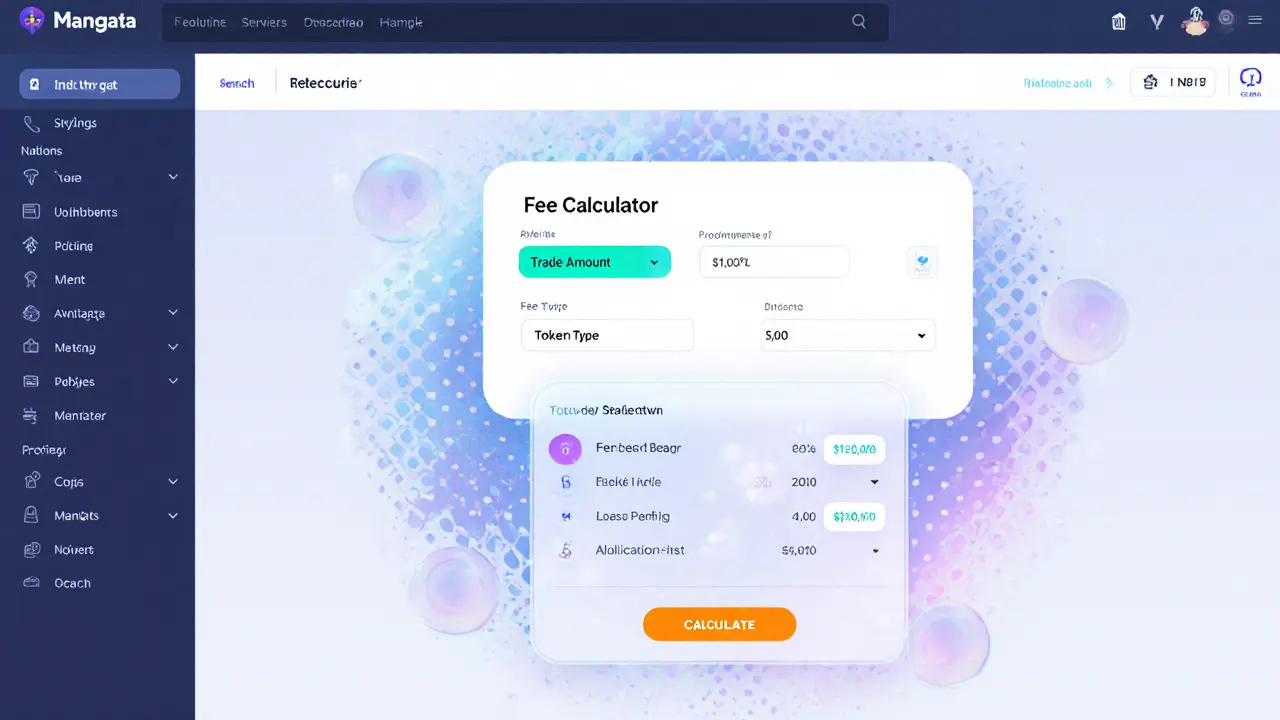

Mangata DEX Fee Calculator

Fee Comparison Tool

See how Mangata's fixed fee model compares to traditional DEXes with dynamic gas fees.

Fee Breakdown

Enter trade details and click Calculate to see fee comparison

Key Features Comparison

| Feature | Mangata | Uniswap | SushiSwap |

|---|---|---|---|

| Trading Fee | Fixed 0.1% | 0.3% | 0.25%-0.3% |

| Gas Model | No-gas, fixed fee | Dynamic gas (ETH) | Dynamic gas |

| Front-running Protection | Built-in order-shielding | MEV-prone (mitigated) | Same as Uniswap |

| Liquidity Incentives | Proof-of-Liquidity rewards | LP fee share | LP fee share + rewards |

Mangata Finance is a decentralized exchange (DEX) built on the Polkadot ecosystem that promises zero gas fees, low fixed trading fees, and protection against front‑running. Launched in 2020 by Mangata Labs, the platform tries to solve two chronic problems in DeFi: the cost of transaction fees and the risk that miners or whales manipulate trade order. This review breaks down how the protocol works, who backs it, how it stacks up against the big DEXes, and what you should watch before putting any capital on the line.

What makes Mangata different?

The first thing to notice is the no‑gas economy. Most DeFi platforms charge a gas fee for every on‑chain action, which can spike to dozens of dollars during network congestion. Mangata sidesteps this by pre‑paying a fixed fee in its native token, so users never see a separate gas charge at checkout. The fee is tiny-often fractions of a cent-making micro‑trades viable for retail traders.

Another differentiator is the Proof‑of‑Liquidity consensus layer. Instead of staking pure tokens, liquidity providers lock up pairs of assets, and the network rewards them based on the amount and duration of liquidity supplied. This mechanism not only boosts security (more assets locked means a higher economic barrier for attacks) but also gives LPs a steady yield that’s separate from typical trading‑fee shares.

Technical foundation: Polkadot and parachains

Being a Polkadot DEX means Mangata inherits cross‑chain messaging and shared security from the Relay Chain. In practice, this lets the exchange connect to other parachains or even Ethereum via bridges, expanding the pool of tradable assets without sacrificing speed. The architecture also benefits from Polkadot’s slot auction system, where a parachain slot gives guaranteed block space-a crucial factor for maintaining the no‑gas promise.

Funding and strategic backers

In a 2023 round, Mangata raised $4.2million from a mix of crypto‑focused investors. The lead investors were Altonomy, a digital asset market‑making firm, Polychain Capital, and TRGC. While the amount is modest compared with multi‑hundred‑million rounds at Uniswap or SushiSwap, it signals confidence in Polkadot‑centric DeFi and provides resources for further parachain integration and UI improvements.

How Mangata stacks up against the heavyweights

| Feature | Mangata Finance | Uniswap (Ethereum) | SushiSwap (Multi‑chain) | PancakeSwap (BNB Chain) |

|---|---|---|---|---|

| Base ecosystem | Polkadot parachain | Ethereum | Ethereum + others | BNB Chain |

| Gas model | No‑gas, fixed fee | Dynamic gas (ETH) | Dynamic gas (varies) | Low‑fee BNB gas |

| Front‑running protection | Built‑in order‑shielding | MEV‑prone ( mitigated by Flashbots ) | Same as Uniswap | Same as Uniswap |

| Liquidity incentives | Proof‑of‑Liquidity rewards | LP fee share (0.3%) | LP fee share + SUSHI rewards | LP fee share + CAKE rewards |

| Typical trading fee | Fixed 0.1% (example) | 0.3% | 0.25% - 0.3% | 0.2% |

| Cross‑chain swaps | Polkadot bridges, upcoming XCM | Limited (via Layer 2) | Multi‑chain via SushiSwap X‑bridge | Limited |

The table highlights where Mangata shines-especially for traders who hate unpredictable gas spikes. However, its market depth is still tiny compared with Uniswap’s billions‑dollar daily volume, so slippage can be an issue on larger orders.

Benefits for everyday traders

- Zero gas surprises: you know exactly what you’ll pay before confirming.

- Lower overall cost: fixed fees are often cheaper than Ethereum’s volatile gas.

- Built‑in protection: order‑obfuscation reduces the chance of a miner‑or‑whale front‑run.

- Passive income: providing liquidity earns Proof‑of‑Liquidity rewards on top of transaction fees.

Potential drawbacks and risks

- Liquidity is thin: low volume can cause higher slippage on bigger trades.

- Limited asset list: currently focused on Polkadot‑related tokens, fewer mainstream pairs.

- Security audit transparency: no public audit reports have been released yet, which raises caution for large investors.

- Network effect: without a large user base, price discovery may be less efficient.

Getting started: a quick user guide

- Install a Polkadot‑compatible wallet (e.g., Polkadot.js or Fearless Wallet).

- Acquire the native token (usually MGT) on a supported exchange and transfer it to your wallet.

- Visit the Mangata web app (https://app.mangata.finance) and connect your wallet.

- Select a trading pair from the dropdown-most pairs involve DOT, KSM, or popular parachain tokens.

- Enter the amount, review the fixed fee preview, and confirm the trade. No extra gas field will appear.

- To become a liquidity provider, click “Add Liquidity”, select a pair, and deposit the required assets. Your LP tokens will appear in your wallet, earning Proof‑of‑Liquidity rewards.

Because the platform does not charge separate gas, you’ll notice the transaction finalizes almost instantly, provided the Polkadot relay chain is not congested.

Adoption challenges and future outlook

While the technical ideas are solid, Mangata faces a classic chicken‑and‑egg problem: attracting traders requires deep liquidity, and deep liquidity needs traders. The $4.2M funding round should help with marketing and bridge development, but the platform still lacks a public security audit, a factor that institutional participants often demand.

Looking ahead, the roadmap mentions expanding XCM (Cross‑Consensus Messaging) support to enable seamless swaps with other parachains. If successful, Mangata could become the go‑to DEX for the burgeoning Polkadot DeFi ecosystem, especially as Ethereum gas fees remain high.

TL;DR - key points to remember

- Mangata Finance is a Polkadot‑based DEX that eliminates gas fees and offers a fixed trading fee.

- Proof‑of‑Liquidity rewards aim to attract LPs while enhancing network security.

- Backed by Altonomy, Polychain Capital, and TRGC with a $4.2M round.

- Compared with Uniswap and SushiSwap, it’s cheaper but has far lower liquidity.

- Best for small‑to‑medium trades on Polkadot assets; larger traders should watch liquidity depth.

Frequently Asked Questions

Is Mangata safe to use without a formal security audit?

Safety is always a concern with newer DeFi protocols. While Mangata has not published a third‑party audit yet, its code is open‑source, and the Proof‑of‑Liquidity model adds an economic security layer. Users should start with small amounts, monitor community channels, and consider the lack of audit as a risk factor before committing large funds.

What wallets are compatible with Mangata?

Any wallet that can sign Polkadot transactions works-Polkadot.js, Fearless, and Talisman are the most common. Mobile wallet support is growing, and all of them can connect directly to the Mangata web interface.

How are fees calculated on Mangata?

Fees are a flat rate expressed in the native token (typically 0.1% of trade value) and are deducted automatically from the trade. There is no separate gas fee because the network pays the underlying transaction cost from the protocol’s reserve.

Can I trade assets from other blockchains on Mangata?

Currently the focus is on Polkadot and its parachains. However, Mangata plans to integrate more cross‑chain bridges via XCM, which could eventually bring Ethereum, BNB Chain, and other ecosystems into the DEX.

What is the advantage of Proof‑of‑Liquidity over traditional staking?

Proof‑of‑Liquidity ties rewards to the actual amount of liquid assets locked in a pair, aligning incentives with market depth. Traditional staking rewards are usually independent of liquidity, which can lead to a mismatch between network security and trading activity.

20 Responses

Mangata looks slick and cheap!

Okay, so they say Mangata is a "no‑gas" DEX, but have you ever wondered who's actually paying for that gas behind the scenes? I mean, the whole blockchain ecosystem runs on miners or validators, right? If the fee is fixed at 0.1%, someone has to cover the transaction costs, and that’s usually the network operators or the insiders pulling the strings.

Look at the timing of the fee model rollout – it coincided exactly with a few major stake‑pool consolidations in Polkadot. Coincidence? I think not.

Plus, the built‑in order‑shielding sounds great until you realize it could be a front door for selective order approvals, letting a few privileged wallets slip through while the rest get throttled.

Even the UI feels a little too polished for a community‑run project; it screams that there’s a marketing budget funded by something shady.

And don’t get me started on the token incentives – those proof‑of‑liquidity rewards are just a clever way to lock up capital and keep the price artificial.

Everything points to a hidden layer of governance that isn’t disclosed.

Remember when a few months back, a big exchange quietly added Mangata pairs without any announcement? That’s the kind of silent partnership that keeps the “no‑gas” myth alive.

In short, if you’re not comfortable with the idea that a few power players might be benefitting while you think you’re paying a flat low fee, maybe stick to the classic DEXes.

Yo, as an American I gotta say this DEX is kinda wild. Fixed 0.1% is cheap, but if it’s built on Polkadot, are we just shifting power to the European tech crowd? Not that I’m against it, but make sure you keep an eye on custody – I don’t want my DOT sitting on some foreign server.

One must contemplate the ontological ramifications of a "no‑gas" paradigm within the decentralized exchange framework. The very notion subverts the canonical economic model predicated upon variable transaction costs, thereby engendering a quasi‑static liquidity landscape. Moreover, the pre‑eminence of a fixed 0.1% fee ostensibly democratizes access, yet simultaneously obfuscates the underlying subsidy mechanisms that sustain network operability. Consequently, scholars of blockchain economics should interrogate the epistemic validity of such fee structures, lest we succumb to a veneer of simplicity that masks systemic intricacies.

Oh great, another DEX promising zero gas. Sure, because we all love paying hidden fees elsewhere. At least the fixed 0.1% is transparent, but don’t expect miracle liquidity.

Looks promising! 😊 Fixed fees are nice for budgeting trades. I’m curious how the order‑shielding works in practice. Let’s see some real‑world data.

🚀 This could be a game‑changer for newcomers! The UI feels clean, and no‑gas means less hassle. Keep an eye on the liquidity rewards – they might boost your yields. 👍

Wow, a "no‑gas" DEX? That’s cute. I bet the real cost is hidden in the tokenomics. Still, if you’re comfortable with the risk, go ahead.

Nice breakdown! The fixed fee makes it easier to compare against Uniswap. If you’re looking for lower slippage, Mangata’s order‑shielding could help.

From a philosophical standpoint, the removal of gas fees could be seen as a step toward more equitable access to financial tools. However, one must ask whether this equity is genuine or merely a veneer covering deeper centralization trends. The proof‑of‑liquidity rewards, while attractive, may inadvertently concentrate power among early adopters. In any case, observing real trading data will reveal the true impact of these design choices.

I’m interested in how the fixed fee compares over larger trade volumes. Does anyone have numbers on total cost for a $10k swap?

Regarding the fee calculator, it’s important to note that the UI may not factor in potential liquidity provider fees. Users should double‑check the final settlement amount.

Love the clean UI and the fact that I can predict my fees ahead of time. Makes budgeting for trades a breeze.

Thanks for the info. I’ll keep an eye on the actual on‑chain fees once I try a small swap.

Interesting that Mangata claims built‑in order‑shielding. If that works, it could mitigate typical MEV exploits we see on other DEXes.

From a technical perspective, integrating a no‑gas model on Polkadot requires careful substrate runtime adjustments. The developers should publish more on the underlying implementation.

FYI, the fixed 0.1% is lower than Uniswap’s 0.3%, but remember to account for liquidity depth when estimating slippage.

Honestly, I’m skeptical. Every DEX promises something new, but the market decides what sticks. Let’s see if Mangata can survive the competition.

Great overview! The fee calculator is super helpful for newbies like me.

Thank you for the detailed review. I appreciate the thorough comparison of fee structures and the inclusion of security considerations. I look forward to testing Mangata in a controlled environment.