Not all crypto projects are created equal. You might see two tokens with similar market caps and think they’re interchangeable. But one could be built on shaky ground, while the other has real staying power. The difference isn’t in the price chart-it’s in the fundamentals. If you’re tired of chasing pumps and dumps, learning how to compare crypto projects fundamentally is the only way to make smarter, longer-term decisions.

Start with the Problem They’re Solving

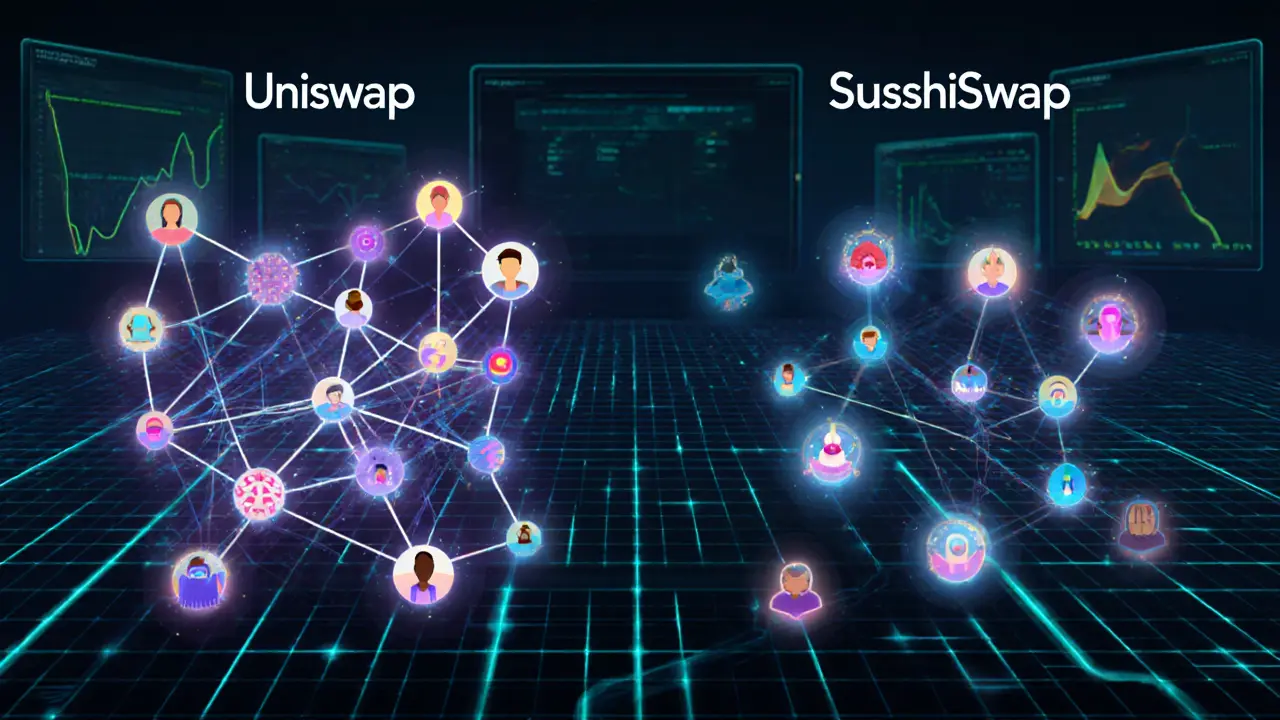

Every successful crypto project exists to fix something broken. Ask yourself: What real-world problem does this token solve? And is that problem even worth solving? Take Bitcoin. It wasn’t built to be a trading asset-it was designed as digital cash that doesn’t need banks. That’s why it’s still the most trusted store of value after 15 years. Now look at a new DeFi protocol claiming to offer 100% APY. Does it actually improve how people lend or borrow? Or is it just a fancy yield farm with no users outside of bots? Projects like Uniswap succeeded because they made decentralized trading simple. Before Uniswap, swapping tokens meant dealing with order books and liquidity providers. Uniswap’s automated market maker (AMM) model removed that complexity. That’s why it now has over 5 million users. Compare that to SushiSwap, which tried to copy Uniswap but added token rewards. It has about half the users-not because it’s worse technically, but because it didn’t solve a new problem. It just offered a better incentive. If a project can’t clearly explain what problem it solves in one sentence, walk away.Look Beyond Market Cap: The Real Metrics That Matter

Market cap tells you how much people are willing to pay right now. It doesn’t tell you if the project will last. Instead, focus on these five metrics:- Active users: How many real people are using the platform daily? Uniswap: ~5 million. SushiSwap: ~2.5 million. That gap isn’t random-it reflects real adoption.

- Total value locked (TVL): How much money is actually in the protocol? A high TVL with low user activity is a red flag. It often means whales are farming rewards, not using the service.

- Funding history: How much has the team raised? Helium raised $350 million to build a decentralized wireless network. Immutable X raised $120 million to scale NFTs. These aren’t just fundraising numbers-they’re bets from investors that the tech will work.

- On-chain transaction volume: Use Glassnode or Dune Analytics to see how many actual transactions are happening. High volume with low user count? That’s a sign of bot activity.

- Token utility: Does the token have a real job? Binance Coin (BNB) gives users fee discounts on the exchange. That’s utility. A token that only exists to be traded? That’s speculation.

Compare the Tech: What Makes It Different?

Technology isn’t just about blockchain speed or smart contract language. It’s about what’s hard to copy. Immutable X uses Layer-2 zk-rollups to make NFT trading fast and cheap. That’s a technical moat. Other NFT platforms can copy the UI, but they can’t easily replicate the underlying scaling tech without years of engineering. That’s why Immutable X has over 1 million users despite being a niche player. Helium built a decentralized wireless network where people earn tokens by installing hotspots. That’s not just a blockchain project-it’s a hardware + software + incentive system. No one else has replicated that model at scale. That’s a true competitive advantage. Compare that to a new DeFi protocol that just clones Uniswap’s code. It’s easy to copy. No moat. No future. Look for projects with:- Unique consensus mechanisms

- Proprietary scaling solutions

- Hybrid models (blockchain + real-world hardware or services)

- Open-source code with active developer contributions

Team and Community: The Invisible Engine

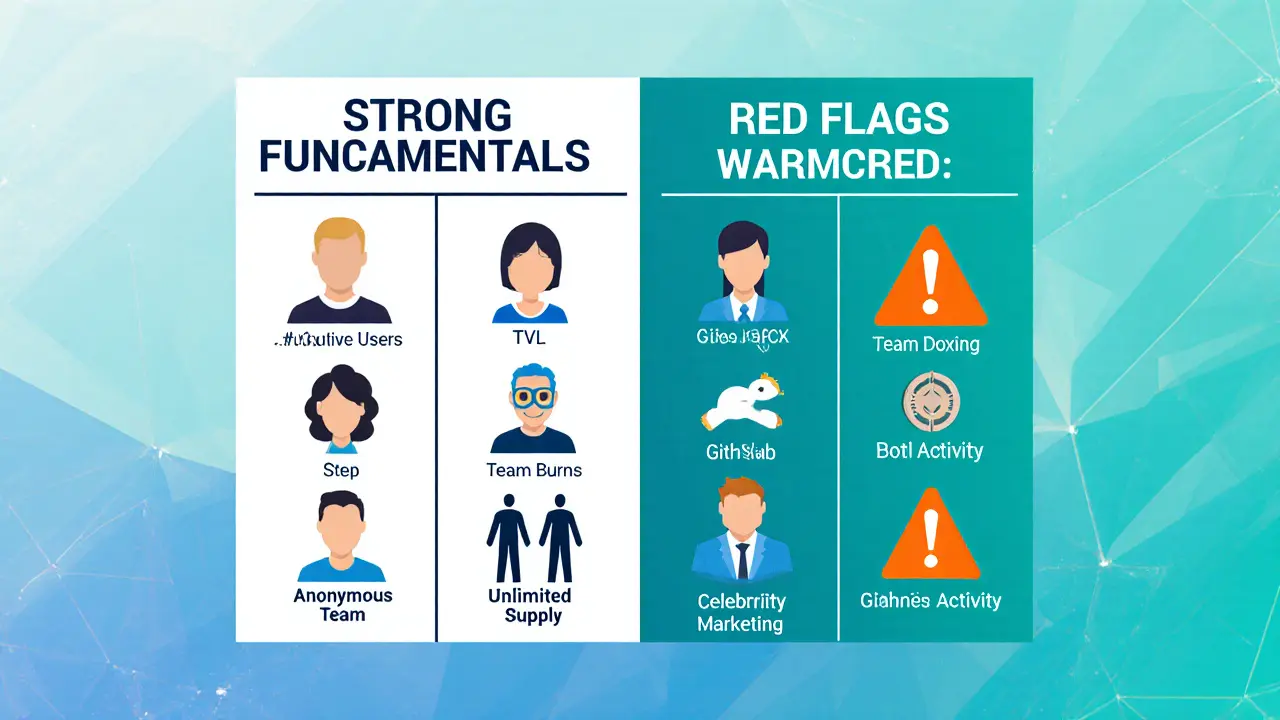

A great whitepaper means nothing if the team vanishes after the ICO. Check:- Who’s on the team? Have they built things before? Look at LinkedIn, GitHub, or past projects. Founders with experience at Google, Meta, or established crypto firms carry more weight.

- Is the team doxxed? Anonymous teams are a major risk. Not impossible to succeed-but you’re betting on strangers.

- Where’s the community? Discord and Telegram are noisy. Look at Twitter/X engagement. Are people talking about the tech? Or just the price?

- Are developers active on GitHub? Check commit frequency, open issues, and pull requests. A project with 50 commits a week is alive. One with 2 a month is dying.

Tokenomics: How Money Flows

Tokenomics is where most retail investors get fooled. A token that gives out 100% APY sounds amazing-until you realize it’s printing 10,000 new tokens every day. That’s inflation, not reward. Good tokenomics have:- Clear supply limits (like Bitcoin’s 21 million)

- Transparent emission schedules

- Token burns that reduce supply over time

- Staking rewards tied to network usage, not just new token creation

Market Position and Sector Context

You can’t compare a DeFi token to a gaming NFT project. They’re in different arenas. DeFi projects compete on:- Liquidity depth

- Security audits

- Yield consistency

- Integration with other protocols

- Transaction fees

- Creator tools

- Marketplace liquidity

- Scalability (can it handle 100k sales in a day?)

- Network size

- Real-world utility

- Hardware adoption

The Tools You Need

You don’t need to be a coder to do this. But you do need the right tools:- CoinMarketCap and CoinGecko: For basic stats-market cap, volume, TVL, token distribution.

- Dune Analytics: Free dashboards to see on-chain activity. Search for “Uniswap user growth” or “BNB burn tracker.”

- Glassnode: For deeper on-chain signals like holder concentration and exchange outflows.

- GitHub: Check code activity. Look for recent commits and open issues.

- Token Terminal: Shows revenue generated by protocols. This is huge. Many crypto projects make zero money. Real ones earn fees.

Red Flags to Avoid

Here’s what to watch out for:- Anonymous team with no track record

- Token supply with no cap or unlimited minting

- High APY with no clear revenue source

- Marketing focused on celebrities, not tech

- No public documentation or whitepaper

- Community is only active when the price rises

Why This Matters Now

The crypto market isn’t the wild west anymore. In 2025, institutions are watching. Regulators are stepping in. The projects that survive won’t be the ones with the flashiest ads. They’ll be the ones with solid tech, real users, and transparent economics. If you’re still judging crypto projects by their price charts alone, you’re playing Russian roulette with your money. Fundamental analysis doesn’t guarantee profits. But it removes the guesswork. It turns speculation into strategy. Start small. Pick one project you’re curious about. Run through these five steps. Compare it to one competitor. You’ll see things you never noticed before.Frequently Asked Questions

What’s the difference between fundamental and technical analysis in crypto?

Technical analysis looks at price charts and trading patterns to predict short-term moves. Fundamental analysis looks at the project itself-its team, tech, users, and token design-to judge long-term value. One tells you when to buy; the other tells you whether you should buy at all.

Can a crypto project with low market cap still be a good investment?

Yes-if it has strong fundamentals. A small project with 50,000 active users, a clear use case, and a doxxed team with experience can outperform a large project with no real users. Market cap is just a snapshot. Fundamentals show the direction.

How often should I re-evaluate a crypto project?

Check in every 3 to 6 months. Look for changes in user growth, team activity, funding, or tokenomics. A project that was strong six months ago might be fading if developers stopped committing code or if users left. Fundamentals shift-don’t set and forget.

Is it possible to compare crypto projects without knowing how blockchain works?

You can get far without being a developer, but you need to understand basic concepts like smart contracts, token supply, and on-chain activity. Use tools like CoinGecko and Dune-they explain metrics in plain language. You don’t need to code to read a dashboard.

What’s the biggest mistake people make when comparing crypto projects?

They focus on price history instead of usage. Just because a token went up 10x doesn’t mean it’s valuable. A project with 100,000 users paying fees is more sustainable than one with a million holders who never interact with it. Real adoption beats hype every time.

38 Responses

Finally someone breaks it down without the crypto bro nonsense. I used to chase every new meme coin until I started checking GitHub commits and TVL vs active users. Realized most projects are just glorified Discord bots with a whitepaper. Now I only look at projects with real usage, not just hype.

Uniswap’s 5M users? That’s insane. SushiSwap’s 2.5M? Yeah, they copied the UI but didn’t build anything new. It’s like opening a Starbucks next to another Starbucks and thinking you’ll win because you have free donuts.

Stop chasing APY. Start chasing adoption.

Man, I wish I had this guide two years ago when I blew my savings on a token called 'DogePunkAI' that had a whitepaper written in Comic Sans. I thought the team was legit because they had a Discord with 200k members. Turns out 90% were bots, and the rest were people spamming ‘to the moon’ in all caps.

Now I check CoinGecko for token utility first. If the token doesn’t do anything besides get traded, I walk away. BNB’s fee discounts? That’s utility. A token that just gives 150% APY because it’s printing 10k new coins an hour? That’s a pyramid with blockchain glitter on it.

The part about team doxxing hit hard. I invested in a project once where the founder’s LinkedIn said ‘ex-Google’ but there was zero trace of them ever working there. Never again. Real people, real track records. No more anonymous geniuses.

Also, Token Terminal is a game changer. Found a DeFi protocol making actual revenue. No one talks about that. Everyone’s obsessed with market cap like it’s a high school popularity contest. Real value is in fees, not FOMO.

And GitHub? If a project has 3 commits in 6 months, it’s dead. I don’t care how pretty their website is. Code doesn’t lie. If the devs are ghosting their repo, so are the users.

TL;DR: Stop looking at charts. Look at people. Real ones. With real activity. That’s the only edge you need.

Interesting framework but fundamentally flawed. You assume utility = value. But value is subjective. Bitcoin has no 'utility' beyond being a store of value, yet it's the most valuable crypto. Why? Because trust, not tech, drives adoption. You're conflating engineering with economics.

Also, TVL is a terrible metric. It's easily manipulated by yield farmers. A project with $10B TVL and 500 users is more dangerous than one with $500M and 50k users. The former is a liquidity trap, the latter organic growth.

And GitHub commits? Don't be naive. Some teams outsource dev work. Others use private repos. Open source doesn't equal legitimacy. Look at the *quality* of commits, not the quantity. One well-placed fix beats 500 meaningless churns.

Also, token burns? Most are performative. Binance burns coins they already control. It's a PR stunt. Real deflation requires burning *user-generated* supply, not treasury tokens.

And why do you assume Layer-2 is superior? zk-rollups are great, but they're not uncopyable. The real moat is network effects. Not code. Not tech. People. Always people.

Market cap is meaningless. TVL is a lie. GitHub commits are theater. You're all still missing the point. The only metric that matters is regulatory risk. If the SEC comes after a project, it dies. No matter how many users or how good the code. The real fundamental is legal exposure. Not tech. Not adoption. Not tokenomics. Compliance. Or lack thereof. That's the only thing that determines survival in 2025.

Everything else is noise.

This is the clearest breakdown I’ve seen in months. I’ve been trying to explain to my friends why I don’t invest in new DeFi tokens and this nails it. I especially love the part about token utility - so many people think ‘staking rewards’ = value, but if the token doesn’t do anything inside the protocol, it’s just a speculative token with a fancy name.

Also, checking GitHub activity? Genius. I started doing that last year and avoided three rug pulls just because the last commit was six months ago. So simple, yet so many overlook it.

Thanks for this. I’m sharing it with my entire family now.

You think this is deep? Nah. This is all controlled. The whole 'active users' thing? Fabricated. Dune Analytics? Manipulated by the same labs that run the exchanges. They pump the numbers to lure in retail. You think Uniswap has 5M users? More like 500k real ones and 4.5M bots paid by VCs to fake adoption.

And GitHub? All staged. Devs are paid to commit. Even the 'doxxed' teams? Most are shell companies with fake LinkedIn profiles. I've dug into three 'transparent' teams - all had the same lawyer, same registered address, same crypto mixer used for funding.

This guide? It's a trap. It's designed to make you think you're being smart while they harvest your wallet.

Only real move? Don't touch crypto. Buy gold. Or cash. Or land. Anything but this rigged game.

Ugh. Another 'fundamental analysis' post. Like anyone actually reads this stuff. I mean, look at the comments - everyone’s quoting Dune Analytics like it’s the Bible. Newsflash: 99% of you don’t even know what a zk-rollup is. You just copy-paste buzzwords because you saw it on YouTube.

Real talk? I bought a coin because the Discord mod said it was 'the next Bitcoin.' I made 7x. Then I sold. I didn’t need a 10-step checklist. I needed a vibe.

Also, why are we still talking about Uniswap? It’s been dead for years. The real action is on Solana now. But nope, you’re all stuck in 2021.

This is good stuff. I’m new to crypto and I’ve been confused by all the noise. This guide helped me understand what to actually look for. I checked a project I was thinking about investing in - no GitHub commits in 4 months, anonymous team, and APY of 200%. Walked away. Saved my money.

Thanks for keeping it simple. No jargon. Just facts. That’s what we need more of.

You call this 'fundamental analysis'? This is basic due diligence. You’re acting like this is revolutionary. It’s not. This is what institutional investors have been doing for years. Retail just caught up because they got burned.

And you missed the biggest point: governance. Who controls the treasury? Who votes on upgrades? If a project has a DAO but the core team holds 70% of votes, it’s not decentralized. It’s a dictatorship with a blockchain logo.

Stop praising 'doxxed' teams. Many are just lawyers with LinkedIn profiles. Look at voting power. Look at multisig keys. That’s the real fundamental.

It’s funny how we treat crypto like it’s some new frontier of finance, when really, it’s just capitalism with extra steps.

We spend hours analyzing tokenomics like it’s quantum physics, but ignore the fact that every single one of these projects is trying to monetize attention. The 'real users' metric? That’s just another form of ad impression. The 'TVL'? That’s just liquidity being rented for a fee.

Maybe the real fundamental isn’t the code or the team - it’s whether we’re still willing to believe that a digital token can be money. Maybe the project that wins isn’t the one with the best tech… but the one that convinces us to keep pretending.

And honestly? I’m not sure I want to be convinced anymore.

While the framework presented is methodologically sound, it is predicated upon a series of empirical assumptions regarding user behavior and network effects that may not be universally applicable across heterogeneous blockchain ecosystems. The conflation of on-chain activity with organic adoption, for instance, fails to account for wash trading, bot-driven liquidity provision, and incentive-driven participation artifacts.

Moreover, the reliance upon public repositories as indicators of project health introduces selection bias, as many high-fidelity teams utilize private or permissioned development environments to preserve intellectual property.

Therefore, while the heuristic is useful as a preliminary screening tool, it lacks the rigor necessary for robust valuation modeling in a non-stationary, high-volatility asset class.

Bro this is 🔥 I’ve been telling my friends this for months but no one listens 😭

Just checked a project I was thinking about - 500k TVL, 2000 daily users, GitHub commits every day, team on Twitter answering questions. Real stuff.

And I love how you mentioned token utility - I saw one where the token was just a reward token. No staking, no fees, no voting. Just a shiny badge. I walked away. No regrets.

Also, Token Terminal? Life saver. Found a DeFi project making $2M/month in fees. No one talks about it. But I’m in. 💪

Thank you for this. Sharing with my whole family now 🙏

You call this fundamental analysis? This is kindergarten investing. You’re measuring surface-level metrics like a toddler with a spreadsheet. You think GitHub commits matter? Try measuring code complexity, vulnerability density, and consensus algorithm efficiency. You think TVL matters? Try measuring impermanent loss exposure and liquidation ratios.

And you didn’t even mention MEV. The real moat isn’t tech - it’s who controls the miner extractable value. That’s where the money is made. Not in your 'active users' chart.

Also, Binance Coin burns? Please. It’s a tax on retail. The real deflation is in the exchange’s hidden fee structures - which you didn’t even touch.

You didn’t analyze the system. You listed a checklist. Big difference.

Look, I’ve been doing this since 2017. I’ve seen every trend. Every 'next Bitcoin.' Every 'decentralized AI.' Here’s the truth: 95% of these projects are scams. The other 5%? They’re the ones with real teams, real users, and real revenue. You don’t need fancy tools. You need common sense.

If a project’s website looks like a 2013 Flash site, walk away.

If the team has no LinkedIn, walk away.

If the APY is higher than your savings account, walk away.

It’s that simple. Stop overcomplicating it.

i just bought a coin called 'moonlamb' because the discord had a cute goat emoji and the founder said 'we gonna moon' and i made 5x in 3 days. i dont need your charts. i need vibes. 🐐🌕

This is exactly what I’ve been trying to tell my sister. She’s been buying every new coin that trends on TikTok. I showed her this and she actually paused. Said she’s going to check GitHub now. I cried. Not because I’m emotional - but because I finally feel like I’m not the only one who thinks like this.

Also, the part about token utility? I never thought about it that way. I used to think staking rewards = passive income. Now I see it’s just inflation disguised as a gift.

Thank you for writing this. I’m printing it out and putting it on my fridge.

Very basic. Everyone knows this. Why are you writing an article about this? In India we have better projects than these. You are still stuck in US market. We have real utility here - like decentralized farming loans and remittance platforms. You don't know because you don't look outside your bubble.

I’ve been in crypto since 2019 and I wish I had this guide back then. I lost so much money chasing pumps. Now I only look at three things: active users, token utility, and GitHub commits. If all three are solid, I do more research. If any one is missing? I skip it.

Also, the part about team doxxing? Huge. I invested in a project once where the founder had no online presence. Turned out they were in jail for fraud in 2020. No joke. So yeah - check LinkedIn. Even if it’s just to see if they’ve ever worked anywhere.

This isn’t just advice - it’s survival.

There’s a deeper layer here that’s rarely discussed: the psychological contract between a project and its community. The most sustainable crypto projects aren’t the ones with the best code - they’re the ones that make users feel like they’re part of something bigger. Ethereum didn’t win because of its tech. It won because it became a movement.

That’s why you see communities defending projects even when the price crashes. They’re not invested in the token - they’re invested in the idea.

So when you check GitHub, don’t just count commits. Look at the tone of the issues. Are people excited? Are contributors arguing passionately? That’s the real signal.

Also - don’t underestimate the power of a quiet, consistent team. The loudest ones are often the ones trying to distract you.

Oh wow. Another 'I did my research' post. Let me guess - you bought Solana because it had 'high throughput' and now you’re broke because it crashed 80%? Or maybe you're still holding a token that 'has real utility' and hasn’t moved in 18 months?

Stop pretending this is analysis. This is self-congratulatory storytelling. You’re not an investor. You’re a blogger with a spreadsheet.

Real investors don’t care about GitHub. They care about liquidity depth, insider selling, and regulatory exposure. You’re analyzing the wrong things because you’re scared of the real risks.

Also - 'doxxed team'? Please. Half of them are pseudonyms with fake degrees. Google their names. You’ll find they’ve been involved in three other failed projects.

Wake up. This isn’t finance. It’s theater.

wait so you mean i should check github before buying a coin?? like… for real??

i just thought the discord mod said it was good so i bought it lol

im gonna go check now…

How quaint. You think metrics matter in a world where the Fed prints $200B/month and banks still hold the keys to your money? This 'fundamental analysis' is just a luxury for those who still believe in the myth of meritocracy.

Real power lies in access - to private sales, to early liquidity pools, to insider networks. The rest of you? You’re reading this guide because you’re still trying to play by the rules.

But the game was rigged from the start.

I love this. I’ve been doing this for a while, but I never thought to use Token Terminal. Just checked a project I’ve been eyeing - it’s making $1.2M/month in fees. No one talks about it. Why? Because it’s not a meme coin.

Also, the GitHub thing? I checked one project last week - 2 commits in 6 months. Walked away. Saved myself from a rug pull.

Thank you for writing this. I’m sharing it with my book club. They’re all into crypto now and have no idea what they’re doing.

Of course you’re telling people to 'check the team.' That’s what they want you to think. The 'doxxed' team? They’re paid actors. The GitHub commits? Generated by AI. The TVL? Pumped by wash trading.

This whole guide is a psyop. Designed to make you feel like you’re in control. But you’re not. The system owns you.

They want you to believe in 'fundamentals' so you keep investing. So they can keep extracting.

Real power? Own physical assets. Own land. Own gold. Not tokens. Not ledgers. Not code.

They’re all lying. Every single one. The 'real users'? Fabricated by bot farms. The 'doxxed team'? Fronts for Chinese state-backed groups. The 'token burns'? Just accounting tricks.

And you think Dune Analytics is free? It’s owned by a venture fund that invested in 7 of the top 10 projects you’re analyzing.

This isn’t analysis. It’s propaganda. You’re being manipulated to keep feeding the machine.

Only real move? Go off-grid. Buy Bitcoin. Hold. Don’t touch anything else.

This is such a helpful breakdown. I’ve been hesitant to jump into crypto because it feels so chaotic. But this gave me a clear path. I’m going to start small - pick one project, check the metrics, and learn before I invest.

Thank you for not making it feel overwhelming. That’s rare.

Western-centric nonsense. You assume all projects are built for global adoption. But in Nigeria we use crypto for survival - remittances, payments, inflation hedge. We don’t care about TVL or GitHub. We care about speed and access. Your metrics are irrelevant to us.

Also why are you using American examples? Helium? Immutable X? Who cares? We have projects that serve 10 million people daily with zero marketing. You don’t see them because you don’t look outside your bubble.

This is why America is losing. You analyze instead of act. You check GitHub instead of betting big. Real investors don’t wait for perfect data. They move fast. They take risks. They trust their gut.

Uniswap? Overrated. Solana is the future. End of discussion.

Great breakdown. In India, we see so many projects that promise DeFi but have zero real users. I checked one last month - 100k TVL, but only 12 daily transactions. That’s not adoption. That’s a liquidity trap.

Also, token utility? We have a project here that lets farmers get loans using their crop data on-chain. That’s real utility. Not another yield farm.

Thank you for highlighting the difference between hype and real value. We need more of this.

Oh wow. So you're telling me I shouldn't trust a project just because the CEO is a TikTok influencer with 2M followers? And that GitHub commits matter? What is this, 2018? I bought a coin because the founder said 'we're building the future' and I made 12x. That's fundamental enough for me.

Also, why are you still using the word 'utility'? That's so last year. Now it's all about 'narrative.'

Next you'll tell me to check the moon phase before investing.

And yet here we are, 3 months later, and that same 'narrative' coin is down 90%. Meanwhile, the one with the quiet team, real usage, and GitHub commits? Up 40%.

Guess which one I’m holding?

It’s not about narrative or utility. It’s about control. The projects that survive aren’t the ones with the best tech - they’re the ones that control the narrative. Who owns the media? Who funds the influencers? Who controls the liquidity?

Real fundamental analysis isn’t about the project. It’s about the power structure behind it.

That’s the real irony - we spend so much time trying to decode the system, but the system doesn’t care if we understand it. It just needs us to keep believing it’s decodeable.

Maybe the most fundamental truth is that we’re all just actors in a play we didn’t write.

And that’s why the quiet teams win. They don’t need to sell you a narrative. They just build. And the community follows - not because they were told to, but because they saw something real.

The loudest voices don’t build movements. The quiet ones do.

I just checked my portfolio. I sold the TikTok coin. Bought the one with the GitHub commits. First time in 2 years I feel like I’m not being played.

Same. I sold my 'vibe' coins last week. Started with one project from this guide. Now I’m actually excited to check my portfolio every week. Not because I’m hoping for a pump - but because I know what I own.

My sister just told me she’s doing the same. She’s been calling me the 'crypto grandma' for years. Now she says I’m the only one who knows what I’m doing.

Feels good to be right.

And that’s the real win. Not the money. Not the returns. It’s the peace of mind.

You stop chasing. You start knowing.