When you trade with leverage in crypto, you’re borrowing money to control a bigger position than your account balance allows. It’s powerful - but it comes with a hidden deadline. If the market moves against you just a little too far, your position gets wiped out automatically. That’s liquidation. It’s not a punishment. It’s not a glitch. It’s the system protecting itself - and you - from losing more than you put up.

Think of it like renting a car with a deposit. If you crash it and the damage costs more than your deposit, the rental company takes your deposit and walks away. Liquidation is the same thing, but with Bitcoin, Ethereum, or any other crypto asset. You put up collateral. You borrow to go long or short. If the price moves too far against you, the exchange closes your trade before you owe them money.

How Liquidation Is Triggered

Every leveraged trade has three key numbers: your entry price, your initial margin, and your maintenance margin.

The initial margin is how much of your own money you need to open the trade. For example, if you’re using 10x leverage on a $50,000 Bitcoin position, you only need $5,000 upfront. That’s your initial margin - 10% of the total position value.

The maintenance margin is the bare minimum you need to keep the trade open. Most exchanges set this between 0.5% and 1%. So if you’re using 10x leverage, your maintenance margin might be $500 - just 1% of the $50,000 position. That means you can lose $4,500 of your $5,000 before the system steps in.

When your account balance drops below that maintenance margin, liquidation kicks in. It’s not about how much you’ve lost overall - it’s about whether you still have enough to cover the risk the exchange is taking on your behalf.

The liquidation price isn’t random. It’s calculated precisely. For a long position (buying), it’s:

Liquidation Price = Entry Price × (1 - Initial Margin Rate + Maintenance Margin Rate)

For a short position (selling), it’s:

Liquidation Price = Entry Price × (1 + Initial Margin Rate - Maintenance Margin Rate)

Let’s say you buy BTC at $70,000 with 10x leverage. Your initial margin is 10%, maintenance margin is 1%. Your liquidation price is:

$70,000 × (1 - 0.10 + 0.01) = $70,000 × 0.91 = $63,700

That means if BTC drops to $63,700, your position gets closed. No warning. No second chance. Just gone.

Why Your Liquidation Price Isn’t What You See

Here’s where most traders get burned. The price you see on your screen isn’t always the price used to calculate liquidation.

Exchanges use something called the mark price - not the last traded price. The mark price is an average of prices across multiple exchanges, adjusted for funding rates and order book depth. It’s designed to prevent manipulation. But it also means your liquidation can trigger even if the price on your chart hasn’t hit your liquidation level yet.

In late 2025, Binance and Bybit updated their systems to use time-weighted average prices over 30 seconds instead of instantaneous prices. That means if there’s a quick 1% dip caused by a whale’s large sell order, you won’t get liquidated unless the dip lasts. But if the dip sticks - even for a few seconds - your position can still be closed.

Traders on Reddit reported losing $8,500 in under a second because their liquidation price was triggered by a mark price spike, not the real-time price. The difference? Just 0.3%. But in leveraged trading, that’s enough.

How Leverage Changes Everything

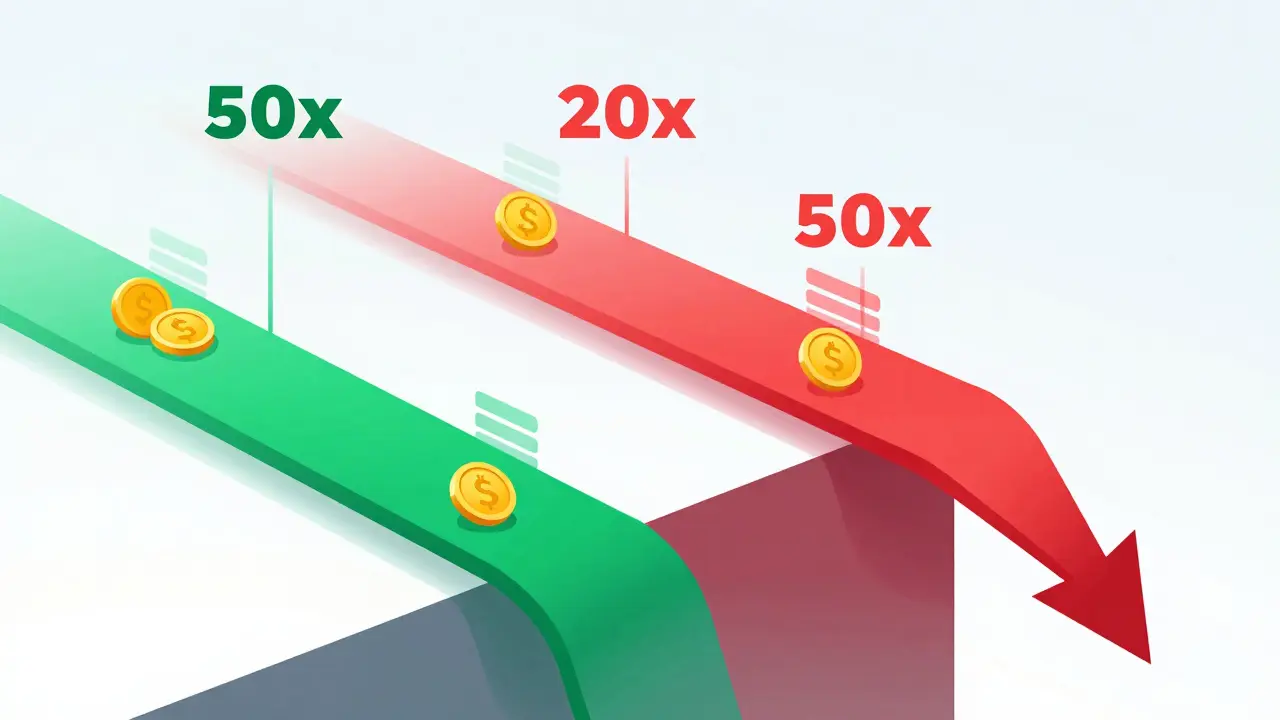

The higher your leverage, the closer your liquidation price is to your entry price.

With 5x leverage, you need a 20% move against you to get liquidated. With 20x, it’s only 5%. With 50x? Just 2%.

That’s why retail traders using 25x leverage on Binance or Bybit have a liquidation rate of 18.3% - nearly 1 in 5 positions gets wiped out. Institutional traders, who stick to 2x-5x leverage, see liquidation rates under 1%.

Low leverage doesn’t mean low profit potential. It means you survive long enough to ride the trend. High leverage means you’re playing Russian roulette with your account.

Differences Between Exchanges

Not all exchanges handle liquidation the same way.

- Binance uses dynamic maintenance margins that adjust based on 15-minute volatility. If the market is choppy, your liquidation threshold gets tighter.

- Bybit started partial liquidations in 2024. If you hit maintenance margin, it closes 25% of your position first. If you’re still underwater, it closes more. This gives you a chance to recover.

- Deribit uses a stricter system. Once you hit maintenance margin, it closes your entire position immediately.

- Kraken requires 1.5% maintenance margin - higher than most. That means you need more capital, but you’re less likely to get liquidated.

- MEXC offers 0.3% maintenance margin on some pairs. That’s great for capital efficiency - but it also means you’re one small price swing away from being wiped out.

And then there’s DeFi. On platforms like Aave or Compound, liquidation isn’t automatic. Anyone can step in and buy your collateral at a discount - usually 5-15% below market value. That creates a whole new kind of risk: someone else can profit from your loss.

What Happens When You Get Liquidated

Once liquidation triggers, the exchange sells your position at the best available price. That’s not always a good price. During volatile spikes, the market can gap down - meaning your position gets sold at a price worse than your liquidation trigger.

Some exchanges charge a liquidation fee. BitMEX charges 0.5%. Binance and Bybit don’t charge a direct fee - but they make up for it by selling your position at a slightly worse price than the market. That’s called a “slippage penalty.”

Your remaining balance - if any - goes back to your wallet. But most of the time, you lose everything. That’s because exchanges use your collateral to cover the loss. If your position is worth $50,000 and you only had $5,000 in margin, the exchange sells your position to cover the $50,000 debt. If the sale doesn’t cover it all, you owe nothing - the exchange eats the loss. That’s called “negative balance protection.” But if the sale covers it and you have leftover funds, you get those back.

Most traders don’t get anything back. Liquidation is designed to erase your position - not return your profit.

How to Avoid Liquidation

You can’t avoid market risk. But you can avoid liquidation.

- Use less leverage. 5x is better than 20x. 10x is better than 50x. You’ll make less per trade - but you’ll make more trades.

- Keep extra collateral. Don’t trade with your exact maintenance margin. Keep 20-30% extra. That gives you breathing room during volatility.

- Set stop-losses. Don’t rely on liquidation to protect you. Set your own stop-loss at 70-80% of your liquidation distance. If your liquidation is at $63,700, set a stop-loss at $65,000.

- Use partial closes. Instead of holding a full position, close 25-50% when you hit your first profit target. That reduces your exposure and raises your liquidation price.

- Monitor funding rates. High funding rates can shift your liquidation price by 0.5-2% in 24 hours. If funding is negative (you’re getting paid to hold), you’re safe. If it’s positive and rising, your liquidation price is moving against you.

- Use cross-margin wisely. Cross-margin lets you use your whole account balance as collateral. That helps - but it also means one bad trade can wipe out your entire portfolio.

Professional trader ‘CryptoWolf’ avoided losing $1.2 million during the May 2025 crash by keeping 15% of his portfolio in stablecoins. He used those to top up his margin when prices dropped. That’s not luck. That’s strategy.

The Bigger Picture: Why Liquidation Matters

Liquidation isn’t just about individual traders. It shapes the whole market.

Studies show 78.3% of liquidations happen within 1.5% of major support or resistance levels. That’s not coincidence. Traders cluster their stop-losses and leverage around these levels. When the price hits them, dozens of positions get liquidated at once - creating a cascade.

That’s why prices sometimes drop 5-7% beyond their true value. It’s not fundamentals. It’s liquidation feedback loops.

Regulators noticed. After $12.3 billion got wiped out in May 2025, the U.S. CFTC required exchanges to add “circuit breakers” - pauses in trading if liquidations exceed a threshold in 10 minutes.

Exchanges are adapting. Binance’s dynamic margins, Bybit’s protection zones, Deribit’s time-weighted pricing - all aim to reduce false liquidations. The next big step? Decentralized liquidation oracles. Ethereum’s EIP-7293, proposed in late 2025, could standardize how liquidations work across DeFi platforms.

But experts warn: if too many liquidations happen at the same price - like $70,000 for Bitcoin - it could trigger a $50 billion cascade. That’s why some exchanges are now randomizing liquidation prices within a 0.5% band. They’re trying to spread out the carnage.

Final Reality Check

Liquidation is the price of leverage. It’s not a bug. It’s a feature. And it’s brutal.

If you’re new to leveraged trading, start with 2x or 5x. Use a calculator to find your exact liquidation price before you open a trade. Never risk more than 5% of your account on a single position. And always, always have a plan B - because when the market turns, your stop-loss won’t save you. Your discipline will.

There’s no magic formula. No secret indicator. Just math. And patience.

What happens to my money when I get liquidated?

When you get liquidated, the exchange sells your position to cover the debt. If the sale covers the full amount and you have leftover funds, you get those back. But in most cases, your entire margin is used up, and you walk away with nothing. Exchanges don’t charge you more than you put in - you won’t owe them money - but you also won’t get anything back.

Can I avoid liquidation by setting a stop-loss?

Yes - but only if your stop-loss is set before your liquidation price. Most traders make the mistake of setting stop-losses too close to their entry price. A better approach is to set your stop-loss at 70-80% of the distance between your entry and liquidation price. That gives you room for normal market noise without getting caught in a liquidation.

Why does my liquidation price change even if I don’t do anything?

Because of funding rates and mark price adjustments. Funding rates are paid every 8 hours in perpetual futures. If you’re long and funding is positive, you pay it - and that slowly eats into your margin. If you’re short and funding is negative, you get paid - which can push your liquidation price further away. Also, exchanges recalculate your liquidation price based on the current mark price, which changes with market conditions.

Is cross-margin safer than isolated margin?

It depends. Cross-margin uses your entire account balance as collateral, so you’re less likely to get liquidated on one trade. But if one trade goes bad, it can wipe out your whole portfolio. Isolated margin limits risk to one position - but if that position hits liquidation, you lose only that trade. For beginners, isolated margin is safer.

Do all exchanges calculate liquidation the same way?

No. Binance, Bybit, and Deribit all use different liquidation engines. Some use partial liquidation, others close everything at once. Some use mark price, others use time-weighted averages. Kraken has higher maintenance margins, MEXC has lower ones. Always check your exchange’s documentation - don’t assume they’re the same.

Can I get liquidated during a market gap?

Yes. If the price gaps down past your liquidation level - say, from $70,000 to $62,000 in one second - your position will be closed at the best available price after the gap. You might lose more than expected. That’s why stop-losses and lower leverage are critical. Gaps don’t care about your calculations.

Are liquidation fees still charged by exchanges?

Most major exchanges like Binance and Bybit no longer charge a direct liquidation fee. Instead, they incorporate the cost into the liquidation price - meaning your position is sold at a slightly worse rate than the market. BitMEX still charges a 0.5% fee. Always check the fee schedule before trading.

14 Responses

Liquidation isn't some evil algorithm-it's just math being honest. You borrowed money to gamble on price, and when the dice rolled wrong, the house took back what was theirs. No drama. No malice. Just arithmetic. I used to hate it. Now I respect it. It keeps the game fairer than most people realize.

People act like it's personal, like the exchange is out to get them. Nah. It's protecting itself from your bad decisions. And honestly? It's protecting you from losing your rent money on 50x leverage.

I once blew $8k on BTC at 25x because I thought 'it'll bounce.' It didn't. Got liquidated at $63k. I cried. Then I made a spreadsheet. Now I use 5x. I make less per trade but I'm still here. That's the real win.

Stop blaming the system. Start respecting the math. The market doesn't care how hard you worked. It only cares if your collateral covers the risk. Period.

So if I got liquidated, I just lose my deposit? No extra fees? That’s kinda fair actually. I thought they’d charge you more after wiping you out.

Let me tell you something real-liquidation isn't the enemy. The enemy is the ego that says 'I know better than the market.' I’ve seen young traders in Johannesburg blow their entire savings on 100x ETH positions because they watched a YouTube video titled 'How to Get Rich in 3 Days.'

They don’t understand that leverage isn’t a shortcut-it’s a trapdoor. And when you fall through, you don’t just lose money. You lose sleep. You lose confidence. You lose trust in yourself.

I used to be one of them. I thought I was a genius because I made $2k in a week. Then I lost $15k in 12 minutes. That’s when I learned: the market doesn’t care how smart you think you are. It only cares if you have enough skin in the game.

So if you’re reading this and you’re still using 20x+ leverage? Put the phone down. Go take a walk. Breathe. Then come back and trade with 5x. Your future self will thank you.

And if you’re already liquidated? Good. That means you’re still alive. Now go learn. Don’t quit. Just get smarter.

Biggest mistake I made? Thinking my stop-loss would save me. Turns out, if the market gaps hard enough, your stop gets ignored. Liquidation price is the real safety net.

Now I always check the mark price, not just the chart. And I keep 30% extra in my wallet-just in case. I’ve been trading for 3 years. Only got liquidated once. That one time taught me more than all my wins combined.

Don’t chase gains. Chase survival. The money follows.

Good breakdown. Just one thing: when you say 'exchanges eat the loss'-that’s only true if they have negative balance protection enabled. Not all do. Some DeFi protocols let you go negative. Always check the fine print.

Also, funding rates aren't just a side note-they're a silent killer. I’ve seen positions get liquidated because funding ate 0.8% of their margin over 24 hours. No price move needed. Just slow, quiet erosion.

Use isolated margin. Set stop-losses. Monitor funding. And never, ever trade with your entire account. That’s not strategy. That’s suicide with a UI.

One thing no one talks about: liquidation triggers aren't just about price. They're about timing.

During the May 2025 crash, I watched a trader get wiped out at $63,700 on Binance-but BTC was trading at $64,100 on his screen. Why? Mark price. The exchange averaged prices across 12 exchanges, and one whale dumped 300 BTC on KuCoin, dragging the average down.

He didn’t panic. He didn’t sell. He just… got erased.

That’s why I use Bybit now. Partial liquidation saved me when I hit maintenance margin. It closed 25% of my position, gave me time to add more collateral, and I ended up turning a $3k loss into a $1.2k profit.

Know your exchange’s engine. It’s not the same as your friend’s.

Wow. So you're telling me that American exchanges are actually… responsible? How quaint. In Europe, they’d just freeze your account and charge you 15% for the 'liquidity risk.'

Also, why are you using USD-denominated terms? BTC should be priced in gold equivalents. This whole system is a fiat illusion.

And don’t even get me started on 'cross-margin.' That’s just institutional manipulation disguised as 'convenience.' You think you’re protected? You’re just giving them more of your money to play with.

Real traders use 1x leverage and hold. Everything else is casino.

This is so helpful! I just started trading last month and I didn’t even know what mark price meant. I thought liquidation was when the price hit my stop-loss. Now I get it.

I used 10x on SOL because I saw it go up 20% in an hour. Got liquidated at $142 when I thought I was safe at $135. Turned out my maintenance margin was at $140.

I cried. Then I printed out your liquidation formula and stuck it on my wall. Now I check it before every trade. Thank you for explaining it so clearly. I’m going to start with 5x now. Small steps.

Man, I used to think leverage was the key to wealth. Now I see it’s the key to stress.

I made $12k in 3 days on 20x LTC. Then lost $18k in 45 minutes. The market didn’t even drop that far-just a 3% dip. But because I had no buffer, I got wiped.

Now I use 3x. I wait for big trends. I only risk 2% of my account. I’ve made $4k in 6 months. Not flashy. Not viral. But I still have my account. And I sleep at night.

Don’t chase the moon. Chase consistency. The moon will come back. Your account won’t if you blow it.

Oh wow. Another ‘leverage is fine if you’re careful’ post. Classic. You people always act like this is a game you can ‘master.’

Let me tell you what really happens: exchanges manipulate mark prices. They know where all the retail stop-losses are clustered. They let the price dip just enough to trigger liquidations-then bounce right back.

That’s not math. That’s predation.

And you’re here, patting yourself on the back for ‘learning the system.’ You’re not learning. You’re being farmed.

Real traders don’t use leverage. They buy and hold. Or they short the entire system. Everything else is just feeding the machine.

Wait so you’re saying I got liquidated because of a 0.3% mark price difference? That’s insane. My whole life savings was on that trade. Now I’m broke. What’s the point of even trying?

Also, why do you sound like a textbook? Did you copy-paste this from Binance’s FAQ? This feels like an ad.

How can you call this a 'practical guide' when you're just promoting centralized exchanges? What about DeFi? Where’s your analysis on how Aave liquidators profit from your losses? You’re ignoring the real threat.

Also, 5x leverage? That’s for beginners. If you’re not using 10x+ you’re wasting your time. And don’t even get me started on ‘stablecoin buffers’-that’s just cowardice dressed up as strategy.

Real traders don’t need safety nets. They need conviction.

Good post. Liquidation is the price of entry. No tears. No blame.

I lost my first $5k on 50x. Didn't cry. Didn't quit. Just studied. Now I trade 2x. Made $20k last year. Not because I'm smart. Because I'm patient.

Market doesn't care about your feelings. It cares about your math. Get the math right. The rest follows.

Look, I’ve been trading since 2017. I’ve seen every bubble, every crash, every ‘revolutionary’ indicator. And let me tell you-none of this matters if you don’t have discipline.

You think the liquidation formula is the problem? No. It’s the trader who ignores it. The one who sets a 50x position with $100 in margin and says ‘it’s gonna pump.’

Exchanges aren’t the enemy. The enemy is the person who thinks they can outsmart math with hope.

And don’t even get me started on people who say ‘I’ll just use cross-margin.’ That’s not protection. That’s a suicide pact with your portfolio.

You want to survive? Use isolated margin. Set stop-losses. Monitor funding. And never, ever trade with money you can’t afford to lose. That’s not advice. That’s survival 101.

If you’re still reading this and you’re using 20x leverage? Close your browser. Go do something real. Like walk outside. Or talk to a human. Then come back when you’ve got a plan.