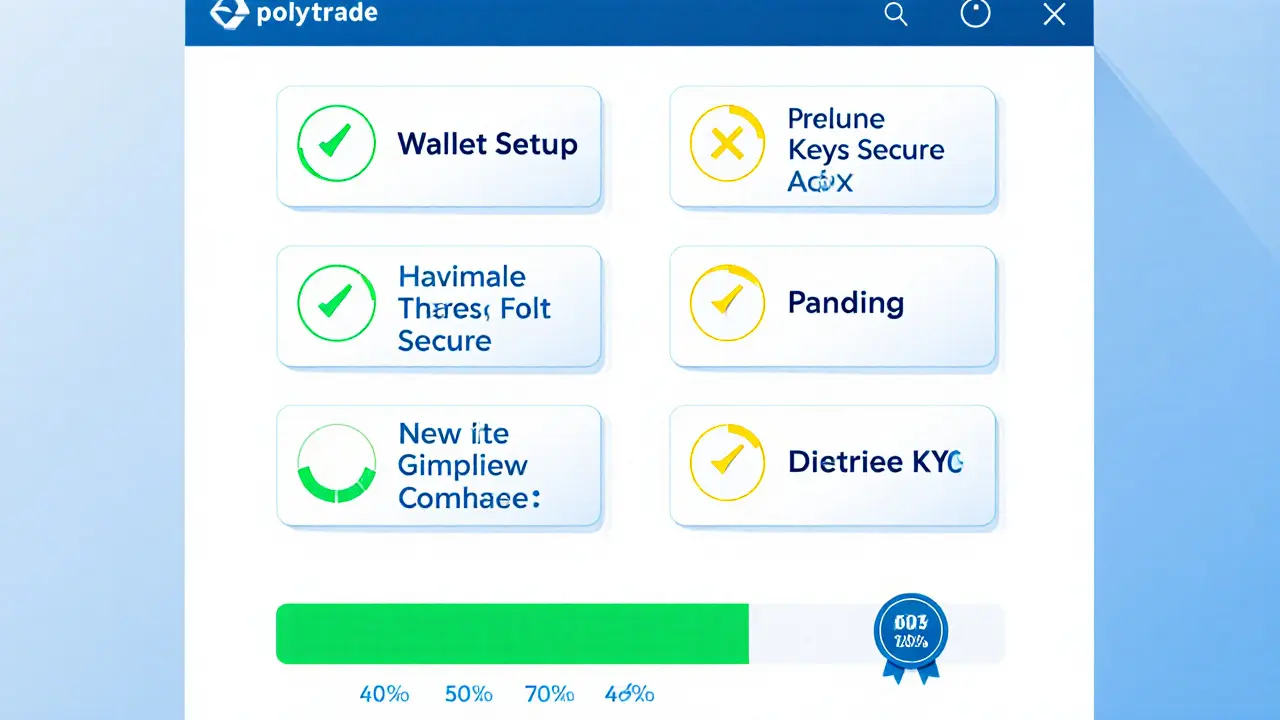

Polytrade Airdrop Preparation Checklist

Wallet Setup

Ensure you have a compatible EVM wallet installed (MetaMask, Trust Wallet, etc.).

Private Keys Secure

Keep your private keys safe and never share them with anyone.

Follow Official Channels

Join Discord, follow Twitter, and subscribe to Medium for updates.

Complete KYC

Fill out the verification form on polytrade.io before the deadline.

Platform Activity

Use the invoice financing portal if available to show activity.

Watch Snapshot

Note the snapshot date when it's announced.

You're currently 0% prepared for the Polytrade airdrop.

Everyone’s buzzing about the Polytrade airdrop and wondering whether it’s a real opportunity or just hype. Below we break down what’s publicly known, why the project matters, and exactly how you can stay ready for a possible token drop.

Quick Takeaways

- Polytrade is a trade‑finance platform built on a public blockchain, targeting SMEs in emerging markets.

- The project has hinted at a community airdrop but has released no official dates or token specifications yet.

- Eligibility will likely hinge on wallet activity, KYC compliance, and participation in Polytrade’s ecosystem.

- Key steps: follow official channels, secure a compatible wallet, and complete any required tasks before the announced snapshot.

- Watch out for phishing scams that mimic Polytrade announcements.

What Is Polytrade?

Polytrade is a decentralized trade‑finance platform that tokenizes invoices and purchase orders, allowing small and medium‑size enterprises to access liquidity on a blockchain. Launched in 2022, the protocol runs on a Layer‑2 solution that combines fast finality with low transaction fees. Its native token, Polytrade Token (PT), is designed to power governance, staking rewards, and fee discounts within the ecosystem.

Understanding Crypto Airdrops

An airdrop is a distribution of free tokens to a community, usually to spark network effects or reward early supporters. Most airdrops follow a predictable pattern: an official announcement, a snapshot date that records wallet balances, and a claim window where eligible users receive tokens.

Key variables that differ between projects include:

- Eligibility criteria - Who qualifies based on ownership, activity, or KYC.

- Distribution method - Direct transfer, claim portal, or Merkle‑proof verification.

- Tokenomics impact - How the airdrop size influences circulating supply and price.

Polytrade Airdrop: Current Status

Official communications from Polytrade’s team have been sparse. The most recent hint came in a community AMA on Discord (June2025) where the CEO mentioned “a forthcoming token distribution for active community members.” No whitepaper amendment, token contract address, or snapshot date has been published.

Because the project is still in a token‑generation phase, the airdrop is likely tied to the launch of the PT token. Until the token is minted on the public chain, the exact allocation and timing remain speculative.

While data is limited, the following sources are considered reliable for future updates:

- Polytrade Twitter - real‑time announcements and link drops.

- Polytrade Discord - community Q&A and moderator alerts.

- Polytrade Medium blog - in‑depth posts about tokenomics and rollout plans.

- Official website (polytrade.io) - the authoritative source for code releases and legal notices.

Typical Eligibility Criteria for a Polytrade‑Style Airdrop

Even without official rules, most blockchain projects set similar thresholds. Based on past airdrops in the trade‑finance niche, expect at least one of the following:

- Wallet ownership: Holding a minimum amount of a base token (e.g., ETH, SOL) on the snapshot date.

- Ecosystem activity: Using Polytrade’s invoice financing portal, staking PT (once available), or voting in governance proposals.

- KYC verification: Providing identity documents to comply with AML regulations, especially for a finance‑focused platform.

- Social engagement: Following Polytrade on Twitter, joining Discord, and sharing official posts during the promotion window.

- Referral milestones: Inviting new users who complete a funded invoice on the platform.

Meeting multiple criteria often boosts the allocation you receive, so keep your activity diversified.

Step‑by‑Step: How to Prepare and Claim (When It Launches)

Below is a checklist you can follow right now, so you won’t scramble when the snapshot hits.

- Set up a compatible wallet. Polytrade runs on the EVM‑compatible chain. Use MetaMask, Trust Wallet, or a hardware wallet that supports the network.

- Secure your private keys. Never share them and consider a hardware device for long‑term storage.

- Connect with official channels. Join the Discord, follow the Twitter, and subscribe to the Medium newsletter. Enable notifications for instant alerts.

- Complete KYC (if required). Fill out the verification form on polytrade.io before the announced deadline.

- Participate in the platform. If the invoice financing portal is live, fund or request an invoice. Even a single transaction can count as activity.

- Watch for the snapshot announcement. The team will publish the exact block number or timestamp. Note it down.

- Claim your tokens. Once the claim window opens, a link to a claim portal (usually hosted on the official site) will appear. Connect your wallet, sign the transaction, and the PT tokens will be transferred.

Common Pitfalls & Safety Tips

Crypto airdrops attract scammers. Here’s how to stay safe:

- Never click unknown links. Only use URLs that start with

https://polytrade.ioor the verified Discord/Twitter handles. - Beware of private‑key requests. No legitimate airdrop will ask for your seed phrase.

- Check gas fees. Claiming on a congested network can be costly; plan to claim during off‑peak hours.

- Verify contracts. If the claim involves a token contract, compare the address with the one posted on the official website.

- Use a hardware wallet for large claims. Even a modest airdrop may become valuable after listing.

Where to Track Real‑Time Updates

Because the official roadmap is still fluid, set up these monitors:

- Twitter alerts. Turn on notifications for the @PolytradeHQ account.

- Discord announcements channel. Pin the #announcements tab for quick reference.

- Medium RSS feed. Subscribe via an RSS reader to catch new blog posts instantly.

- Explorer watch. Add the PT contract address (once public) to Etherscan or Polygonscan to see token creation events.

- Telegram bots. Some community‑run bots echo official news into a single chat.

Comparison: Polytrade Airdrop vs. Typical Crypto Airdrop

| Aspect | Polytrade (Projected) | Typical Airdrop |

|---|---|---|

| Token purpose | Governance & fee discounts for trade‑finance services | Varies - often utility or governance |

| Eligibility focus | Platform activity, KYC, and social engagement | Usually wallet balance alone |

| Distribution method | Potential claim portal after snapshot | Direct transfer or Merkle‑proof claim |

| Regulatory considerations | Higher scrutiny due to finance‑related use‑case | Generally low‑regulation tokens |

| Community incentives | Staking rewards, reduced fees, governance voting power | Often just token ownership |

Frequently Asked Questions

When is the Polytrade airdrop scheduled?

The team has not announced a specific date. Keep an eye on official channels for the snapshot announcement, which is expected before the PT token launch in Q42025.

Do I need to hold any specific cryptocurrency to qualify?

While Polytrade has not confirmed, most airdrops require a minimum balance of the blockchain’s native token (e.g., ETH or MATIC) to pay gas fees during the claim.

Is KYC mandatory for the airdrop?

Given Polytrade’s focus on regulated trade finance, a KYC step is highly likely. Prepare your ID documents early to avoid missing the deadline.

How can I avoid phishing scams related to the airdrop?

Only interact with URLs that originate from polytrade.io or the verified @PolytradeHQ Twitter handle. Never share your private key or seed phrase, and double‑check any contract address against the official announcement.

What can I do with PT tokens after receiving them?

PT is expected to grant governance voting rights, enable staking for fee discounts, and possibly serve as collateral for future invoice financing within the Polytrade ecosystem.

18 Responses

I've been watching the crypto jungle for years, and every time a project like Polytrade promises an airdrop, I see the same script playing out behind the curtain. The official channels are full of polished graphics, but look closer – the whitepaper still hides the token details like a secret dossier. Is this a genuine attempt to decentralise trade finance, or just another smoke‑and‑mirrors scheme to lure unsuspecting investors? The fact that no token contract address has been disclosed yet screams "unfinished business". Add to that the vague timeline – "before Q4 2025" – which could be a tactical delay to buy time while they shuffle funds. I suspect a coordinated effort to harvest KYC data under the guise of eligibility, a dangerous precedent for a sector that claims to be regulated. Remember the 2022 DeFi airdrop that turned out to be a phishing magnet? Same pattern: hype, snapshot, a claim portal that asks for wallet signatures that can drain your funds. If you’re not willing to hand over your identity documents without a clear legal framework, you might be stepping into a regulatory minefield. The promise of governance tokens sounds appealing, yet governance can be a front for centralised control when a few whales hold the majority. And let’s not ignore the possibility of a rug‑pull – when the token finally launches, the early birds could sell en masse, leaving the rest with a worthless paper token. The community must stay vigilant, verify every link, and treat any claim portal with the same suspicion you would a stranger asking for your house keys. In short, prepare, but never trust the hype blindly; the airdrop may be a siren song leading to a financial wreck.

Whoa, this guide is 🔥🔥🔥!

Polytrade's L2 architecture reduces gas fees dramatically, making invoice tokenization viable at scale. Keep your MetaMask on the right RPC and watch for the snapshot block number.

Honestly, the whole airdrop hype feels like a circus act where the clown is the project team and the audience is us, eagerly waiting for the next balloon to burst. Even if they deliver a token, its utility might be as hollow as a paper crown. I'd bet my coffee that most participants will end up with dust after the first market correction. The drama around "governance rights" is just a fancy way to say "you get a noisy vote in a sea of silence". Still, it's entertaining to watch the speculation unfold.

Appreciate the thorough breakdown. I’ll make sure to follow the official channels and keep my private keys safe.

While practicality dictates securing one’s seed phrase, one must also contemplate the philosophical implications of decentralised finance on sovereign autonomy. The airdrop, if executed with transparency, could symbolize a shift toward collective empowerment. Yet, without clear legal scaffolding, the endeavor remains a fragile construct.

Sure, get ready for the airdrop – because every project that whispers "airdrop" automatically guarantees moon. Also, enjoy the endless waiting game.

Yeah, right – as if a free token solves all our problems.

Dearest fellow enthusiasts, allow me to articulate the gravitas of this prospective airdrop with utmost solemnity. The very notion of a token distribution within the venerable realm of trade‑finance is, in itself, a herald of epochal change. Yet, one must not be swayed solely by the gilded promises of governance tokens and fee discounts. Scrutinise the underlying protocol, for the architecture must be as robust as the statues of antiquity. Should the team falter in delivering a functional token, the repercussions shall echo through the corridors of the community. Thus, prepare with diligence, lest we be swept aside by the tides of unfulfilled hype.

Look, if you follow the checklist you’ll be fine. The airdrop isn’t rocket science.

Sounds like a solid plan. I’ll keep an eye on the Discord announcements and share any updates here.

While your optimism is commendable, one must recognize that the tokenomics outlined thus far are, frankly, under‑engineered. The projected circulating supply appears inflated, suggesting a potential dilution of value for early adopters. I would advise a cautious approach, perhaps allocating only a modest fraction of your portfolio until concrete metrics surface.

From a philosophical standpoint, the pursuit of an airdrop mirrors humanity's eternal quest for unearned bounty. Yet, the true reward lies in active participation within the ecosystem, not merely in the hope of a free token. Engage with the platform, and the benefits will unfold organically.

Your reflections are elegant, yet we must ground them in pragmatic vigilance. The community should verify contract addresses amidst the noise, for deception often masquerades as legitimacy. Let us champion both idealism and diligence.

Happy to help! A quick way to stay ahead is to set up a custom alert on Etherscan for any new contract creation related to Polytrade. Also, double‑check the KYC form URL to ensure it matches the domain on the official site. When the claim portal launches, make sure to have some ETH in your wallet for gas, but try to claim during off‑peak hours to minimize fees. Finally, consider diversifying your activity – staking, governance voting, and invoice financing can all boost your eventual allocation.

Honestly, you’re over‑complicating a simple airdrop. Just follow the steps and you’ll get the tokens, no need for all that extra vigilance.

Cool. :)

Let’s keep the conversation constructive, folks. If you’re serious about the airdrop, focus on completing the KYC and staying active on the platform – that’s the most reliable path to eligibility.