Byzantine Fault Tolerance Simulator

This simulator demonstrates how Byzantine Fault Tolerance works in distributed systems. Adjust the percentage of malicious nodes (up to 33%) and see if the network can reach consensus.

Network Visualization

In a Byzantine Fault Tolerant system, at least 2/3 of nodes must agree for consensus. The maximum number of malicious nodes allowed is 1/3 of the total network. Try increasing the malicious percentage to see when consensus fails.

When you send Bitcoin or swap Ethereum tokens, you’re trusting a network of strangers to get it right-no bank, no middleman, no second chances. What if half the nodes on that network were lying? What if someone tried to double-spend, fake a transaction, or crash the whole system? That’s where Byzantine Fault Tolerance comes in. It’s not flashy. It doesn’t make headlines. But without it, crypto wouldn’t work at all.

What Byzantine Fault Tolerance Actually Does

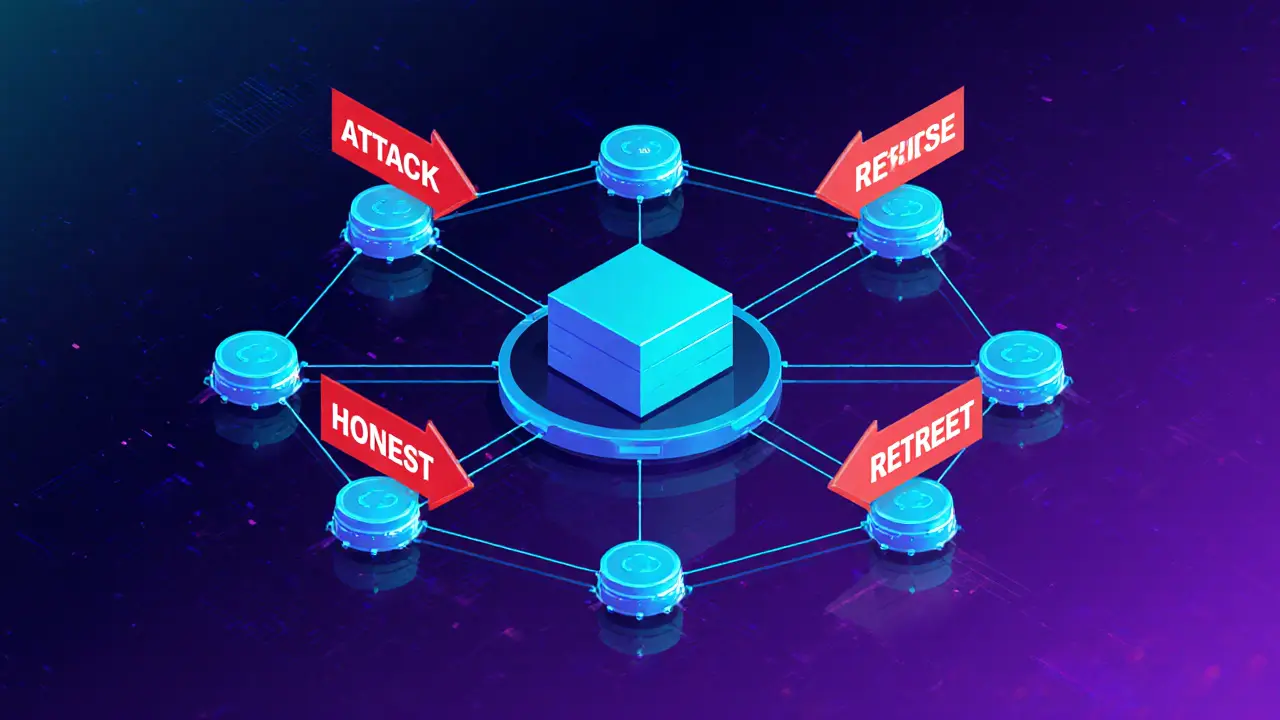

Imagine a group of generals surrounding a city. They need to attack at the same time. But some generals are traitors. They might send conflicting messages: "Attack at dawn!" to one group, "Retreat!" to another. If the loyal generals can’t agree on a plan, the whole mission fails. That’s the Byzantine Generals Problem-and it’s exactly what blockchain networks face every second. Byzantine Fault Tolerance (BFT) is the solution. It’s a set of rules that lets honest nodes in a network agree on one truth-even when up to one-third of the nodes are malicious or broken. It doesn’t assume anyone is trustworthy. It assumes everyone might be lying. And still, the system keeps working. This isn’t theory. It’s running right now in Bitcoin, Ethereum, Solana, and dozens of other chains. But not all BFT is the same. Some are built on brute force. Others on economics. Some are rigid. Others are evolving.How Bitcoin Uses BFT (Without Calling It That)

Bitcoin doesn’t use PBFT or any classic BFT algorithm. But it still solves Byzantine faults. How? By making cheating astronomically expensive. Every Bitcoin block requires proof of work-a massive amount of electricity and hardware to solve a cryptographic puzzle. If you try to double-spend or rewrite history, you need to outpace the entire network’s combined computing power. That’s a 51% attack. And it’s not just hard-it’s practically impossible on Bitcoin’s scale. The network has over 1,000 exahashes per second. Even a nation-state couldn’t afford to build that much hardware, let alone power it. So Bitcoin’s BFT isn’t about message passing. It’s about cost. The more you try to break it, the more you lose. Honest miners earn rewards. Cheaters burn money. That’s the economic layer of Byzantine fault tolerance.Ethereum’s Proof of Stake: BFT Through Financial Risk

Ethereum switched from mining to staking in 2022. Now, instead of using GPUs, you lock up 32 ETH to become a validator. If you act honestly, you earn rewards. If you try to sign two conflicting blocks (a slashable offense), your entire stake is burned. This is BFT through punishment. The system doesn’t need to detect every lie. It just needs to make lying too costly to be worth it. Validators have skin in the game-literally. Lose your stake, lose your income, lose your role. Ethereum’s consensus layer, called the Casper FFG protocol, combines finality gadgets with BFT principles. Once a block gets enough attestations from validators, it’s considered “finalized.” Reversing it would require destroying over 1/3 of the total staked ETH-currently worth over $50 billion. That’s not a hack. That’s a global economic shock.

Practical BFT: How Solana and Cosmos Actually Use PBFT

Not all chains rely on economics. Some use classic BFT algorithms like Practical Byzantine Fault Tolerance (PBFT) or its faster cousins: Tendermint, HotStuff, and dBFT. Solana uses a hybrid called Proof of History (PoH) with a BFT consensus engine. PoH timestamps transactions in sequence, so validators don’t waste time agreeing on order. Then, they use a BFT protocol to vote on the next block. If 67% agree, it’s final. No reorgs. No uncertainty. Cosmos uses Tendermint BFT. It’s a round-robin system where validators take turns proposing blocks. Each proposal goes through three rounds of voting. If 2/3 agree, the block is locked. If a validator misbehaves, they’re slashed and replaced. This system handles over 10,000 transactions per second on mainnet-something Bitcoin could never do. These aren’t academic experiments. They’re live networks processing real payments, DeFi trades, and NFT transfers every second. And they do it because BFT gives them speed, finality, and predictability.The Hidden Weaknesses: Where BFT Breaks Down

BFT isn’t magic. It has limits. And those limits have been exploited. The biggest risk? Centralization. If a few entities control most of the stake or hash power, BFT’s 1/3 fault tolerance becomes meaningless. In 2024, Ethereum Classic suffered a 51% attack where a mining pool controlled over 60% of the network. They reversed $2 million in transactions. Why? Because ETC’s hash rate was too low. The cost to attack was under $100,000. Sybil attacks-where one person creates hundreds of fake identities-are another threat. In low-stake networks, attackers can flood the validator set with fake nodes. That’s why most serious chains require high minimum stakes. You can’t just spin up a node on a $5 VPS. You need real capital. And then there’s the blockchain trilemma: you can’t have security, decentralization, and scalability all at once. BFT is great for security. But it’s slow. PBFT requires every node to talk to every other node. That doesn’t scale. When you have 1,000 validators, each message has to be sent 1 million times. That’s why Solana uses PoH. That’s why Avalanche uses snowball sampling. They’re all trying to make BFT faster without breaking it.

Who Uses BFT Today-and Why It Matters

You don’t see BFT in ads. But you feel it in every transaction you make:- Hyperledger Fabric uses BFT to let banks settle trades in seconds instead of days.

- Algorand uses pure BFT to eliminate forks entirely-every block is final from the start.

- Polkadot uses BABE and GRANDPA, a BFT-based finality gadget that secures its relay chain.

- Stellar uses Federated BFT to enable low-cost cross-border payments with 2-5 second confirmations.

The Future: Adaptive BFT and Beyond

The next generation of BFT isn’t about making it faster. It’s about making it smarter. Projects like Near’s Doomslug and Celestia’s modular BFT are experimenting with dynamic validator sets. Instead of fixed nodes, they use reputation scores, historical performance, and even economic incentives to rotate validators automatically. The goal? Keep security high while letting the network adapt to traffic spikes. Others are exploring threshold cryptography-where signatures are split across nodes so no single validator can act alone. That’s how Apple’s Secure Enclave works. Now, blockchain is borrowing it. We’re also seeing BFT integrated with zero-knowledge proofs. Imagine a validator proving they followed the rules without revealing their data. That’s the future: BFT + ZK = unbreakable, private, scalable consensus.Final Reality Check

BFT doesn’t make crypto perfect. It doesn’t stop rug pulls. It doesn’t stop bad code. It doesn’t stop human error. But it does stop the most fundamental threat: malicious consensus. It’s the reason your crypto wallet doesn’t vanish overnight. It’s why exchanges don’t lose billions to double-spends. It’s why you can trust a decentralized system without trusting any single person. The next time you send crypto, remember: you’re not just sending coins. You’re relying on a 40-year-old computer science breakthrough that lets strangers agree on truth-even when some of them want to lie.That’s not magic. That’s Byzantine Fault Tolerance.

18 Responses

So let me get this straight - we’re trusting math and money to stop liars from breaking the internet? Wild. I mean, if I tried to double-spend my rent money, my landlord would kick me out. But here, we just make it cost more to cheat than to play fair. Kinda poetic, actually.

Bitcoin’s ‘BFT’ isn’t BFT at all. It’s just a brute-force denial-of-service defense wrapped in crypto bro jargon. PBFT is real consensus. PoW is just energy waste with a side of delusion.

What’s fascinating is how BFT abstracts trust into a mathematical invariant - not a social contract, not a legal framework, but a computable property of distributed state. The Byzantine Generals Problem isn’t about loyalty; it’s about epistemic stability under adversarial uncertainty. Bitcoin’s PoW is a cost-based equilibrium solution, not a consensus protocol per se. Ethereum’s Casper FFG, by contrast, introduces economic liveness guarantees via slashing - a form of mechanism design that turns validator behavior into a Nash equilibrium. The real innovation isn’t the algorithm - it’s the incentive alignment.

When you look at Tendermint or HotStuff, you’re seeing synchronous communication primitives optimized for low-latency networks. But that’s not scalable beyond hundreds of nodes. That’s why Solana’s PoH is clever - it decouples ordering from consensus, allowing BFT to operate on pre-ordered streams. The trade-off? Trust in a single time source. Which, ironically, reintroduces a point of centralization - just one that’s cryptographically verifiable.

And yet, we keep pretending these are ‘decentralized’ systems. The truth is, they’re permissioned systems with economic barriers to entry. 32 ETH isn’t accessibility - it’s gatekeeping. The 51% attack on ETC wasn’t a failure of BFT. It was a failure of economic scale. BFT assumes rational actors. But in crypto, actors are often irrational, desperate, or state-sponsored.

What we’re really building isn’t trustless systems. It’s trust-minimized systems. And that’s a subtle but vital distinction. We’re not eliminating trust. We’re redistributing it - from banks to miners, from auditors to stakers, from regulators to algorithmic incentives. The real question isn’t whether BFT works - it’s whether we’re comfortable betting our financial infrastructure on a game theory experiment.

And then there’s ZK-BFT hybrids. Imagine a validator proving compliance via zk-SNARKs without revealing inputs. That’s not just scalable. That’s ontologically revolutionary. It turns consensus into a zero-knowledge proof of correct execution. If that scales, we’re not just solving Byzantine faults - we’re rendering them irrelevant.

bro this is deep. i never thought about how we’re all just betting on math to keep things fair. in india we dont have much crypto but i read this and felt like wow, its like a new kind of democracy. no one person in charge, just rules. cool.

Exactly. Cost > Control. That’s the core. Keep it simple.

From India, just wanted to say this is one of the clearest explanations of BFT I’ve ever read. We don’t have big crypto hubs here, but the ideas? Universal. It’s like a silent engine running the digital world. Respect.

Okay but let’s be real - this whole thing is just a glorified lottery where the rich get richer and everyone else gets FOMO. PoW burns electricity. PoS burns your savings if you’re not careful. And don’t even get me started on how ‘finality’ means nothing when a chain gets reorged because some whale bought 40% of the staking tokens. This isn’t innovation - it’s just new ways to lose money while pretending it’s science.

And don’t tell me about ‘economic security’ - the fact that Ethereum’s slashing condition requires over $50B to break means nothing if you’re not actually holding that much. The average user doesn’t have $50B. They have $500 and they’re hoping for a moon. Meanwhile, the real power players? They’re not even on this chain. They’re in private equity funds, hedge funds, and central bank digital currency labs. This whole ‘decentralized’ thing is a marketing tactic. BFT doesn’t save us from power. It just makes it look prettier.

And don’t even get me started on Solana. ‘High throughput’? Sure. Until it goes down for 12 hours straight because one node had a bad update. Then suddenly ‘finality’ means nothing. And you know what? No one apologizes. They just blame the ‘network congestion’ and move on. This isn’t reliability. It’s performance theater.

And don’t tell me about ZK-BFT as the future. We’re still in the wild west. No one knows how to audit these systems. No one knows how to recover from a bug. And when something breaks, there’s no customer service. No legal recourse. Just a blockchain that says ‘you signed the terms’ and walks away.

So yes, BFT works. Technically. But does it *matter*? Or is it just a fancy name for a system that lets billionaires play god with money they didn’t earn?

They’re lying. All of them. BFT? More like Byzantine *Control* Tolerance. The ‘validators’? Centralized by design. The ‘economic security’? A front for institutional capture. The 51% attacks? Planned. The ETC hack? A warning shot. They want you to believe this is decentralized. It’s not. It’s a controlled demolition of trust - disguised as innovation. They’re building the ultimate surveillance ledger. And you’re cheering for it.

Most people don’t realize that BFT in crypto isn’t about consensus - it’s about *finality*. Bitcoin doesn’t have finality, which is why you wait 6 confirmations. Ethereum with Casper has immediate finality via checkpointing - once a block is justified and finalized, it’s immutable unless you burn a third of the network’s value. That’s not just security - that’s economic sovereignty. But here’s the kicker: no one talks about how this makes chain reorganizations impossible, which means no more ‘accidental forks’ like in Bitcoin. That’s huge for DeFi. Imagine a DEX that can’t be frontrun because the block is final before it’s even mined. That’s the real win.

And yes, PBFT is slow, but that’s why modern chains like Avalanche and Near use recursive BFT - they don’t validate every node. They sample a subset. It’s like jury duty for consensus. You don’t need everyone. You just need enough to be statistically certain. That’s how you get 10k TPS without 10k nodes talking to each other.

Also, the ‘centralization’ critique misses the point. Every system has a trust boundary. Banks trust SWIFT. Governments trust the Fed. Crypto trusts the math. The difference? You can verify the math. You can’t verify a Fed banker’s lunch.

And yes, Sybil attacks are a threat - which is why minimum stakes exist. If you can’t afford to be a validator, you’re not meant to be one. That’s not elitism. That’s engineering.

Finally - ZK-BFT? That’s the future. Imagine a validator proving they didn’t double-sign without revealing their private key. That’s not just privacy. That’s cryptographic immutability of behavior. We’re not just securing data. We’re securing intent.

Stop pretending this is tech. It’s gambling with math.

i just think it's wild that we built something that lets strangers agree without knowing each other. no one had to trust anyone. just math. that feels like something humans have been trying to do forever.

Reading this made me think about how we used to rely on clerks and ledgers. Now we rely on code and economics. It’s not perfect, but it’s the first time in history we’ve built a system that doesn’t need a person in charge. That’s huge. Even if it’s messy. Even if it’s slow sometimes. It’s still a win.

My uncle in Texas thinks crypto is a scam. I showed him this post. He said ‘well that’s just how banks work, but with computers.’ And honestly? He’s not wrong. The difference is we can see the code. We can audit it. That’s the real power.

Byzantine what? This is just american tech bros pretending they invented trust. In real countries we have banks. Real laws. Real accountability. This is just chaos with a whitepaper.

the part about solana using poh to timestamp before consensus… that’s genius. i never thought about ordering as a separate problem. makes sense why they’re fast. but still… what happens if the time source gets hacked? it’s like trusting a clock that no one can check. kinda scary.

They’re all controlled by the same 5 people behind the scenes. PBFT? More like ‘Please Be Fooled Together.’ The ‘validators’ are all funded by the same VCs. The ‘decentralized’ networks? Just front companies for Wall Street. You think you’re free? You’re just a node in a corporate surveillance grid.

Bro. This is the quiet revolution. No one’s cheering for it. No one’s making memes. But every time you send crypto? That’s BFT holding it all together. We’re building the future, one final block at a time.

Julissa’s comment about ‘American tech bros’ misses the point - BFT isn’t American. It’s mathematical. The Byzantine Generals Problem was posed in 1982 by Leslie Lamport, a Turing Award winner who worked at SRI International. The solution didn’t come from Silicon Valley. It came from pure computer science. What’s American is the *application* - the way we’ve turned abstract theory into global infrastructure. That’s not arrogance. That’s innovation.

And yes, centralization is a risk. But it’s not inherent to BFT. It’s inherent to *adoption*. When networks grow, capital concentrates. That’s not a flaw in the protocol - it’s a feature of human behavior. The fix isn’t to abandon BFT. It’s to design better incentive structures - dynamic validator sets, reputation systems, cross-chain redundancy. That’s what Near and Celestia are doing.

And Amanda? You’re not wrong about the surveillance angle. But you’re ignoring the counterpoint: if the state controls your money, they control your life. If the algorithm controls it? You can still opt out. You can still verify. You can still run your own node. That’s freedom. Not perfect. Not easy. But real.