. It’s a business decision, not a technical one.

How do I know if my country is restricted?

Try signing up for a Coinbase account. If you’re blocked during registration, your country isn’t supported for fiat services. You can also check Coinbase’s Help Center - they updated their country list on January 30, 2025. The most reliable method: log into your account and look for the deposit options. If you don’t see bank transfer, card, or PayPal, your country is restricted.

3 Responses

Honestly? I just use Binance P2P now. No drama, no VPNs, just trade with locals. Coinbase? Too much red tape for my taste. 🤷♂️

i tried using a vpn once... lost my entire bag. never again. 😅

Crypto was supposed to be the great equalizer... the decentralized, borderless future... and now we’re stuck in a world where your access to digital money depends on whether your country is on a U.S. government’s list? This isn’t innovation-it’s digital colonialism. We’re building a financial apartheid, and Coinbase? They’re the gatekeepers with the keycards. And we call this progress?