China Crypto Ban Timeline & Comparison Tool

Timeline of China's Crypto Prohibitions

Comparison: China vs. Taiwan

| Aspect | China | Taiwan |

|---|---|---|

| Legal status of ownership | Prohibited (ownership in legal gray area, no protection) | Legal, subject to reporting |

| Trading | Illicit activity, criminal penalties | Allowed, taxed as capital gains |

| Mining | Explicitly illegal | Legal, treated as income |

| Tax treatment | None - profits seized as illicit proceeds | 5% VAT on trading revenue + income tax on mining rewards |

| Regulatory body | People's Bank of China | Financial Supervisory Commission |

Key Takeaway

In China, cryptocurrency is treated as a criminal activity rather than a taxable event. This means that there is no framework for crypto taxation. Profits from crypto-related activities are considered illicit proceeds and are subject to confiscation instead of being taxed.

If you thought you needed to file a crypto tax return in China, you’re out of luck. The country has taken a hard‑line stance that treats every crypto‑related activity as illegal, which effectively eliminates any tax‑reporting requirement. This article breaks down how the ban evolved, what the law looks like today, and why "crypto taxation" is essentially a moot point for anyone inside China’s borders.

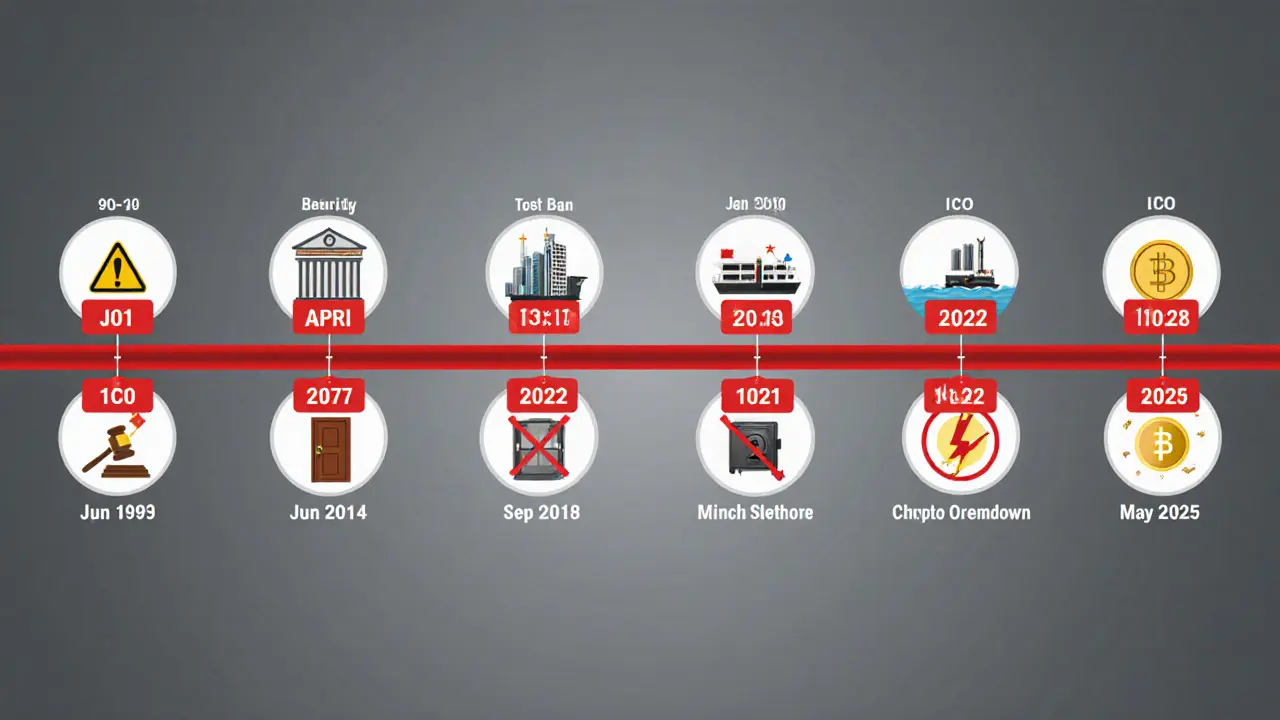

From Skepticism to Full Prohibition - A 16‑Year Journey

Back in June2009 the People's Republic of China issued its first warning against virtual currencies, fearing they could be used to purchase real‑world goods anonymously. The People's Bank of China (the country’s central bank and primary regulator of financial markets) tightened the noose over the next decade:

- December52013 - banks and payment firms barred from handling Bitcoin transactions.

- April12014 - all Bitcoin trading accounts ordered shut.

- September302017 - outright ban on Initial Coin Offerings (ICOs).

- January2018 - mining operations forced offshore.

- June2021 - mining crackdown citing energy waste.

- September242021 - comprehensive ban on trading, mining, and transactions.

- May302025 - the final ownership ban decree (a legal order that prohibits private possession of any cryptocurrency) takes effect on June12025.

The result? China now operates on a zero‑tolerance model where crypto is treated as a criminal activity, not a taxable event.

What the Current Legal Framework Actually Says

The May302025 decree classifies crypto transactions as “illegal financial activities.” The key takeaways are:

- All forms of cryptocurrency trading are prohibited.

- Mining any digital token, including crypto mining, is illegal.

- Holding crypto is not explicitly criminal, but any related contract is void and offers no legal protection.

- Financial institutions cannot provide custodial, exchange, or settlement services for crypto.

- Violations trigger administrative fines, asset seizure, and possible criminal charges.

Because the law never labels these activities as taxable income, there is no framework for capital‑gains tax, income tax on mining rewards, or value‑added tax on transactions.

Why "Crypto Taxation" Doesn’t Exist in China

In most jurisdictions, the tax authority asks:

- Did you earn crypto? → Income tax.

- Did you sell crypto for profit? → Capital gains tax.

- Did you provide services and get paid in crypto? → Payroll tax.

China’s ban flips the script. Since the activity itself is illegal, any profit is deemed illicit proceeds and is subject to confiscation, not tax. The government’s focus is enforcement, not revenue collection.

For example, if a person mined Bitcoin in a hidden basement and sold it on a foreign exchange, Chinese authorities would treat the proceeds as “illegal earnings” and seize the assets under anti‑money‑laundering statutes. No tax form, no declaration, just a criminal case.

Enforcement - Penalties and Asset Seizure

Enforcement mechanisms are harsh:

- Administrative fines range from ¥10,000 to ¥100,000 for first‑time offenders.

- Repeat violations can lead to criminal charges carrying up to 7years in prison.

- All crypto assets found in a suspect’s possession are subject to confiscation without compensation.

- Foreign nationals inside China face the same penalties as citizens.

The People's Bank of China coordinates with public security and market supervision bodies to monitor online activity, blockchain analytics, and even electricity usage patterns to locate illegal mining farms.

How China Differs From Its Neighbors - A Quick Comparison

| Aspect | China | Taiwan |

|---|---|---|

| Legal status of ownership | Prohibited (ownership in legal gray area, no protection) | Legal, subject to reporting |

| Trading | Illicit activity, criminal penalties | Allowed, taxed as capital gains |

| Mining | Explicitly illegal | Legal, treated as income |

| Tax treatment | None - profits seized as illicit proceeds | 5% VAT on trading revenue + income tax on mining rewards |

| Regulatory body | People's Bank of China | Financial Supervisory Commission |

The contrast shows why China’s approach is an outlier: rather than creating a tax code, it chose outright prohibition.

Is the Ban Permanent? Signals of a Possible Shift

In July2025, a Shanghai State‑owned Assets Supervision and Administration Commission meeting sparked speculation. Participants discussed stablecoins and the digital yuan's role, hinting that the government may soften its stance on private digital assets. So far, no concrete policy changes have been announced, but two trends are worth watching:

- China continues to push the digital yuan (the state‑issued central bank digital currency (CBDC)) as the official digital payment method.

- International pressure and the rise of stablecoins may force regulators to consider limited, state‑controlled usage scenarios.

Until an official revision lands, the safest assumption remains: no crypto activity = no tax filing.

Practical Checklist for Anyone in China

- Stop all crypto trading or mining immediately. Continuing after June12025 exposes you to criminal liability.

- If you already hold crypto, consider moving assets out of China before the ban’s enforcement date. Use legal offshore accounts and be aware of foreign exchange controls.

- Do not open any crypto‑related accounts with Chinese banks or payment providers.

- Keep records of any crypto transactions that occurred before the ban. While you won’t file taxes, documentation may help if authorities question the source of funds.

- Stay updated on official announcements from the People's Bank of China and the State Council regarding digital assets.

- If you’re a foreigner visiting China, avoid using any private crypto wallets while on Chinese soil. The ban applies equally to non‑citizens.

Following these steps reduces the risk of frozen accounts, fines, or even imprisonment.

Frequently Asked Questions

Is cryptocurrency ownership illegal in China?

Ownership sits in a legal gray area - the law does not specifically criminalize possession, but any related contract is void and offers no protection. Practically, holding crypto can lead to asset seizure if discovered.

Do I need to report crypto gains on my Chinese tax return?

No. Since crypto activities are illegal, the tax system does not have a reporting category. Any profit is treated as illicit proceeds, not taxable income.

What penalties can I face for mining Bitcoin in China?

Mining is explicitly banned. Penalties range from hefty fines (up to ¥100,000) to criminal charges carrying up to seven years in prison and confiscation of equipment.

Can foreigners trade crypto while visiting China?

No. The ban applies to everyone on Chinese territory, regardless of nationality. Violations are subject to the same administrative and criminal penalties.

Will the digital yuan replace all other digital assets?

The government promotes the digital yuan as the only legal digital currency. While it may coexist with foreign CBDCs, private crypto remains prohibited unless policy shifts.

21 Responses

China’s crypto ban essentially kills any tax discussion because the activity is illegal, so there’s no taxable event to report. If you’re living abroad and hold crypto, you still need to watch your local tax obligations, but inside China the government simply confiscates the assets.

It is obvious that the authorities are using the ban as a pretext to seize wealth and monitor digital transactions under the guise of “anti‑money‑laundering.” The hidden agenda is to funnel crypto capital into state‑controlled channels and keep ordinary citizens in financial servitude. 😒

Reflecting on the timeline, one sees a pattern of escalating control that mirrors broader sociopolitical trends. The shift from warning to outright prohibition signals a deeper distrust of decentralized finance, perhaps rooted in an ideological fear of losing monetary sovereignty.

The moral vacuum created by criminalizing crypto is stark; it forces people into the shadows where they become easy prey for organized crime. By refusing to tax, the government reveals its true colors-protecting the elite while punishing the curious.

Honestly, they’re just scared of losing control, like they’re on some secret agenda to keep all the money in the party’s pockets. i cant beleve they think this will work.

Let’s look at the broader implications of a nation that chooses prohibition over regulation. When a government decides that an entire class of financial activity is illegal, it eliminates any incentive for compliance and drives innovation underground. This underground activity is not only harder to monitor, but it also deprives the state of potential revenue that could be used for public services. Moreover, the ban creates a chilling effect on entrepreneurship; potential startups that might have leveraged blockchain technology are forced to abandon their ideas or relocate abroad. In addition, the legal uncertainty surrounding crypto assets discourages foreign investment, as investors fear sudden policy reversals. The lack of a tax framework also means that individuals cannot claim legitimate deductions or report legitimate gains, leaving them vulnerable to accusations of illicit activity. Over time, this approach erodes public trust in the financial system, as citizens see the state imposing blanket bans without transparent justification. The state’s focus on confiscation rather than taxation suggests a punitive mindset rather than a constructive regulatory one. This environment stifles competition, hampers technological progress, and ultimately damages the broader economy. It also creates a black market where prices are inflated due to risk premiums, harming ordinary users. While the government may think it is protecting its citizens, the reality is that they are pushing them into covert channels where they have no legal protection. In the long run, such policies may backfire, as citizens demand more openness and the state may be forced to reconsider its stance. Finally, the prohibition does not address the underlying motivations for crypto adoption, such as financial inclusion and cross‑border payments, leaving a gap that other jurisdictions will fill.

China’s ban is just a façade for massive wealth expropriation.

The ethical paradox here is palpable: the government criminalizes a technology that promises financial freedom, yet it claims to act in the public interest. By refusing to tax, they sidestep accountability and instead impose draconian penalties that punish ordinary users. This double standard is a hallmark of authoritarian regimes that fear any decentralization of power. Moreover, the lack of a clear tax code means that individuals cannot differentiate between legitimate earnings and illicit proceeds, leaving them in legal limbo. The state’s narrative of protecting citizens becomes a justification for sweeping confiscations, reinforcing a climate of fear.

From a regulatory perspective, the absence of a tax framework creates significant compliance challenges for multinational firms that operate across borders. Companies seeking to engage with Chinese entities must navigate a legal gray area where crypto transactions are deemed illicit yet still occur in practice. This necessitates robust AML monitoring and heightened due diligence to mitigate exposure to asset seizures. Additionally, the prohibition hampers the development of fintech ecosystems that could otherwise benefit from blockchain’s transparency and efficiency. As a result, China risks falling behind in the global digital finance race, especially when neighboring economies like Taiwan are establishing clear tax regimes that encourage innovation while ensuring fiscal responsibility.

What a joke, calling it a ban when everyone knows they’re just scared of losing their grip on the money flow. They’ll fine you, lock you up, but can’t stop the tech from leaking out.

Hey, I totally get the fear factor, but it’s also true that the crackdown has pushed a lot of miners to move to greener regions, which might actually be good for the environment in the long run.

Oh great another ban, as if that’ll stop people from trading on the dark side of the net. 🙄

While it may seem harsh, the public announcement emphasized the need for financial stability and consumer protection; therefore, aligning with global AML standards is a priority, even if the approach feels heavy‑handed.

Honestly, the whole thing feels like a power move, and the drama around it just adds fuel to the fire for those who already distrust the system.

If you’re outside China, just remember to report any crypto gains to your local tax authority, because the Chinese ban doesn’t affect your home country’s rules.

Tax or no tax, the ban is a clear signal of control.

The formal legal stance taken by the People's Bank of China effectively nullifies any fiscal responsibility towards cryptocurrency activities. By categorizing crypto transactions as illegal financial conduct, the government sidesteps the need to develop a nuanced tax code. This approach has several ramifications. Firstly, it creates a vacuum where illicit proceeds are seized rather than taxed, which may deter some participants but also fuels the black market. Secondly, it imposes significant compliance burdens on multinational corporations that must ensure no crypto exposure when dealing with Chinese partners. Thirdly, the lack of tax revenue from a potentially lucrative sector could be viewed as a missed opportunity for public finance. Finally, the prohibition may encourage a brain drain of talent to more crypto‑friendly jurisdictions, thereby hampering domestic innovation. In sum, the ban reflects a policy of zero tolerance rather than strategic regulation.

It is important to recognize that while the ban eliminates tax reporting obligations within China, it also places a heavy burden on individuals who must navigate a complex legal environment. Encouraging them to seek legal avenues abroad, maintain accurate records, and stay informed about evolving regulations can help mitigate risks and protect personal assets.

Honestly, the drama around crypto bans is just another chapter in the saga of governments trying to act like they own the future of money, while the tech keeps moving forward.

Let’s keep the conversation focused on how people can stay safe and compliant, sharing resources and tips rather than just shouting about the restrictions.

Everyone loves to claim the ban is about security, but it’s really just a convenient cover for power consolidation-classic move.