South Korea doesn’t just allow crypto trading-it demands you prove who you are before you can even start. Since January 2018, every trade on a Korean exchange has to be tied to a real-name bank account. No aliases. No offshore wallets. No anonymous deposits. If you want to buy Bitcoin, Ethereum, or any other crypto in Korea, you need to link your legal identity to your bank and your exchange. It’s one of the strictest systems in the world-and it’s not going away.

How the Real-Name System Actually Works

The system isn’t just a form you fill out. It’s a tightly locked pipeline between your bank and your crypto exchange. You can only deposit or withdraw Korean Won (KRW) between accounts that share the same name and are linked through approved partnerships. If your bank is Shinhan and your exchange is Korbit, that’s the only route you can use. Try to send money from a different bank? The transfer gets blocked. No exceptions.

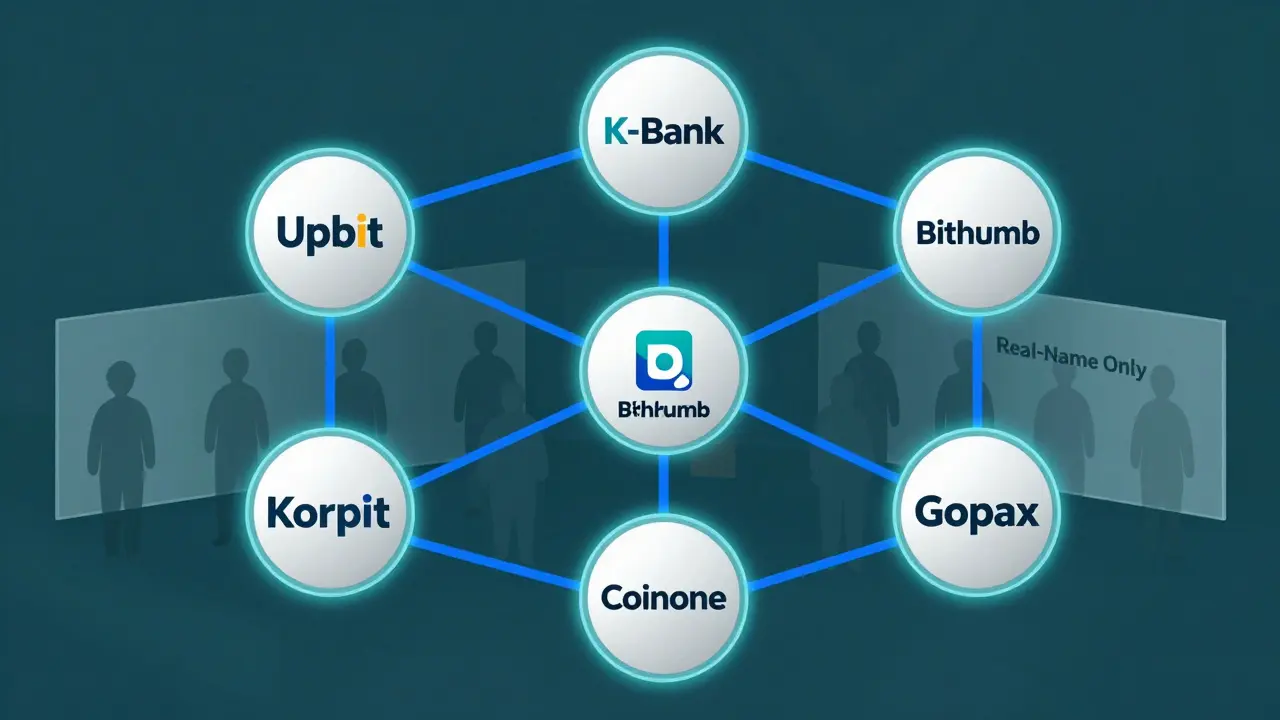

There are only five exchanges in Korea that have full approval to connect directly with real-name bank accounts. That’s it. Upbit works with K-Bank. Bithumb is tied to Kookmin Bank. Korbit partners with Shinhan. Coinone uses Kakao Bank. These aren’t random choices-they’re government-approved matches. The Financial Intelligence Unit (FIU) keeps a tight grip on who gets access. Even though 28 virtual asset providers have filed paperwork with the FIU, only those five have the actual bank connections needed to operate legally.

When you sign up, you go through full KYC: government ID, selfie verification, phone number tied to your real name, and a bank account in your exact legal name. The exchange shares your transaction history with your bank. If the bank sees suspicious activity-like sudden large transfers or patterns matching money laundering-they can freeze the account. No warning. No appeal process. Just cut off.

Why Korea Built This System

In 2017, crypto prices skyrocketed in Korea. Everyone was trading. But so were scammers. Pump-and-dump schemes, fake exchanges, and money laundering through crypto were rampant. The government almost banned crypto entirely. Then, over 220,000 citizens signed a petition asking for regulation, not prohibition. That’s when the Financial Services Commission stepped in. Instead of shutting it down, they decided to control it-by forcing every transaction back to a real person.

The result? A market with less fraud, more trust, and fewer anonymous players. Korean exchanges are now among the most secure in the world. They’re audited. They report to regulators. They can’t operate without bank partnerships. And because of that, institutional investors are starting to take notice. By 2030, the Korean crypto exchange market is expected to hit $635 million, growing at 16.1% a year.

But this isn’t just about safety. It’s about control. The government wants to track every crypto transaction. That’s why they’re preparing to tax digital asset profits starting in 2027. Individuals will pay income tax on gains. Foreign companies earning from Korean traders will be treated as having domestic income. This isn’t just regulation-it’s integration into the national financial system.

Who Can Use It? (Spoiler: Most Foreigners Can’t)

If you’re a South Korean citizen with a valid ID and a local bank account, you’re in. The process is straightforward: pick an approved exchange, link your real-name bank account, deposit KRW, and start trading. Most users report deposits hit their exchange wallet within 30 minutes. The system works-just not for everyone.

Foreigners? Forget it. Unless you have permanent residency, a long-term visa, an alien registration card, and a Korean mobile number, you can’t open a real-name bank account. No exceptions. Even if you live in Seoul on a work visa, without the alien card, you’re locked out. International exchanges like Binance or Coinbase can’t connect to Korean Won or accept Korean credit cards. You can’t send money from your U.S. bank to Upbit. You can’t use your European PayPal. The system is designed to keep non-residents out.

Some try to work around it-using third-party services, peer-to-peer trades, or fake documents. But these are risky. Korean banks actively monitor for mismatched names. If they catch you, your account gets frozen, your funds can be seized, and you could face legal consequences under the Foreign Exchange Transaction Act.

What Happens If You Try to Bypass It?

There’s no gray area. The system is built to catch circumvention. If you use a friend’s account, a shell company, or a fake name, the bank and exchange are required to report it. The FIU has tools to trace transactions across banks and exchanges. Even small anomalies trigger alerts.

Some users think they can use crypto ATMs or P2P platforms to avoid the system. But those platforms are also regulated. Any platform operating legally in Korea must comply with the same rules. If you’re caught using an unregistered service, you’re not just violating terms-you’re breaking the law.

The penalties aren’t just fines. In extreme cases, authorities have seized assets and prosecuted individuals for violating financial reporting laws. The government doesn’t tolerate evasion. They’ve spent years building this system. They’re not going to let it be undermined.

The Trade-Off: Security vs. Accessibility

South Korea’s system is a model for compliance. It’s clean. It’s traceable. It’s safe. But it’s also exclusionary. While the U.S. and EU allow pseudonymous trading with basic KYC, Korea demands full identity linkage at every step. That’s why only 12 million Koreans are estimated to be using crypto-still a huge number, but far below what it could be without restrictions.

For locals, the trade-off makes sense. They get a stable, regulated market with trusted exchanges. For foreigners, it’s a wall. You can’t invest. You can’t trade. You can’t even deposit money unless you’re legally part of the system.

Some experts argue this is holding Korea back. While the U.S. and Singapore attract global crypto firms, Korea’s rules keep international players away. No Coinbase, no Kraken, no Bitstamp-only the five approved local exchanges. That limits innovation, competition, and liquidity.

But the government isn’t swayed. Their priority isn’t market size-it’s control. They want to know who’s trading, how much, and why. They want to tax it. They want to stop crime. And they’re willing to sacrifice global access to get it.

What You Need to Do If You’re a Korean Citizen

If you’re a Korean resident, here’s how to get started:

- Choose one of the five approved exchanges: Upbit, Bithumb, Korbit, Coinone, or Gopax.

- Go to their website and select ‘Real-Name Account Registration’.

- Upload your national ID card and take a live selfie.

- Link your existing real-name bank account (you must already have one).

- Wait for verification-usually under 24 hours.

- Once approved, deposit KRW using your bank’s app or online banking.

- Start trading. Deposits typically appear in under 30 minutes.

Stick to the approved exchanges. Don’t try to use unregistered platforms. Even if they promise better rates or lower fees, they’re not legal. And if they get shut down, your money disappears.

What’s Coming Next?

The 2027 tax change is the biggest shift yet. Right now, crypto profits aren’t taxed in Korea. But starting in 2027, individuals will pay income tax on gains from trading. That means if you make $10,000 from Bitcoin, you’ll owe tax on it-just like salary or business income. The rate? Up to 45% depending on your total income.

Corporate taxes are also rising. Exchanges now pay up to 24.2% in combined corporate and local taxes. That’s one of the highest rates in the world for crypto businesses. It’s pushing smaller exchanges out and concentrating power in the hands of the big five.

Expect more scrutiny. More reporting. More integration with the national financial system. Korea isn’t just regulating crypto-it’s absorbing it into its economy. And once that happens, there’s no turning back.

Final Thoughts

South Korea’s real-name bank account system for crypto isn’t just a rule-it’s a statement. The government believes financial freedom should come with accountability. If you want to trade, you must be known. No anonymity. No loopholes. No shortcuts.

For locals, it’s a secure, regulated path to crypto. For foreigners, it’s a closed door. And for the market, it’s a paradox: one of the most advanced systems in the world, built to keep most of the world out.

If you’re in Korea, play by the rules. If you’re not, don’t waste your time trying to break in. The system was designed to stop you-and it’s working.

7 Responses

Bro this is actually kind of beautiful. No more sketchy rug pulls or fake exchanges. I know people hate the restrictions but honestly? I’d rather trade on a platform where I know my money won’t vanish overnight. 🤝

This is why America’s crypto scene is a joke. You let anyone with a VPN and a fake ID trade? Pathetic. Korea got it right-no anonymity, no excuses. If you can’t prove you’re real, you don’t get to play. 🤬

yo so like korea just locked out everyone who isnt a citizen? thats wild. i mean i get the whole anti-laundering thing but like… what if u just wanna buy some btc and leave? no cap, this feels kinda janky

Of course foreigners can't use it why would they even try to sneak in like that? This system is flawless. Anyone who complains is just mad they can't cheat the system like they do in the US

Imagine living in a world where your identity is your currency… literally. 🌍✨ Korea isn’t just regulating crypto-it’s redefining the soul of financial sovereignty. We’re not just trading tokens, we’re negotiating the boundaries of human trust. This is poetry in blockchain form. 💭💎

So basically Korea’s saying ‘you can’t touch this’ to the whole world? 😭 I mean… I get it but also… I just wanted to buy some Dogecoin and be done with it. This feels so dramatic. Like why do they need to be this intense? 😩

While the Korean model is commendable for its strict adherence to financial integrity, one must also consider the socio-economic implications for diaspora communities and expatriates. The exclusionary nature may inadvertently marginalize legitimate residents who lack permanent status despite long-term contributions to the economy. A more nuanced approach might be advisable.