Iranian Rial to Stablecoin Converter

Currency Value Calculator

Compare official and black market rates for Iranian rial to USDT

Currency Restrictions Information

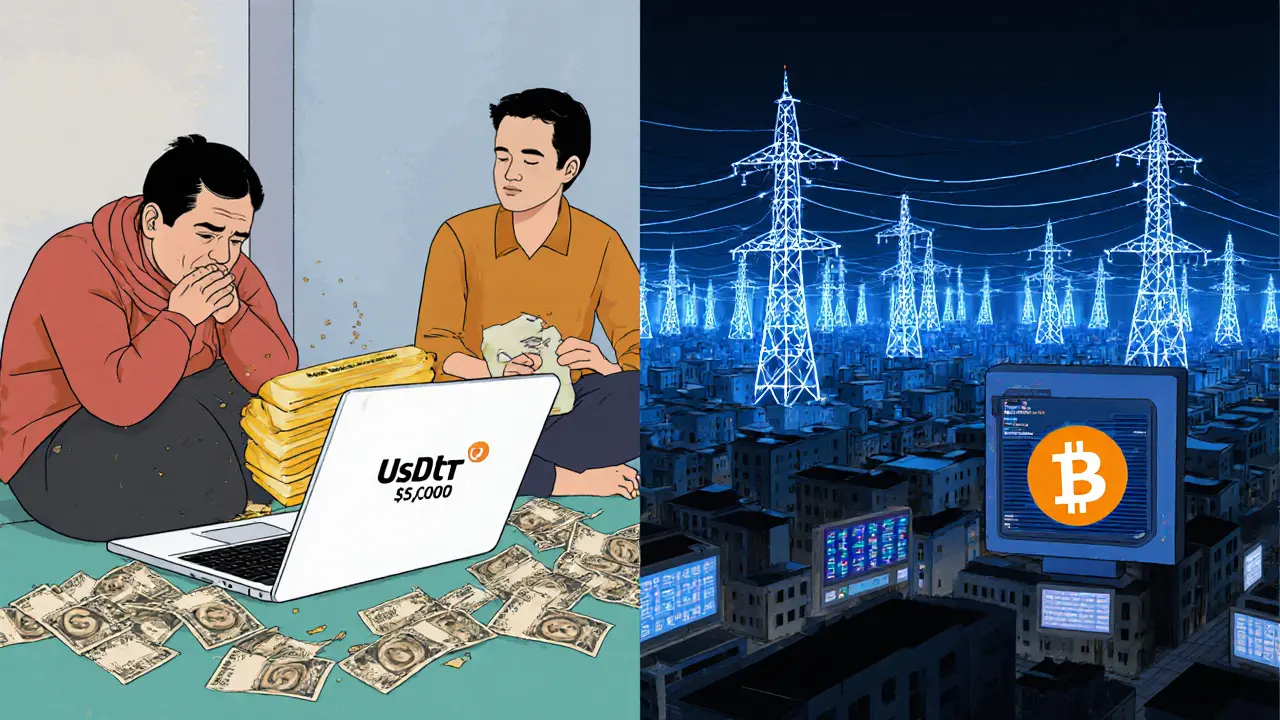

Iran has one of the strangest crypto policies on Earth: it lets you mine Bitcoin but bans you from buying it with your local money. That’s not a joke. It’s the reality for millions of Iranians trying to protect their savings from a currency that’s lost over 90% of its value since 2018. The Iranian rial is collapsing. Inflation is out of control. And the government’s answer? Don’t trade crypto with rials-but you can still mine it, as long as the state gets a cut.

Why the Iranian Rial Keeps Crashing

The Iranian rial isn’t just weak-it’s broken. Years of U.S. and international sanctions have choked off oil exports, the country’s main source of income. At the same time, domestic mismanagement, energy subsidies, and corruption have made prices for basic goods skyrocket. In 2025, the official exchange rate is around 420,000 rials to the U.S. dollar. But on the street? You’d need over 800,000 rials for one dollar. That gap isn’t a glitch-it’s the system. People aren’t sitting still. They’re turning to crypto not for speculation, but survival. Bitcoin, Ethereum, and especially stablecoins like USDT let Iranians hold value that won’t vanish overnight. A $100 USDT wallet can buy groceries for a family for weeks. A $100 rial note? Not even a loaf of bread.The 2024 Ban: No More Rial-to-Crypto Payments

On December 27, 2024, Iran’s Central Bank pulled the plug. All domestic platforms were forced to shut down direct rial-to-crypto and crypto-to-rial conversions. That meant you couldn’t use your bank account to buy Bitcoin on Nobitex or any other local exchange. No credit cards. No bank transfers. No cash deposits. The goal? Stop capital flight. Keep rials inside the system, even if they’re worth less every hour. But here’s the twist: the ban didn’t stop crypto trading. It just moved it underground. People started using peer-to-peer (P2P) apps, Telegram bots, and cash meetups. A trader in Tehran might sell you $500 in USDT for 450,000 rials per dollar-way below the black market rate-but it’s still better than watching your savings evaporate.January 2025: The Government API Trap

By January 2025, the Central Bank quietly reopened some payment channels-but only if exchanges connected to a government-controlled API. This system gives officials real-time access to every transaction: who sent what, when, and to whom. It’s not about security. It’s about control. Exchanges like Nobitex and Digifin had to comply or shut down. Users had to submit ID, phone numbers, and even biometric data. The government now knows exactly who’s holding crypto and how much. That’s a big deal. In most countries, crypto is private. In Iran? It’s monitored like a bank account.September 2025: The $5,000 Stablecoin Cap

The biggest blow came on September 27, 2025-just hours before the UN reinstated sanctions. Iran’s Central Bank announced new rules for stablecoins:- Each person can buy a maximum of $5,000 in stablecoins per year.

- No one can hold more than $10,000 total in stablecoins at any time.

- You have one month to reduce holdings above $10,000-or risk losing access to your funds.

Tether’s July 2025 Freeze: A Warning Shot

On July 2, 2025, Tether froze 42 cryptocurrency addresses linked to Iranian users. Over half of those addresses were connected to Nobitex. Some were tied to wallets flagged by Israeli counter-terror agencies as linked to the IRGC. Tether didn’t say who owned them. But the message was clear: if you’re using crypto to bypass sanctions, you’re a target. The fallout was immediate. Iranian crypto influencers, many of whom had been pushing USDT as the safest option, suddenly switched tone. They started telling people: “Sell your USDT. Move to DAI.” Why DAI? Because it’s a decentralized stablecoin built on the Polygon network-faster, cheaper, and harder for Tether to freeze. Iranians didn’t wait for government orders. They adapted on their own, moving millions in value overnight.The Mining Paradox: Bitcoin for the State, Not the People

Iran is now the 5th largest Bitcoin miner in the world. It’s not because its citizens are tech geniuses. It’s because electricity costs less than 1 cent per kWh. The government encourages mining because it brings in hard currency-$1 billion a year from Bitcoin alone. That money flows into state coffers, not into people’s pockets. But here’s the catch: miners need power. And Iran’s grid is already overstretched. In 2025, the government started cutting electricity to entire neighborhoods during peak hours to save energy for mining farms. People were furious. But they couldn’t protest. The state owns the power. The state owns the miners. The state owns the Bitcoin.The Digital Rial: A Government-Controlled Alternative

Iran isn’t just fighting crypto-it’s trying to replace it. The Central Bank launched its own digital currency: “Rial Currency.” It’s not Bitcoin. It’s not Ethereum. It’s not even decentralized. It’s a digital version of the rial, controlled entirely by the government. Piloted on Kish Island, it’s meant to replace dollar transactions and reduce reliance on foreign payment systems. But here’s the problem: no one trusts it. Why would you use a digital rial when the real rial is falling 10% a month? The digital version doesn’t fix the problem-it just digitizes it.

Now There’s a Tax on Crypto Profits

In August 2025, Iran passed the Law on Taxation of Speculation and Profiteering. For the first time, crypto gains are taxed like gold, real estate, or foreign currency. If you bought Bitcoin for $5,000 and sold it for $8,000, you owe tax on the $3,000 profit. The government says this is about fairness. The real reason? They want a cut. Even if you’re trading crypto to survive, they still want their share. The tax isn’t enforced yet-it’s being phased in slowly. But it’s coming. And it shows the state no longer sees crypto as a threat. It sees it as a revenue stream.What This Means for Iranians

The Iranian government’s approach is simple: you can’t use crypto to escape the rial-but you can use it to help us escape sanctions. For ordinary people, it’s a lose-lose. You can’t buy crypto easily. You can’t hold much of it. You can’t advertise it. You’ll be taxed on any profit. And if you’re caught holding too much, the government can freeze your wallet. Yet, millions still trade. Because the alternative-watching your life savings vanish-is worse.What This Means for the Rest of the World

Iran’s model is becoming a blueprint for other sanctioned nations: Russia, Venezuela, North Korea. They’re all watching. They see how Iran mines crypto for hard cash, blocks retail access, and uses digital tools to monitor citizens. It’s not about freedom. It’s about control. The world’s crypto regulators are watching too. Iran proves that even in the most open financial systems, governments can still shut down access. If a country with no banking ties to the West can still control its crypto market, what does that mean for the future of decentralization? It’s not a question of whether crypto can be banned. It’s whether people will still find a way to use it-even when the state tries to stop them.Can Iranians still trade cryptocurrency legally?

Yes-but only under strict conditions. Iranians can buy and sell crypto using peer-to-peer methods, but direct rial-to-crypto transactions through exchanges are banned unless they use the government’s approved API. All transactions are monitored, and users must complete KYC verification. Holding stablecoins is limited to $10,000 per person, with annual purchases capped at $5,000.

Why did Iran ban crypto payments but allow mining?

Iran allows mining because it generates hard currency (mostly Bitcoin) that the state can sell abroad to bypass sanctions. Mining also uses cheap domestic electricity, turning a national problem-power surplus-into a revenue source. But allowing citizens to trade crypto with rials would accelerate the rial’s collapse, so the government blocks those flows to maintain monetary control.

What happened to Tether’s Iranian users in July 2025?

In July 2025, Tether froze 42 cryptocurrency addresses linked to Iranian users, most connected to Nobitex and flagged wallets tied to the IRGC. Over half of the frozen addresses showed direct transaction links to sanctioned entities. This was Tether’s largest single freeze ever and triggered a mass migration of Iranian users from USDT to DAI on the Polygon network to avoid future freezes.

Is the Iranian digital rial the same as Bitcoin?

No. The Iranian digital rial is a centralized, government-controlled digital currency backed by the Central Bank and tied to the value of the paper rial. Unlike Bitcoin, it cannot be mined, is not decentralized, and has no supply limit beyond what the government decides. It’s designed to replace cash and reduce dollar dependence-not to offer financial freedom.

Are Iranians being taxed on their crypto profits?

Yes. Since August 2025, Iran has imposed a capital gains tax on cryptocurrency trading under the Law on Taxation of Speculation and Profiteering. Profits from crypto are taxed the same way as gains from gold, real estate, or foreign currency. The tax is being phased in gradually, but it signals the government’s shift from blocking crypto to taxing it.

What’s the future of crypto in Iran?

The future is a two-track system: state-controlled mining and digital rials for the regime, and underground P2P crypto trading for citizens. As long as the rial keeps falling, Iranians will find ways to use crypto-even if it means risking fines, freezes, or surveillance. The government may tighten controls further, but history shows that when people need to preserve wealth, they’ll find a way.

18 Responses

It’s wild how the Iranian government turned crypto into a state resource while punishing its own people. Mining for profit but banning personal use? That’s not policy-it’s exploitation.

The structural irony here is breathtaking. The state uses cheap electricity to mine Bitcoin for foreign currency, while citizens are forced to trade on Telegram because their own currency is worthless. This isn’t regulation-it’s economic cannibalism.

So the government lets you mine Bitcoin but you can’t buy it? That’s like letting someone chop wood but not letting them light a fire. Classic authoritarian logic.

Let’s not romanticize this as some grassroots resistance. The P2P networks are just the informal economy adapting to hyperinflation. The real story is the central bank’s API-this isn’t about control, it’s about surveillance capitalism with a theocratic twist. The state doesn’t want to stop crypto, it wants to own the metadata.

Iranians are basically doing financial parkour. Every time the state slams a door, they kick open a window. DAI over USDT? Brilliant. No central authority can freeze a decentralized stablecoin on Polygon as easily. This isn’t just survival-it’s crypto anthropology in real time.

I’ve seen this pattern before-in Venezuela, in Lebanon, in Argentina. When the state fails, people turn to crypto not as an investment but as a lifeline. The fact that Iran allows mining but blocks retail access shows they’re not anti-crypto-they’re anti-wealth-transfer. They want the Bitcoin, not the people holding it. And now they’re taxing profits? That’s the final insult. You can’t escape the system, but you have to pay to try.

It’s funny how the same people who scream about decentralization when it’s convenient suddenly don’t mind when the state controls every node. The digital rial? It’s not even a currency-it’s a loyalty card with a blockchain logo. And Tether freezing wallets? That’s not enforcement, that’s corporate compliance with authoritarian regimes. Crypto’s promise was freedom. What we’re seeing in Iran is what happens when freedom gets monetized, regulated, and then weaponized.

It’s heartbreaking but inspiring. People are risking fines and surveillance just to feed their families. The $10,000 cap sounds generous until you realize it’s less than half a year’s rent in Tehran. This isn’t about crypto policy-it’s about dignity.

The regulatory architecture described here represents a novel synthesis of authoritarian control and digital financial pragmatism. The state leverages mining as a macroeconomic hedge while simultaneously deploying KYC/AML infrastructure to surveil individual financial behavior. The imposition of capital gains taxation on crypto profits, though procedurally consistent with conventional fiscal policy, functions as a de facto confiscatory mechanism under conditions of hyperinflation. The institutional paradox-permitting the accumulation of hard assets while prohibiting their liquid acquisition-suggests a systemic preference for extractive sovereignty over citizen welfare. This model may indeed serve as a template for other sanctioned states, particularly those with substantial energy reserves and weak institutional legitimacy.

As someone who has studied monetary policy in crisis economies, I find Iran’s approach both chilling and predictable. The state has effectively created a two-tiered financial system: one for the regime, one for the people. Mining generates foreign exchange revenue that bypasses sanctions, while the prohibition of rial-to-crypto conversions prevents capital flight. The API-based monitoring system ensures compliance without overt repression, making it a sophisticated form of financial authoritarianism. The taxation of crypto profits is not about fairness-it’s about revenue capture. When a currency loses 90% of its value, citizens aren’t speculating-they’re surviving. And yet, the state insists on its cut. This is not governance. It’s extraction with a digital veneer.

The digital rial is the ultimate irony. A government that can’t maintain the value of its own currency tries to digitize it. No decentralization. No transparency. Just another ledger under the Central Bank’s thumb. It’s not innovation-it’s rebranding collapse.

Let’s be real-this is all a CIA psyop. The US and Israel are pushing Tether to freeze wallets to destabilize Iran’s economy. The mining? That’s a distraction. The real goal is to make Iranians desperate enough to turn on their own government. The digital rial? A trap. They’re gonna track every transaction and then accuse people of ‘crypto terrorism’ when they try to buy bread. You think this is about sanctions? It’s about regime change. And the people? They’re just pawns in a game they didn’t sign up for.

So many layers here. 😔 The state mines Bitcoin with stolen electricity 🌩️, people trade USDT on Telegram 📱, Tether freezes wallets 🚫, then Iranians switch to DAI on Polygon 🔄, and the government taxes their survival 💸. This isn’t crypto-it’s a dystopian survival game where the rules keep changing. But hey, at least they’re still trying. Respect. 🙏

They let you mine but not buy? That’s like letting someone bake bread but not eat it. The government just wants the profit. People are just trying to keep their families fed. It’s not about crypto-it’s about not starving.

The real story is Tether freezing wallets. That’s the moment crypto died as a freedom tool. If a private company can shut down your savings because of political pressure, then decentralization is a myth. The state doesn’t need to ban it-Wall Street does it for them.

Why are we still pretending this is about economics? This is a totalitarian regime using financial tools to crush dissent. The mining is a cash cow. The cap is a leash. The API is a spy tool. The tax is a punishment. And the digital rial? A propaganda prop. Stop acting like this is a policy debate. It’s oppression with a whitepaper.

Oh please. The whole thing is a lie. Iran doesn’t even mine that much Bitcoin. The numbers are fake. The government just wants to scare people into using the digital rial. This is all theater. The sanctions aren’t hurting them-they’re helping them. They’re using this to justify more control. Don’t fall for it.

And yet, despite all this-the surveillance, the caps, the freezes, the taxes-people still trade. Not because they love crypto. Because they hate losing everything. That’s the quietest revolution: not with guns, but with wallets.