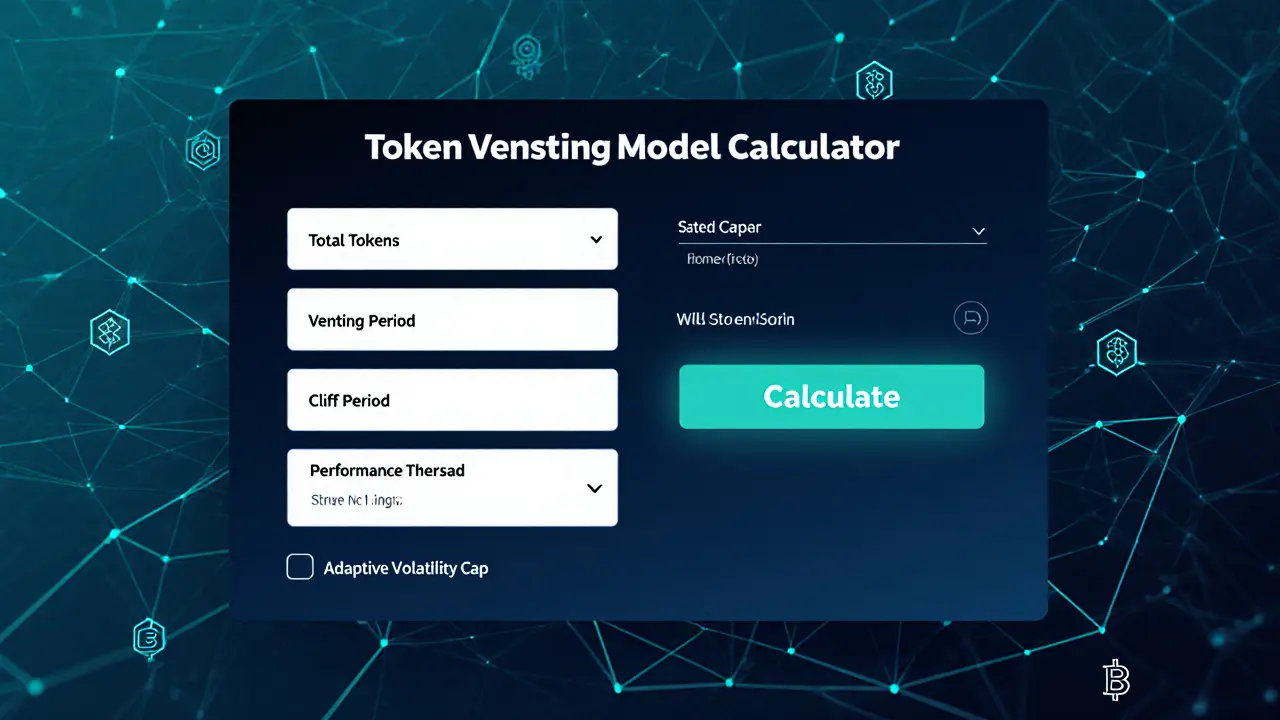

Token Vesting Model Calculator

Vesting Schedule Summary

When a Token Vesting Model is a structured plan that releases crypto tokens to recipients over time or upon achieving specific goals, it does more than just space out supply-it aligns incentives, curbs dumping, and builds trust. As the Web3 ecosystem matures in 2025, founders are swapping static, time‑only schedules for dynamic, milestone‑driven systems that react to market conditions, user activity, and regulatory pressures. Below you’ll find the most relevant trends, practical steps, and pitfalls to watch when designing the next generation of token vesting.

Quick Take

- Linear, cliff, and back‑loaded vesting remain useful for baseline allocations.

- Performance‑based vesting ties releases to KPIs such as on‑chain activity or product milestones.

- Adaptive schedules adjust automatically to market volatility or regulatory triggers.

- Transparent dashboards and on‑chain proof increase community trust.

- Compliance‑first designs attract institutional capital while keeping decentralization intact.

Why Vesting Still Matters in 2025

Even after a decade of token launches, the fundamental problems remain: sudden token floods can crash prices, early backers may abandon projects, and regulators scrutinize opaque token distributions. A well‑crafted vesting plan solves three core issues:

- Alignment: Recipients earn full ownership only when they continue to add value.

- Stability: Gradual release flattens supply curves, dampening price spikes.

- Credibility: Public, auditable schedules signal long‑term commitment to investors.

These benefits are amplified when the vesting logic lives on‑chain, allowing anyone to verify upcoming releases without trusting a single party.

Core Vesting Mechanisms Explained

Below are the most common building blocks, each introduced with its own schema markup for easy knowledge‑graph mapping.

- Linear Vesting releases a fixed percentage of tokens at regular intervals (e.g., monthly over 48 months). Ideal for steady‑state employee compensation.

- Cliff Period a waiting window (often 12months) during which no tokens vest, after which a lump‑sum releases. Prevents early exits.

- Back‑Loaded Vesting allocates a larger share toward the end of the schedule, rewarding long‑term loyalty.

- Performance‑Based Vesting ties token release to quantifiable milestones such as TVL growth, active users, or code commits.

- Milestone Vesting unlocks tokens when specific project phases (e.g., mainnet launch, audit completion) are verified on‑chain.

- Adaptive Vesting adjusts release rates in real‑time based on market volatility or regulatory events.

- Decentralized Exchange (DEX) platforms where vested tokens often become liquidity provision assets, affecting trading depth.

- Staking locking tokens to earn rewards; vesting can be linked to staking duration for extra incentives.

Emerging Trends Shaping the Future

2025 is a turning point. Three innovations dominate the conversation among token architects.

1. KPI‑Driven Unlocks

Projects now embed smart‑contract logic that reads on‑chain analytics-daily active wallets, transaction volume, or governance participation-and releases a portion of the allocation once thresholds are met. This turns token ownership into a performance badge rather than a passive grant.

2. Multi‑Signal Adaptive Schedules

Hybrid models combine time, KPI, and external market signals (e.g., a 30‑day volatility index). If price volatility spikes, the contract temporarily slows releases, protecting token value and discouraging panic sells.

3. Transparent Dashboard Layer

Front‑ends now pull vesting data from block explorers and display real‑time release calendars. Community members can set alerts for upcoming unlocks, dramatically reducing speculation‑driven volatility.

Benefits of Modern Vesting Designs

When you move beyond static schedules, you unlock tangible advantages:

- Risk Mitigation: Performance triggers prevent token dumps if project metrics stall.

- Investor Appeal: Institutional funds demand verifiable, auditable token release plans.

- Community Engagement: Users earn tokens by actively using the platform, turning them into brand ambassadors.

- Regulatory Alignment: Adaptive models can automatically pause releases if a jurisdiction issues a cease‑and‑desist, demonstrating good‑faith compliance.

Implementation Checklist

Before you code the next vesting contract, run through this practical list.

- Define Stakeholder Groups: founders, developers, advisors, community, liquidity providers.

- Pick Core Triggers: time, KPI, or hybrid. Document exact metrics (e.g., 100k weekly active users).

- Set Cliff & Duration: typical founder cliffs: 12months; overall duration: 48-72months for core team.

- Choose On‑Chain Oracle: Chainlink, Band, or a custom DAO‑voted data feed for KPI verification.

- Write Transparent Smart Contract: use OpenZeppelin’s Vesting library as a base, then add custom triggers.

- Audit Rigorously: security firms, formal verification, community bug bounty.

- Publish Schedule Publicly: embed JSON‑LD or a simple HTML table on your site; link to block explorer.

- Plan Governance Overrides: include a multi‑sig DAO guardrail to pause or modify the schedule if needed.

Comparison of Vesting Approaches

| Model | Primary Trigger | Typical Use‑Case | Pros | Cons |

|---|---|---|---|---|

| Linear + Cliff | Time only | Employee salaries, early team | Simple, predictable | Ignores performance, possible dumps |

| Performance‑Based | KPI thresholds | Liquidity provider rewards, growth‑linked grants | Aligns incentives, reduces dump risk | Complex oracle setup, metric disputes |

| Milestone Vesting | Project milestones (on‑chain verification) | Founders, core developers | Rewards tangible achievements | Milestone definitions can be vague |

| Adaptive / Hybrid | Time + KPI + market signals | Institution‑grade token sales, regulated IDOs | Highly resilient to volatility, compliant | Most code‑heavy, higher audit costs |

Regulatory Landscape and Compliance

Global regulators are finally publishing clear guidance on digital asset issuance. In the U.S., the SEC treats certain token allocations as securities, demanding lock‑up periods and disclosure. Europe’s MiCA framework mandates transparent vesting schedules for public offerings. By embedding compliance logic-e.g., auto‑pause on jurisdictional alerts-projects can satisfy both tokenomics goals and legal obligations.

Key compliance steps:

- Register the vesting contract address with relevant authorities.

- Publish a human‑readable vesting schedule in the project’s white‑paper and on‑chain.

- Offer a governance mechanism for emergency freezes.

- Maintain audit trails for every release event.

Case Study: Adaptive Vesting in a DeFi Lending Protocol

Imagine a DeFi lending platform that wants to reward early liquidity providers while protecting token price. The team implements a hybrid model:

- Initial 12‑month cliff for founders.

- Quarterly linear releases for developers (5% per quarter).

- Performance tranche that unlocks 2% of total supply each time total value locked (TVL) grows by 25% month‑over‑month, verified via a Chainlink TVL oracle.

- Adaptive cap: if 30‑day price volatility exceeds 15%, the next performance tranche is reduced by 50% to dampen sell pressure.

Result: Token price remains relatively stable, liquidity grows steadily, and investors cite the transparent, data‑driven vesting as a major confidence factor.

Next‑Step Guide for Founders

Ready to upgrade your token vesting? Follow this short roadmap.

- Audit Existing Allocation: list every stakeholder and current schedule.

- Identify Desired Outcomes: reduce dump risk, meet regulatory thresholds, drive user adoption.

- Select Model Mix: combine linear for staff, performance for community, adaptive for investors.

- Build Smart Contract Prototype: reuse audited libraries, add custom triggers.

- Run Simulations: model token price impact under worst‑case unlock scenarios.

- Publish Full Schedule: embed a live dashboard linked to the blockchain.

- Engage Legal Counsel: ensure the schedule meets SEC, MiCA, or local regulations.

- Launch with Community AMA: answer questions, collect feedback, and iterate.

Doing this groundwork not only safeguards your token’s value but also signals to investors that you’re playing the long game.

Frequently Asked Questions

What is the main difference between time‑based and performance‑based vesting?

Time‑based vesting releases tokens on a set calendar, regardless of project outcomes. Performance‑based vesting ties releases to measurable milestones-like TVL growth or code commits-so tokens only unlock when the project hits specific targets.

How can I make a vesting schedule transparent for my community?

Publish the schedule in plain language on your website, embed a live table that reads directly from the contract, and provide a link to the block explorer. Tools like Dune Analytics or custom dashboards let users set alerts for upcoming unlocks.

Are adaptive vesting models legal in major jurisdictions?

Yes, as long as the model includes clear disclosure, an audit trail, and a governance mechanism to pause releases if regulators require. Europe’s MiCA and the U.S. SEC both accept dynamic lock‑ups when they are fully documented.

What oracle should I use for KPI‑based vesting?

Chainlink remains the industry standard because of its decentralised data feeds and strong security record. For niche metrics, a custom DAO‑voted oracle can work if you run a thorough audit.

Can vesting be combined with staking rewards?

Absolutely. Many projects lock vesting tokens in a staking contract that awards extra yields once the tokens unlock, creating a two‑tier incentive structure.

24 Responses

I think the guide does a solid job of breaking down the different vesting mechanisms. The clear tables make it easy for founders to compare options. It’s especially helpful that the checklist is included for implementation.

Honestly, the article glosses over the real pitfalls of adaptive vesting. Most projects will end up with overly complex contracts that no one can audit properly.

From a national perspective, it’s evident that token economies must align with our country’s growth goals. By tying vesting to on‑chain activity, we ensure that tokens serve as a catalyst for domestic blockchain adoption.

Vesting is just math.

While your enthusiasm for national alignment is noted, the broader ecosystem benefits from standardized, cross‑border vesting frameworks. Diversifying triggers beyond pure KPI can mitigate localized regulatory shocks and foster global collaboration.

Reading through the extensive checklist reminded me of the meticulous planning required for any successful token launch. First, identifying the stakeholder groups sets the foundation for fairness and clarity; founders, developers, advisors, and community members each have distinct risk tolerances. Second, selecting the core triggers-whether time, KPI, or a hybrid-should be driven by the project’s long‑term vision rather than short‑term hype. Third, the cliff period remains a proven tool to deter premature exits, especially for early backers who might otherwise cash out immediately. Fourth, incorporating an on‑chain oracle like Chainlink guarantees that performance metrics are tamper‑proof and widely accepted. Fifth, leveraging OpenZeppelin’s vetted vesting library reduces smart‑contract vulnerabilities, but custom logic must still undergo rigorous audits. Sixth, publishing the schedule in both human‑readable and machine‑readable formats fosters transparency and invites community scrutiny. Seventh, a governance override mechanism, typically a multi‑sig DAO, provides an emergency brake if market conditions deteriorate or regulators intervene. Eighth, the adaptive volatility cap you described can protect token value during sudden market swings, though it introduces additional complexity that must be clearly communicated. Ninth, regular simulations of worst‑case release scenarios help anticipate price impact and adjust parameters proactively. Tenth, engaging legal counsel early ensures compliance with SEC, MiCA, and other jurisdictional guidelines, preventing costly retrofits later. Eleventh, a live dashboard linked to the blockchain empowers token holders with real‑time insights, reducing speculation‑driven panic. Twelfth, community AMAs following the launch serve to educate users and reinforce trust in the vesting design. Thirteenth, iterative feedback loops allow the schedule to evolve as the project matures, keeping incentives aligned. Fourteenth, remember that token economics are only as strong as the community’s belief in the underlying value proposition. Lastly, by treating vesting as a dynamic, data‑driven process rather than a static calendar, you unlock a powerful alignment tool that can sustain growth for years to come.

While the enumeration is thorough, one must question whether such exhaustive detail does not overwhelm fledgling teams. A more streamlined approach may better serve startups lacking extensive legal resources.

Great post! I love seeing the blend of performance‑based and adaptive models-gives teams flexibility while keeping token holders happy. Keep the momentum going!

Flexibility sounds nice until the code becomes a black box that no one can audit.

It’s crucial that we maintain a balanced perspective, recognizing both the technical merits and the community governance aspects of vesting. Transparency dashboards are indeed a step forward.

Absolutely! 🎉 A clear on‑chain view builds trust and reduces speculation. Plus, community‑driven alerts can keep everyone informed in real‑time. 🚀

From a tokenomics standpoint, integrating a volatility‑adjusted release curve mitigates swing‑risk exposure while preserving liquidity depth. Smart‑contract orchestration must be modular to accommodate future protocol upgrades. 🤖

Sure, if you enjoy spending endless gas on overly complex modules that nobody really needs.

One could argue that the philosophical justification for adaptive caps is sound, yet the practical implementation often lacks rigorous formal verification, which is a glaring oversight.

Encouraging teams to set clear milestones will not only align incentives but also showcase progress to investors, building confidence throughout the journey.

Looks like another buzzword checklist without real substance.

It is incumbent upon us, as responsible developers, to ensure that our token distribution mechanisms adhere to both ethical standards and regulatory compliance, lest we compromise the integrity of the ecosystem.

Honestly, the whole adaptive vesting thing feels like a gimmick to mask poor project fundamentals.

Optimism drives innovation-setting ambitious performance thresholds can ignite community participation and accelerate growth.

While enthusiasm is valuable, over‑promising on KPIs can backfire if the underlying tech cannot deliver, leading to token devaluation and community disillusionment.

Indeed, the interplay between philosophical incentives and pragmatic token economics is a delicate dance; balancing them requires both vision and disciplined execution.

Providing a step‑by‑step guide with precise grammar and clear examples helps developers implement vesting contracts confidently, reducing errors and fostering adoption.

Exactly! A structured approach empowers even newcomers to navigate complex smart‑contract logic without feeling overwhelmed.

While the article is comprehensive, it fails to address the potential for centralized control inherent in many adaptive vesting implementations.