When you swipe your card or tap your phone to pay, you don’t expect the government to know exactly what you bought, when, and from whom. But with Central Bank Digital Currencies (CBDCs), that could change-forever.

What Exactly Is a CBDC?

A CBDC is digital money issued by a country’s central bank, like the Federal Reserve or the European Central Bank. It’s not Bitcoin. It’s not PayPal. It’s the same currency you already use-dollars, euros, or pesos-but in digital form, directly controlled by the state. Over 130 countries are exploring it. Eleven have already launched retail versions, including China, the Bahamas, and Jamaica. But here’s the catch: most of these systems aren’t built on blockchain. They’re built on centralized databases. That means the central bank holds all the data.Why Privacy Is the Biggest Hurdle

A 2023 Pew Research survey found 68% of Americans have major concerns about government surveillance through a digital dollar. That’s not fear-mongering. It’s logical. If your payments are tracked by the central bank, they could see every coffee, every gift, every protest donation. Imagine being denied a loan because you bought books on political activism. Or having your child’s allowance frozen because a school trip was flagged as "non-essential." This isn’t sci-fi. It’s the design trade-off baked into most CBDCs.The Digital Euro vs. The Digital Yuan: Two Opposite Paths

The European Central Bank claims it’s building "privacy by design" into the digital euro. Under their plan, you can make offline payments up to €100 without showing ID. Online, you can spend up to €5,000 per month anonymously. That’s a real attempt at balance. China’s digital yuan is the opposite. It uses tiered accounts. A basic wallet can hold up to 10,000 yuan (about $1,400) and allow only 2,000 yuan in daily spending-no ID needed. But if you want to spend more, you must verify your identity with your real name, phone number, and bank account. And once verified, every transaction is visible to authorities. By November 2023, China raised the anonymous limit to 50,000 yuan after public backlash. But the underlying structure remains surveillance-ready.Why Blockchain Isn’t the Answer (Usually)

Many assume CBDCs will use blockchain like Bitcoin. They don’t. Why? Because blockchain is too slow. Bitcoin handles about 7 transactions per second. Visa handles 24,000. China’s digital yuan hit 100,000 per second during tests. To match that speed, central banks need centralized systems. That means no public ledger. No decentralization. Just one database controlled by the state. And that’s where privacy dies.

The Myth of "Better Than Big Tech"

The ECB says your data will be safer with them than with Apple or Google. But 74% of Europeans don’t believe that, according to Eurobarometer. Why? Because tech companies profit from your data. Central banks control your money. That’s a different kind of power. Tech firms can’t freeze your account because you criticized a politician. A central bank can. And they already have the tools to do it.What Privacy Features Actually Exist?

Some CBDCs are experimenting with real privacy tech. Zero-knowledge proofs let the system verify a transaction without seeing who sent it or what it was for. Homomorphic encryption lets the bank check if you’re eligible for a subsidy without knowing your income. These aren’t sci-fi. The Hong Kong Monetary Authority tested them in 2022. The European Investment Bank used decentralized identity for digital bonds in 2021. But these tools add complexity, slow things down by 15-25%, and cost more. Most central banks are avoiding them.The AML Trap: Privacy vs. Crime Fighting

Governments say CBDCs will stop money laundering and terrorism funding. Fair point. But the Financial Action Task Force (FATF) requires all digital transfers over $1,000 to include sender and receiver info-the "travel rule." That’s incompatible with true anonymity. So if you want to prevent crime, you give up privacy. If you want privacy, you leave a loophole criminals can exploit. There’s no clean solution. That’s why the U.S. halted retail CBDC development in 2025. The conflict was too deep.Adoption Rates Prove the Point

The Bahamas’ Sand Dollar launched in 2020. Every transaction is visible to the central bank. Two years later, only 15% of adults used it. Jamaica’s JAM-DEX? Better adoption in rural areas-but only because people cared more about access than privacy. Sweden’s e-krona pilot? Users felt slightly more comfortable with the central bank than with private apps. But comfort isn’t trust. Compare that to the Eastern Caribbean’s DCash. It lets users choose their privacy level. Two years in, adoption hit 22%. Meanwhile, Uruguay’s e-Peso pilot in 2017-2019? Only 5% adoption. It was shut down.

What Happens When Privacy Isn’t Built In?

Nigeria’s eNaira launched in 2021 storing transaction data for 50 years. Public outcry forced them to reduce it to 7. That’s not a feature. That’s a mistake. And it’s not rare. Most CBDC designs don’t have clear data retention rules. They assume they’ll be trusted. History shows that’s dangerous.Who’s Winning the Global Race?

The U.S. is out. China is ahead. By 2025, China’s digital yuan will likely be the most widely used CBDC. That means global payment standards will reflect Beijing’s priorities-not privacy, but control. The Atlantic Council warns this could let China dictate how other countries design their own systems. If the digital yuan becomes the model, privacy becomes the exception, not the rule.What Can You Do?

If you live in a country exploring a CBDC, pay attention to the design details. Ask: Can I transact offline without ID? Is there a spending limit without verification? Is data retention clearly limited? Is there a way to opt out of surveillance? If the answer is no to any of these, the system isn’t built for you. It’s built for control.The Future: User-Controlled Privacy Dashboards

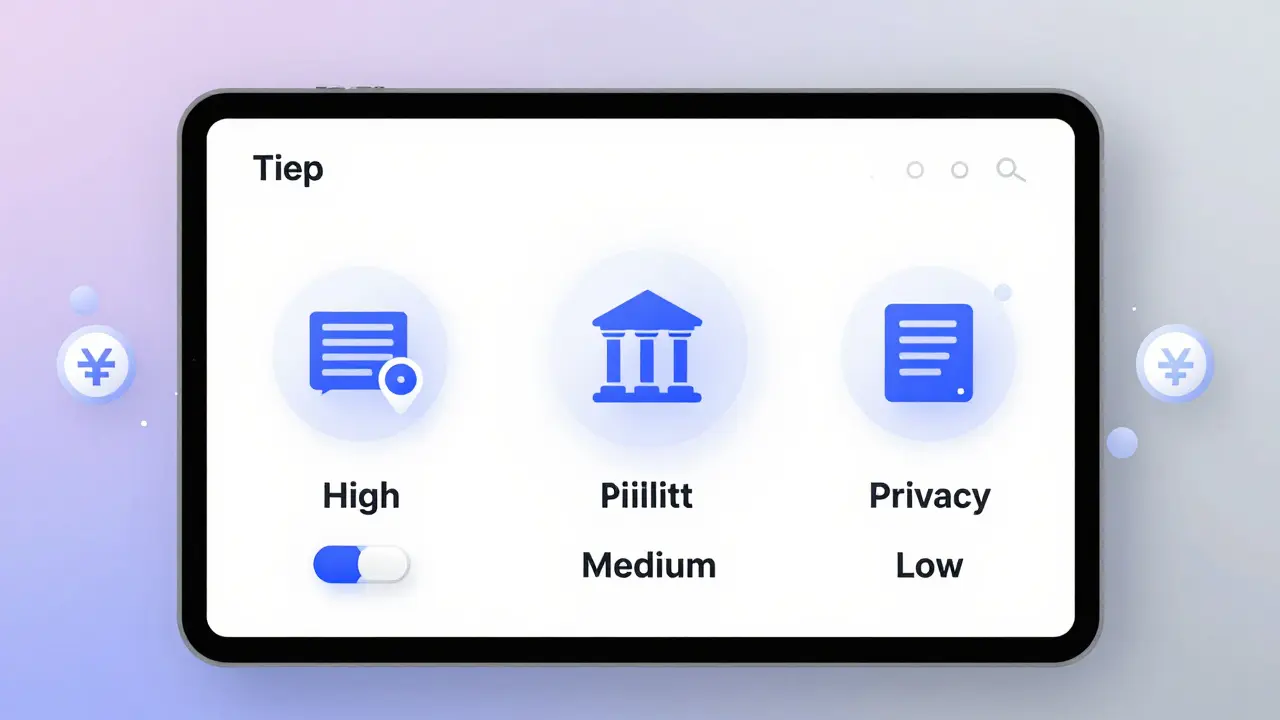

A new wave of pilots is testing something different: privacy dashboards. Imagine an app where you set your privacy level per transaction: "High" (anonymous), "Medium" (visible to bank, not government), "Low" (fully tracked). The World Economic Forum is running 14 such pilots in 2024. If this works, it could shift the balance. But it’s still early. And it requires trust in the system to enforce your choices.CBDCs aren’t coming because they’re better. They’re coming because governments fear losing control. The real question isn’t whether they’ll work. It’s whether you’ll accept living in a world where every dollar you spend is watched. And if you don’t like that idea-start asking questions now. Because once the system is live, it’s too late to change the rules.

Can CBDCs really be anonymous?

Some CBDCs offer limited anonymity, but it’s always restricted. China’s digital yuan allows anonymous wallets up to 50,000 yuan, but only for small daily transactions. The digital euro lets you spend up to €100 offline without ID. But once you exceed those limits, you must verify your identity. True anonymity-like Bitcoin-isn’t possible because CBDCs must comply with anti-money laundering rules.

Why isn’t the U.S. developing a digital dollar?

The U.S. halted retail CBDC development in 2025 after Congress couldn’t resolve the conflict between privacy rights and financial surveillance. Without federal privacy laws, lawmakers feared a digital dollar would enable unchecked government monitoring. The executive order blocking development was a direct response to public pressure and legal uncertainty.

Are CBDCs more private than PayPal or Apple Pay?

Not necessarily. Private payment apps already track your spending. But they don’t have the power to freeze your account or block payments based on what you buy. CBDCs combine the tracking power of private apps with the control power of the state. That’s why 61% of Americans say they’d "definitely not" use a CBDC-even if it’s faster or cheaper.

Can the government track my CBDC transactions in real time?

Yes, if the system is designed that way. Most CBDCs use centralized databases, meaning the central bank can see every transaction instantly. Even "anonymous" wallets often require identity verification for larger amounts. Real-time tracking isn’t a bug-it’s a feature in most designs, meant to help with tax collection, welfare distribution, and crime prevention.

Will CBDCs replace cash?

Not officially-but they’re designed to make cash obsolete. If you can’t pay anonymously, if your account can be frozen, and if digital payments are faster and more convenient, people will stop using cash. The ECB and other central banks have said they’ll keep cash available. But without privacy, cash becomes the choice of the few who can afford to avoid the system.

What’s the difference between a CBDC and a stablecoin like USDT?

A CBDC is issued by a government and backed by a central bank. A stablecoin like USDT is issued by a private company and backed by reserves-often held in opaque financial institutions. CBDCs are centralized and regulated. Stablecoins are decentralized and often more private. As of 2023, stablecoins processed nearly 50 times more daily volume than all CBDCs combined, largely because users trust them more for privacy.

Could a CBDC be used to enforce social policies?

Yes, and that’s already being tested. China uses its digital yuan to restrict spending on luxury goods for certain welfare recipients. The EU is exploring "programmable money" that only works for specific purchases, like groceries or energy bills. This isn’t theoretical. It’s already in pilot stages. A CBDC gives governments the power to control how money is spent-not just who spends it.

9 Responses

Honestly, I just want to know if I can buy my kid a birthday cake without the government logging it. If they’re tracking every coffee, why not every cupcake? This isn’t about crime-it’s about control.

And yeah, I’d rather use cash than let them know I bought that one book on protest history.

The concerns raised here are valid and deserve serious attention. While digital currencies offer efficiency, privacy must not be sacrificed in the name of convenience. Governments must prioritize transparency and clear legal safeguards before implementation.

India, too, must tread carefully. Financial inclusion should not come at the cost of civil liberties.

They’re already putting microchips in vaccines. Now they want to put trackers in your money. Wake up. This isn’t about ‘anti-money laundering’-it’s about total control. The digital yuan is a prototype for the New World Order.

They’ll freeze your account if you donate to the wrong cause. They’ll block your groceries if you’re ‘non-compliant.’ You think this is science fiction? It’s already happening in China. And they’re coming for you next.

Let me tell you something-when your money becomes a tool of surveillance, you lose more than privacy. You lose freedom. And freedom? It doesn’t come back once it’s gone.

I’ve seen what happens when people stop asking questions. In my country, we used to trade in cowrie shells. Then came colonial cash. Then came mobile money. Now? We’re being nudged toward digital chains. And nobody’s asking if we want them.

It’s not about tech. It’s about power. And power? It never asks permission. It just takes.

So yes, I’m angry. But I’m also ready to fight. Not with violence-with awareness. Talk to your neighbors. Share this. Don’t let them silence us with convenience.

Look, I get why people are scared. But CBDCs aren’t the enemy. The real enemy is bad design. If we build them right-with real privacy layers, opt-in tracking, and clear limits-we could actually help millions who don’t have bank accounts.

China’s system is scary? Yeah. But that’s because they didn’t listen to their people. We can do better. The EU’s trying. So are some African pilots.

Let’s not throw the baby out with the bathwater. We need better rules, not fear.

Money has always been a tool of control. Coins bore kings’ faces. Paper bore central bank logos. Now it’s just code.

The real question isn’t whether CBDCs can be anonymous. It’s whether we still believe in the idea of anonymous exchange at all.

If you’ve never bought something you didn’t want anyone to know about, you’ve never lived.

Privacy isn’t about hiding crime. It’s about preserving dignity.

Everyone’s acting like this is new. Newsflash: the IRS already tracks every bank transfer over $10k. The Fed already has your transaction history through your debit card. The only difference is now they’re cutting out the middleman.

And let’s be real-privacy advocates are the same people who scream about Big Tech but still use Venmo. You want anonymity? Use Bitcoin. Stop pretending CBDCs are the first thing to ever track you.

Also, the U.S. didn’t ‘halt’ development. We’re still testing it under the radar. Congress just doesn’t want the headlines.

It’s funny how we panic about government tracking but don’t blink when Apple knows what we bought last Tuesday. We’re not scared of surveillance. We’re scared of being held accountable.

What if the real threat isn’t the state… but the fact that we’ve forgotten how to be private?

Maybe we don’t need CBDCs to be anonymous.

Maybe we need to be.

From a systemic architecture standpoint, the centralization of CBDCs fundamentally undermines the trustless consensus models that underpin decentralized finance. The lack of cryptographic verifiability in most implementations creates a single point of failure and a latent vector for state-level coercion.

Moreover, the economic externalities of programmable money-particularly in the context of conditional disbursements-introduce a novel form of fiscal authoritarianism that diverges from liberal democratic norms. The EU’s ‘privacy by design’ claims are performative at best, given the FATF travel rule’s mandatory KYC/AML infrastructure.

True resilience requires layer-2 privacy protocols: ZKPs, homomorphic encryption, and decentralized identity. But adoption is hamstrung by legacy infrastructure inertia and regulatory capture.