Upbit KYC Violations Impact Calculator

Results Summary

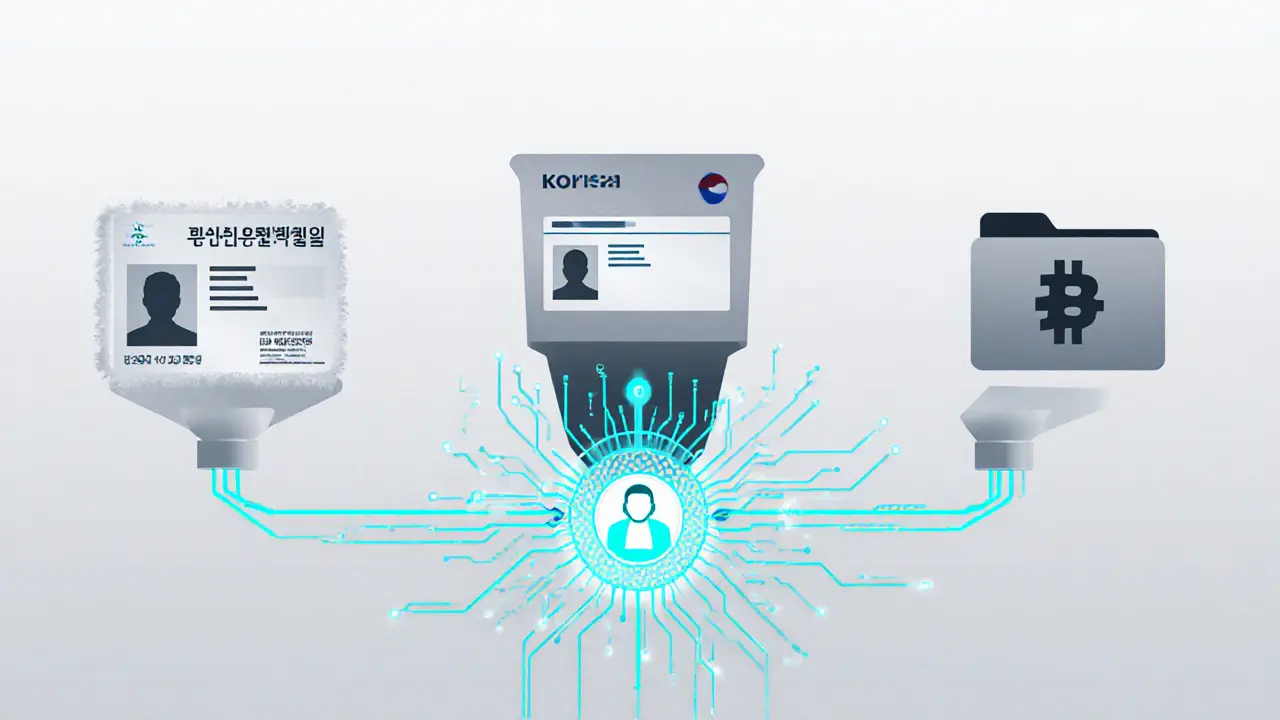

South Korea’s biggest crypto exchange is under the microscope after regulators uncovered more than half a million Know‑Your‑Customer breaches. The fallout is reshaping how exchanges meet anti‑money‑laundering rules, and it could set a global benchmark for digital‑asset compliance.

When the Financial Intelligence Unit (FIU South Korea’s financial‑crime‑fighting agency) started a routine license‑renewal audit in late 2024, investigators discovered a staggering 500,000 alleged KYC violations at Upbit the country’s largest cryptocurrency exchange, operated by Dunamu. The findings are the most extensive enforcement action ever recorded in the Korean crypto market.

What the violations look like

Upbit’s compliance gaps fall into three clear buckets:

- Document handling lapses: Photocopied IDs were accepted, and many submissions contained blurred or obscured details.

- Driving‑license checks gone wrong: In roughly 190,000 cases, the exchange verified only personal data without cross‑checking the encrypted serial number that Korean licences require.

- Missing verification records: Auditors found over 9million accounts where no official ID was on file at all.

Beyond onboarding, the FIU flagged about 45,000 transactions that involved unregistered foreign exchanges - a direct breach of the Special Financial Transactions Act South Korea’s anti‑money‑laundering statute. Each breach technically carries a maximum fine of 100million KRW (≈$68,600), meaning the theoretical exposure could reach $34billion.

How the case compares globally

Upbit’s 500,000‑plus violations dwarf most high‑profile enforcement actions. For perspective, Binance paid a $4.3billion settlement to U.S. authorities in 2023 for AML failures - a massive sum, but far fewer individual breaches. The table below puts the two cases side by side.

| Metric | Upbit (South Korea) | Binance (U.S.) |

|---|---|---|

| Number of violations | ≈500,000 | ≈10,000 (estimated) |

| Maximum per‑violation fine | 100million KRW (~$68,600) | $1.5million (per U.S. AML statute) |

| Theoretical total exposure | ≈$34billion | ≈$15million |

| Actual penalty imposed (as of Oct2025) | Negotiated settlement pending | $4.3billion |

| Regulatory body | Financial Services Commission (FSC) | U.S. Department of Justice & FinCEN |

Why the Korean crackdown matters

Upbit controls about 80% of domestic trading volume - roughly $40billion a day. When the FSC South Korea’s Financial Services Commission proposed a six‑month freeze on new user registrations, the impact rippled through the entire market. Traders feared sudden liquidity loss, while rival platforms like Bithumb saw a surge in sign‑ups.

The case also signals a shift in how Asian regulators view crypto. Earlier policies focused on bans and strict capital controls; today, the emphasis is on licensing, audit trails, and banking‑grade KYC. Legal analysts describe the Upbit audit as a “stress test” for the whole fintech sector, arguing that other jurisdictions will likely adopt a similar deep‑dive approach for future license renewals.

Practical steps exchanges are taking

In response to the FIU findings, several compliance‑focused changes are already underway across the industry:

- Document‑authentication tech: AI‑driven image analysis and blockchain‑anchored hash verification to detect forged IDs.

- Multi‑layer identity checks: Combining facial‑recognition, live‑liveness detection, and encrypted serial‑number validation for Korean driving licences.

- Extended data retention: Storing full onboarding packets for at least five years, allowing regulators to audit historic records without delay.

- Dedicated compliance teams: Hiring former FIU and FSC auditors to design internal controls that meet the Special Financial Transactions Act.

- Cross‑border monitoring: Real‑time screening of outbound transfers to foreign exchanges, with automated alerts for unregistered counterparties.

These upgrades are costly - estimates suggest a 30‑40% rise in compliance budgets for major Asian exchanges. However, industry veterans argue that the expense is a small price compared with the risk of losing a operating license.

Community reaction and market impact

Reddit threads in Korean crypto sub‑forums lit up with mixed feelings. Some users praised the crackdown, saying stricter rules will weed out bad actors and stabilize prices. Others warned that excessive regulation could drive capital to offshore platforms, jeopardizing South Korea’s reputation as a crypto hub.

Twitter sentiment analysis for the week following the FIU’s announcement showed a 12% uptick in negative mentions of Upbit, while mentions of “compliance” and “regulation” rose sharply. International traders began scouting alternatives, with a noticeable bump in Google searches for “Bithumb sign‑up” and “global crypto exchanges that comply with Korean law.”

Legal battle and next milestones

Upbit’s parent company, Dunamu, filed a lawsuit challenging the FSC’s sanctions, arguing that the audit methodology was biased and that many flagged accounts were actually verified after the fact. The court’s decision is slated for early 2026, but in the meantime the FSC has set a January20,2025 deadline for Upbit to submit a remediation plan.

If the exchange complies and negotiates a reduced fine, analysts predict a swift rebound in trading volumes. A harsher outcome-such as a prolonged ban on new registrations-could push a sizable share of Korean traders toward offshore services, potentially eroding the domestic market’s $50billion daily turnover.

Key takeaways

- Upbit faces over 500,000 alleged KYC breaches, the largest crypto compliance case on record.

- The FIU’s audit uncovered missing documents, faulty driving‑license checks, and unregistered foreign‑exchange transfers.

- Potential fines could reach $34billion, though a negotiated settlement is expected.

- Regulators are forcing exchanges to adopt advanced verification, longer data retention, and dedicated compliance teams.

- Community sentiment is split-some welcome tighter rules, others fear market flight to offshore platforms.

Frequently Asked Questions

What triggered the FIU’s investigation of Upbit?

A routine business‑license renewal review in late 2024 revealed gaps in Upbit’s customer‑verification records, prompting the FIU to launch a full‑scale audit.

How many violations did the FIU find?

More than 500,000 KYC‑related breaches, including missing IDs, flawed driving‑license checks, and unregistered foreign‑exchange transactions.

What are the possible penalties?

Each violation can attract up to 100million KRW (≈$68,600). In theory the total exposure tops $34billion, though the final settlement is expected to be far lower after negotiations.

How is Upbit responding?

Upbit has pledged to overhaul its KYC processes, introduce AI‑driven document verification, and submit a remediation plan by Jan202025. It also filed a legal challenge to the FSC’s sanctions.

Will this affect South Korean crypto traders?

A six‑month pause on new registrations could limit market growth, and some users may shift to other domestic or international exchanges. However, existing accounts remain active unless further penalties are imposed.

24 Responses

It must be proclaimed, with the gravest seriousness, that Upbit's flagrant neglect of KYC protocols represents a monumental breach of fiduciary duty; the sheer volume of alleged infractions – half‑a‑million cases – is nothing short of an institutional calamity; one cannot help but lament such egregious disregard for regulatory compliance; the market ramifications, both domestically and internationally, are profound and demand immediate rectification; the punitive calculus, albeit speculative, signals a watershed moment for exchange accountability.

Hey folks, great to see such detailed analysis! This calculator really helps demystify the potential impact. Even if the numbers are rough, it's a solid step toward transparency and understanding what we might be facing.

Upbit's situation underscores the importance of robust KYC frameworks globally. In many jurisdictions, similar compliance lapses have led to substantial fines and stricter oversight. By strengthening verification processes, exchanges can protect both users and the broader financial ecosystem. Moreover, this case may encourage regulators to standardize enforcement criteria, which could benefit market stability.

Nice work on breaking down the numbers. It’s a good reminder that behind each violation there’s a real risk to users’ funds. Staying vigilant and supporting exchanges that prioritize compliance is key for the community.

From a technical perspective, the enforcement of KYC isn’t just about paperwork; it’s about leveraging AML algorithms, blockchain analytics, and real‑time monitoring. When an exchange scales to half a million non‑compliant accounts, it suggests a systemic failure in data pipelines, risk scoring, and customer onboarding. Fixing this will require not only legal adjustments but also substantial infrastructure upgrades.

Yo, that calculator is fire! If you plug in 500k violations at 30M KRW each, you’re looking at a jaw‑dropping 15 trillion KRW before any discounts. Even with a 50% multiplier, that’s still 7.5 trillion – insane numbers that could shake up the entire crypto market.

The sheer scale of non‑compliance suggests deeper operational issues. Upbit likely lacked proper segregation of duties in the KYC department, and perhaps the internal audit trails were insufficient. This sort of systemic breakdown can’t be patched with a simple fine; it requires a cultural overhaul.

Wow, look at Upbit trying to play the blame game while the numbers keep climbing. Maybe they should've hired a real compliance team instead of counting on luck.

i think its really sad how all these big numbers just go unnoticed by the average user. they should do more to educate ppl about these risks, lol.

It is incumbent upon the regulatory authorities to impose a proportionate and equitable sanction upon Upbit, thereby upholding the integrity of the financial system. The exhibited negligence cannot be condoned, and a diligent review of the enforcement framework is warranted.

I feel for users who might have been caught in the crossfire. Transparency is key, and tools like this calculator empower us to understand potential repercussions.

This is the perfect example of why we need stricter oversight! If an exchange can get away with half a million KYC violations, what’s to stop even bigger scams? We must demand accountability now.

Ah, the drama of regulatory fallout-nothing like a massive fine to keep the crypto world on its toes. Honestly, though, it’s almost poetic how every misstep becomes a headline.

Let’s keep the discussion constructive. If Upbit wants to regain trust, they should publish a clear remediation plan and involve independent auditors.

First and foremost, the sheer magnitude of half a million non‑compliant accounts is an alarming indicator of systemic failure, which not only undermines the credibility of the exchange itself but also casts a long, ominous shadow over the wider cryptocurrency ecosystem. When regulators impose fines, the monetary penalties, while substantial, are merely the tip of the iceberg; the real costs manifest in eroded user confidence, potential loss of market share, and the incursion of heightened scrutiny from both domestic and international bodies. Moreover, the operational repercussions for Upbit are multifaceted. They will likely need to overhaul their KYC infrastructure, integrating more robust identity verification tools, perhaps leveraging biometric authentication, blockchain‑based AML solutions, and real‑time monitoring systems. This overhaul is not a trivial expense; it requires significant capital investment, hiring of seasoned compliance professionals, and a cultural shift toward a risk‑averse mindset. In addition, the fines-if we take the calculator’s baseline of 30 million KRW per violation-suggest an astronomical figure that could dwarf Upbit’s annual revenue, potentially forcing them to seek external financing or restructure. Such financial strain could ripple through the market, affecting token liquidity and potentially driving price volatility for assets listed on the platform. While the multiplier adjustment offers a concession, even a 50 % reduction leaves a staggering sum that cannot be ignored. It is also worth noting that the reputational damage may outlast any financial penalty; users may migrate to competitors with more transparent compliance histories, further impacting Upbit’s market position. Finally, this episode should serve as a cautionary tale for all exchanges. The regulatory environment is evolving rapidly, and complacency is no longer an option. Proactive compliance, regular audits, and transparent reporting are essential safeguards against similar catastrophes in the future.

Wow, that's a massive oversight! If Upbit dives into a sea of fines, they might have to start offering free coffee to retain users-just kidding, but seriously, the stakes are high.

Honestly, I’m just here for the numbers. Looks like a wild ride for Upbit if they don’t sort this out.

Isn't it suspicious how these massive fines always seem to appear right after a big price surge? Something's fishy.

Upbit needs to fix its KYC ASAP.

One must consider the hidden agendas behind regulatory crackdowns-perhaps a power play by entrenched financial interests seeking to stifle decentralized finance, thereby preserving the status quo. Indeed, the timing of these fines could be more than mere coincidence.

While some may dismiss these fines as routine enforcement, the underlying dynamics suggest a broader narrative: the relentless push by central authorities to rein in crypto's disruptive potential, coupled with an industry that sometimes underestimates its own vulnerabilities. The result? A perfect storm of regulatory pressure, public scrutiny, and internal complacency that culminates in the kind of crisis we now witness at Upbit. Yet, within this turmoil lies an opportunity-if Upbit can rise to the occasion, implement rigorous compliance, and restore trust, it may emerge stronger and set a benchmark for the entire sector.

🤔💡 Let’s hope this leads to better security for everyone! 🌟

These numbers are a wake‑up call for all of us. Even simple steps like regular KYC reviews can make a huge difference.

While the penalties are severe, it’s essential to approach the situation analytically rather than emotionally. A measured response will benefit the ecosystem.