Upbit KYC Violations Impact Calculator

Potential Fine Amount

0

Based on 0 violations at 0 KRW each

This calculator estimates the potential financial impact of Upbit's KYC violations based on regulatory penalties.

- Upbit is facing 500,000+ suspected Know Your Customer (KYC) violations

- Each violation carries a potential penalty of 100 million KRW (~$68,600 USD)

- Total theoretical maximum fine could reach $34 billion

- Actual settlements will likely be significantly lower due to negotiation factors

When South Korea’s Financial Intelligence Unit (FIU) tossed a spotlight on Upbit is a South Korean cryptocurrency exchange operated by Dunamu, handling over $8billion in daily transactions as of early 2025, the crypto world sat up straight. The FIU’s audit uncovered more than 500,000 suspected Know‑Your‑Customer (KYC) breaches - a number that dwarfs any previous enforcement action in the digital‑asset space. Below is a plain‑English breakdown of what happened, why it matters, and what traders, exchanges, and regulators should watch next.

What the FIU Found: A Quick Overview

The investigation, triggered during a routine business‑license renewal in late2024, identified several systematic gaps:

- Photocopied IDs accepted as genuine documents in thousands of registrations.

- Driving‑license submissions (≈190,000 cases) verified only by name and birthdate, ignoring the encrypted serial number that proves authenticity.

- Over 9million re‑verification attempts proceeded without any official ID collected from the user.

- About 45,000 cross‑border transactions routed to unregistered foreign exchanges, directly breaching the Act on Reporting and Using Specified Financial Transaction Information.

These failures fall under South Korea’s Special Financial Transactions Act, which mandates banking‑level AML/KYC standards for every virtual‑asset service provider.

Why the Scale Is Unprecedented

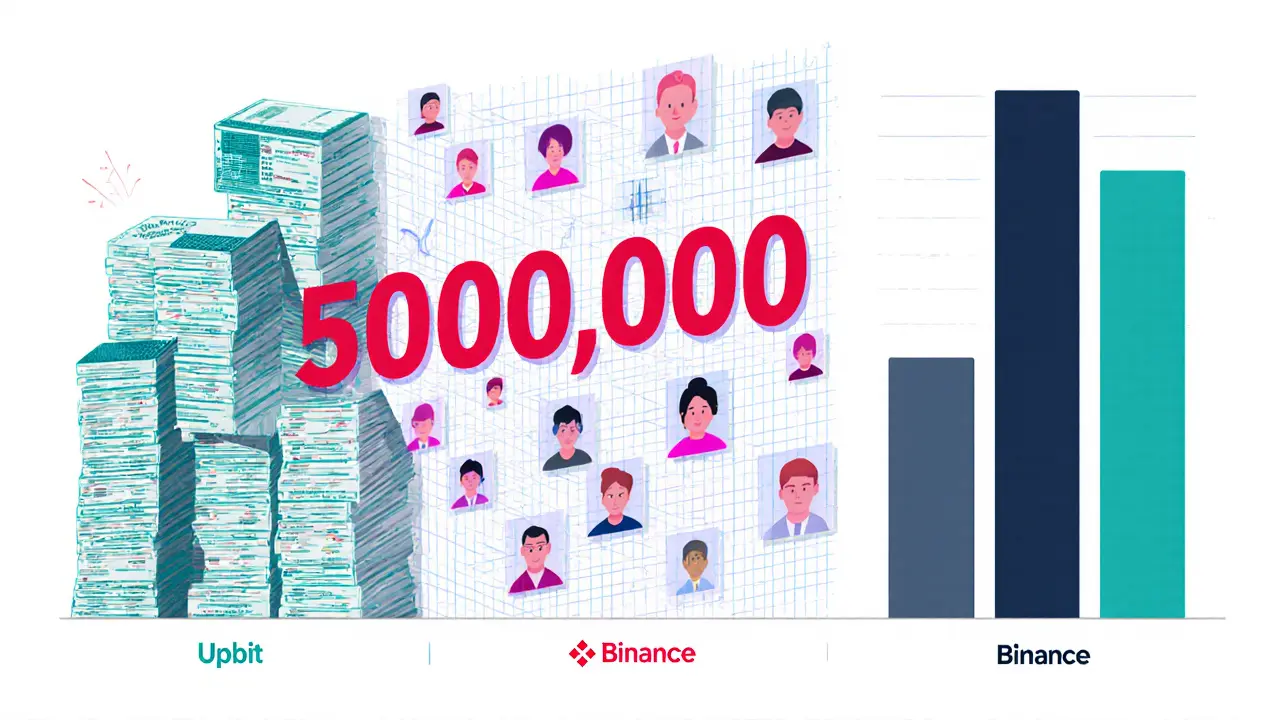

Globally, cryptocurrency exchanges have faced fines - Binance paid $4.3billion in the US, and KuCoin settled for $22million in multiple jurisdictions. Yet none have been scrutinized for half a million individual KYC lapses. The potential penalty - up to 100millionwon (≈$68,600) per breach - could theoretically reach $34billion, though realistic settlements will be far lower. The sheer volume of violations turns the case into a litmus test for how rigorously regulators can audit an exchange’s entire user‑onboarding history.

How Upbit’s Violations Compare to Other Exchanges

| Exchange | Regulatory Body | Number of Violations | Typical Penalty per Violation | Total Potential Fine |

|---|---|---|---|---|

| Upbit | South Korea FIU / FSC | ~500,000 | 100Mwon (~$68,600) | Up to $34billion (theoretical) |

| Binance | U.S. Department of Justice & FinCEN | ~20 (major AML breaches) | $215million (settlement amount) | $4.3billion (combined global settlements) |

The table shows that while Binance’s headline‑grabbing $4.3billion settlement was a single negotiated sum, Upbit faces a per‑violation fine that could explode if regulators pursue the maximum rate. That difference underscores how regional enforcement frameworks shape risk exposure.

Implications for Traders and Investors

For everyday users, the immediate worry is service continuity. The Financial Services Commission (FSC) has proposed a six‑month freeze on new user registrations, but existing accounts remain active. Traders should consider the following steps:

- Check account access. Log in now and verify that withdrawal functions are working.

- Update KYC documents. If you received a request from Upbit, submit original, high‑resolution IDs and a selfie‑verification as soon as possible.

- Diversify holdings. Moving a portion of your crypto to another reputable exchange (e.g., Bithumb, or a regulated international platform) can reduce exposure to a single point of failure.

- Monitor official communications. Both the FSC and Upbit will release statements before the Jan202025 deadline; staying informed helps you react quickly to any suspension or forced migration.

Community sentiment on Korean forums and on Reddit shows a spike in interest for alternative platforms, but also a growing appreciation for stronger compliance - many users are now vetting exchanges based on audit histories rather than just fees or UI.

What Exchanges Need to Do Moving Forward

Upbit’s case sends a clear signal: regulators will dig deep into historic onboarding records, not just current snapshots. Exchanges operating in strict jurisdictions should adopt a layered compliance strategy:

- Document authentication technology. Deploy AI‑driven image analysis that checks for tampering, validates encrypted serial numbers on Korean driving licenses, and cross‑references government databases.

- Multi‑factor identity checks. Combine facial recognition, live‑video verification, and proof‑of‑address services to meet the Special Financial Transactions Act’s standards.

- Extended audit trails. Store every KYC interaction for at least five years, with immutable logs that can be exported on demand during license reviews.

- Dedicated compliance teams. Increase staff ratios (aim for 1 compliance officer per 10,000 active users) to ensure continuous monitoring and rapid remediation.

These upgrades will raise operational costs, but they also provide a defensive shield against future fines and help maintain user trust.

Legal and Regulatory Outlook

Upbit’s operator, Dunamu, has already filed a lawsuit challenging the FSC’s sanctions. The Jan202025 deadline for responding to the suspension notice will be the first major legal showdown. Experts predict three possible outcomes:

- Negotiated settlement. Upbit may agree to pay a scaled‑down fine and commit to a compliance overhaul.

- Partial penalty. The FSC could impose a modest monetary fine while keeping the exchange operational, using the case as a warning to the industry.

- Escalated enforcement. In a worst‑case scenario, regulators could extend the registration freeze beyond six months or impose stricter capital requirements.

Regardless of the final decision, the case will cement South Korea’s reputation as a crypto‑regulation pioneer. Other jurisdictions - from the EU to Japan - are watching closely, and many are expected to embed similar “license‑renewal audit” clauses into their own frameworks.

Key Takeaways for the Crypto Community

- Upbit faces the largest KYC‑violation count in crypto history - >500,000 breaches.

- Potential fines could reach billions, but settlements will likely be negotiated.

- Regulators are now scrutinizing historic onboarding data, not just current compliance.

- Traders should verify their accounts, consider diversifying, and stay tuned to official updates.

- Exchanges must invest in robust, AI‑powered KYC pipelines and maintain long‑term audit logs.

Frequently Asked Questions

What triggered the FIU’s investigation into Upbit?

The FIU started a deep‑dive during Upbit’s routine three‑year business‑license renewal in late2024. A random sample of onboarding records revealed widespread use of photocopied IDs and missing documents, prompting a full audit.

How many users could be affected by the KYC breaches?

Roughly half a million accounts showed at least one compliance shortfall. The exact number of impacted users will become clearer once Upbit provides a final remediation report.

Will Upbit shut down completely?

Current proposals limit only new user registrations for six months. Existing accounts remain active, so a total shutdown is not on the table at this stage.

How does this case compare to Binance’s US settlement?

Binance paid a single $4.3billion settlement for multiple AML violations. Upbit, by contrast, faces per‑violation fines that could total tens of billions if fully applied, highlighting the impact of South Korea’s per‑case penalty structure.

What steps should I take to protect my crypto on Upbit?

Log in today, ensure you can withdraw, and promptly upload any requested original IDs. If you’re uneasy about future disruptions, consider moving a portion of your holdings to another regulated exchange.

11 Responses

they're not even trying anymore. the whole system is rigged. every crypto exchange is a front for shadow banking, and Upbit? they're just the first one dumb enough to get caught. they knew the IDs were fake, they knew the serial numbers weren't checked, and they still let it ride. why? because the real money isn't in trading - it's in laundering. the FIU didn't find violations - they found a blueprint for how the entire global underground economy runs. and now they want to shut it down? please. this is just the first domino. next up: your bank account. you think you're safe? you're not.

lol at these westerners acting shocked. we in India have been doing this since 2017 - photocopy Aadhaar, slap on a selfie, boom, crypto account. Upbit’s got 500k violations? we had 50 million unverified wallets before RBI woke up. at least they’re trying to fix it now. if you want real compliance, go to Japan or Singapore. South Korea’s just playing catch-up with a stick.

I just want to say how brave it is for Upbit to even try to comply in such a complex system. So many exchanges just ignore KYC entirely, but they’re trying to fix it. That takes courage. To everyone scared about losing access - you’re not alone. I’ve been there. I moved my assets to Bithumb last week and it was terrifying, but also kind of empowering. We’re not just users - we’re part of building something better. Keep your head up, stay informed, and don’t let fear make you reckless. We’ve got this.

500k violations and you’re still trading on Upbit? you’re not a trader you’re a sucker. they knew. they let it happen. they’re laundering your money and you’re too lazy to move it. your portfolio is a liability now. sell everything. move to Binance.US. or better yet - go full Hodl on Bitcoin and never touch another exchange again. this isn’t finance it’s a crime scene and you’re standing in the blood.

did you even check your account?

It is imperative to note that the Financial Services Commission’s regulatory framework operates under the Special Financial Transactions Act, which mandates stringent documentation protocols for virtual asset service providers. The presence of photocopied identification documents constitutes a material breach of statutory obligations, and the failure to validate encrypted serial numbers on Korean driver’s licenses represents a systemic failure in identity verification infrastructure. Furthermore, the absence of official ID collection in over nine million re-verification attempts suggests a deliberate circumvention of compliance protocols, which may constitute criminal negligence under Korean penal code Article 132.

Man, I’ve been on Upbit since 2021 and honestly I didn’t even know they were this sloppy. But hey - we’re all learning, right? I just uploaded my new ID and selfie today. Took 3 tries because my lighting was bad lol. But seriously, if this pushes all exchanges to get better? I’m all for it. We need real KYC, not just checkboxes. And to everyone panicking - chill. My cousin in Mumbai uses a similar exchange and they just got fined last year. He’s still trading. We’ll be fine. Let’s not turn this into a panic fest. Support the fix, don’t run from it.

bro i just checked my upbit app and it says 'KYC pending' like it's been that way since last year. i just ignore it. i'm not paying $68k to prove i'm me. if they want me to send a notarized letter from my grandma in ohio then i'm moving to binance. who even has time for this?

hey guys just a heads up - if u got ur id rejected by upbit, try using ur passport instead of drivers license. i did that last week and it went thru in 2 hrs. also make sure ur pic is in good light and ur face is not covered by hair. i missed it first time cause i had a beard. lol. also dont upload pdfs - only jpg/png. hope this helps!

For anyone stressed about this - you’re not alone. I’ve been in crypto since 2017 and seen exchanges come and go. Upbit’s mistakes are serious, but they’re fixable. The fact that they’re being held accountable is actually a good sign. This is how the industry matures. If you’ve got funds on there, update your docs. If you’re unsure, move 20% to a regulated platform like Kraken or Coinbase. Don’t panic, just act. This isn’t the end - it’s the beginning of a smarter, safer crypto ecosystem. You’re part of that change.

the west is jealous. we built a system where people can trade freely without begging for permission. now the americans and europeans want to copy our rules but they can’t even get their own banks to stop laundering. this isn’t compliance - it’s control. they want to own your money. don’t fall for it. if upbit gets shut down, it’s not because they broke the rules - it’s because they refused to be another puppet of the fiat empire.