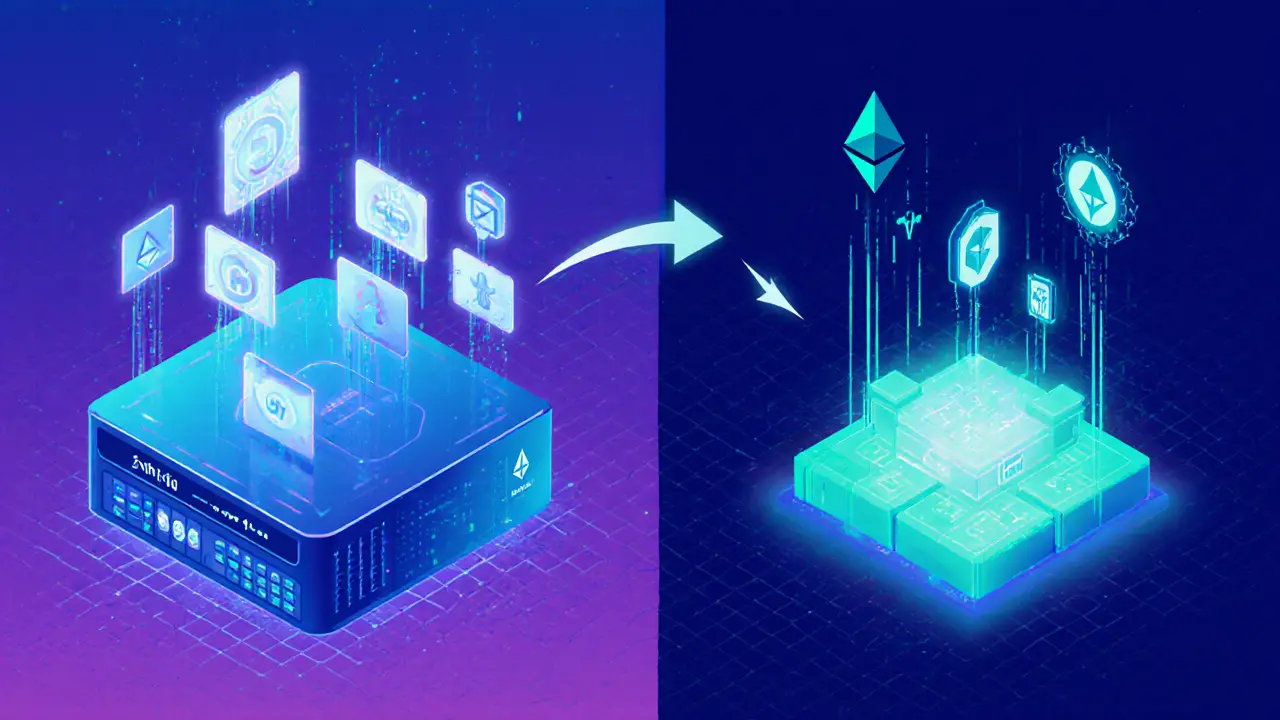

0x Protocol vs. AMM DEX Comparison Tool

0x Protocol

Hybrid off-chain order relay + on-chain settlement model that reduces gas costs significantly.

AMM DEXs (Uniswap, SushiSwap)

Fully on-chain automated market maker model that provides instant liquidity but higher gas fees.

| Feature | 0x Protocol | AMM DEXs |

|---|---|---|

| Architecture | Hybrid (off-chain order relay + on-chain settlement) | Fully on-chain AMM model |

| Gas Efficiency | Only final settlement costs (~20-30% lower) | Every swap costs full gas |

| Supported Assets | ERC-20, ERC-721, ERC-1155 | ERC-20 (ERC-721 via wrappers) |

| Liquidity Provision | Order-book style; liquidity mined via ZRX staking | Concentrated liquidity pools (Uniswap V3) / Standard pools |

| Governance Token | ZRX (governance, fee discounts, staking) | UNI/SUSHI (governance, staking rewards) |

- Significantly lower gas fees for large trades

- Supports NFTs and complex token standards

- Hybrid architecture provides flexibility

- Decentralized order book management

- Advanced governance through ZRX token

- Instant liquidity for any token pair

- No reliance on third-party relayers

- Simple and straightforward trading experience

- Proven track record with large user base

- Automated market making eliminates need for order matching

Trade-off Summary

0x Protocol excels in cost-efficiency for large orders and complex asset types, while AMM-based DEXs provide superior instant liquidity and simplicity. Your choice should depend on whether you prioritize gas savings or immediate execution.

Quick Takeaways

- 0x Protocol is an open‑source layer that lets anyone build a DEX on Ethereum.

- Its native ZRX token powers governance, fee discounts and liquidity mining.

- The hybrid off‑chain order relay + on‑chain settlement cuts gas costs dramatically.

- Developers use the 0x Launch Kit or 0x API to add instant swaps to wallets and DeFi apps.

- Compared with on‑chain‑only DEXs, 0x offers better price‑depth and lower transaction fees.

When people talk about decentralized trading, 0x Protocol is an open‑source infrastructure that lets developers build their own decentralized exchanges on the Ethereum blockchain. Launched in 2017 by 0x Labs, it introduced a hybrid model where most of the order‑book lives off‑chain, while the final settlement happens on‑chain. The result is a faster, cheaper way to swap ERC‑20 tokens, NFTs and even tokenized real‑world assets. Below we break down the core pieces, why the ZRX token matters, and how you can start using the stack today.

How 0x Protocol Works

The architecture splits into two layers:

- Off‑chain order relay: Relayers (Relayer) host order books, match makers with takers, and broadcast signed orders through APIs like 0x Mesh. Because no transaction is sent to the blockchain until a trade is filled, you avoid paying gas for every order update.

- On‑chain settlement: When a taker decides to fill an order, the signed order data is submitted to a set of smart contracts on the Ethereum blockchain. The contracts verify the maker’s signature, check balances, and atomically swap the assets. Only this final step consumes gas.

This four‑step flow (create‑sign‑match‑settle) gives you the security of blockchain while keeping most communication off‑chain, which is why 0x can undercut the gas fees of fully on‑chain DEXs like Uniswap.

Roles of Makers, Takers, and Relayers

A Maker is anyone who posts an order-think of them as the seller or liquidity provider. They specify the token pair, price, and expiration, then sign the order with their private key. A Taker is the counterparty who fills part or all of that order. The taker sends a transaction to the settlement contract, which validates the maker’s signature and moves the tokens.

Relayers simply host the off‑chain order book. They don’t hold users’ funds and they never execute trades themselves; they charge a small fee for matchmaking and for providing a reliable API endpoint. Popular relayers include Matcha, MetaMask Swaps and the open‑source 0x Mesh network.

Why ZRX Token Matters

The ZRX token is the economic glue of the ecosystem. Its three main uses are:

- Governance: Token holders can submit and vote on protocol upgrades, fee‑structure changes, and funding proposals via the 0x DAO. Larger ZRX balances give you proportionally more voting power.

- Fee discounts: While anyone can pay gas in ETH, relayers often offer a discounted fee rate to users who pay with ZRX. The discount rate is set by each relayer and can be as high as 30%.

- Liquidity mining: Projects can stake ZRX to earn a share of trading fees generated on the DEXs built on 0x. Stakers lock their tokens for a defined period, and the protocol distributes rewards in proportion to the amount staked.

Holding ZRX doesn’t obligate you to any action, but it gives you a voice and a way to boost your returns if you provide liquidity.

Building on 0x: Launch Kit & API

If you’re a developer, the easiest entry point is the 0x Launch Kit. It’s a ready‑made codebase that bundles the smart‑contract suite, a React front‑end, and scripts for deploying on mainnet or testnets. With a few commands you can spin up a fully functional DEX, add your own branding, and start earning fees.

For teams that only need swap functionality, the 0x API aggregates liquidity from every relayer in the network. You send a simple HTTP request with the tokens you want to trade, and the API returns the best price, gas estimate, and a transaction payload ready for signing. Wallets like MetaMask and DeFi apps such as dYdX already embed the API to offer instant swaps without users ever leaving the app.

0x Protocol vs. Other Decentralized Exchanges

| Feature | 0x Protocol | Uniswap V3 | SushiSwap |

|---|---|---|---|

| Architecture | Hybrid (off‑chain order relay + on‑chain settlement) | Fully on‑chain AMM | Fully on‑chain AMM |

| Gas efficiency | Only final settlement costs (≈20‑30% lower) | Every swap costs full gas | Same as Uniswap |

| Supported assets | ERC‑20, ERC‑721, ERC‑1155 | ERC‑20 (ERC‑721 via wrappers) | ERC‑20 |

| Liquidity provision | Order‑book style; liquidity mined via ZRX staking | Concentrated liquidity pools | Standard pools |

| Governance token | ZRX (governance, fee discounts, staking) | UNI (governance, fee rebates) | SUSHI (governance, staking rewards) |

The table makes it clear that 0x’s biggest advantage is cost‑efficiency for large orders, while AMM‑based DEXs shine on instant liquidity for any token pair. Your choice depends on whether you prioritize price impact or gas savings.

Real‑World Use Cases

Beyond simple token swaps, developers have integrated 0x into:

- DeFi aggregators: Platforms like Matcha route trades through multiple relayers to find the best price.

- Wallets: MetaMask and Trust Wallet embed the 0x API so users can swap tokens without leaving the wallet.

- NFT marketplaces: By supporting ERC‑721, 0x enables batch sales of NFTs with lower gas than on‑chain listings.

- Tokenized assets: Early pilots have tokenized real‑estate parcels, allowing fractional ownership and instant transfers via 0x settlement contracts.

These examples show how the protocol is not just a swap engine but an infrastructure layer for any application that needs trustless asset exchange.

Future Outlook

Since its 2017 debut, 0x has steadily expanded to Layer‑2 networks like Arbitrum and Optimism, further cutting fees. The roadmap includes:

- Cross‑chain support: Bridges to Polygon and Solana are in beta, letting users trade assets across ecosystems.

- Enhanced order types: Conditional orders, stop‑loss, and TWAP (time‑weighted average price) are being added to the smart‑contract suite.

- Governance upgrades: Proposals to allocate a portion of trading fees to a community development fund are already on the ballot.

As DeFi matures, the hybrid model that 0x pioneered is likely to remain relevant, especially for institutional traders who need deep liquidity without massive gas burns.

Frequently Asked Questions

What is the main difference between 0x and typical AMM DEXs?

0x uses an off‑chain order book and only settles on‑chain when a trade is executed, which reduces gas costs compared to AMM models that require a full on‑chain transaction for every swap.

Do I need ZRX to trade on a 0x‑based DEX?

No. Anyone can trade using ETH for gas. ZRX is optional but gives fee discounts and voting rights if you hold it.

How safe are orders posted to relayers?

Orders are just signed messages; they don’t move funds until a taker submits the order to the settlement contract. Even if a relayer disappears, the order remains harmless.

Can I use 0x to trade NFTs?

Yes. The protocol supports ERC‑721 and ERC‑1155 tokens, so NFT marketplaces can batch‑list and swap NFTs with the same low‑gas settlement flow.

What are the steps to launch my own DEX with 0x?

1. Clone the 0x Launch Kit repo. 2. Configure your smart‑contract addresses (Ethereum or Layer‑2). 3. Deploy the contracts with your own admin keys. 4. Customize the front‑end UI. 5. Connect to the 0x Mesh network or a relayer API. 6. Test on a testnet before going live.

18 Responses

Wow, the hybrid design of 0x really feels like a breath of fresh air for traders who hate sky‑high gas fees. By keeping the order book off‑chain and only committing the final settlement, you get both speed and security. It’s especially helpful for those moving large ERC‑20 positions or NFTs. I can see how this architecture could lower barriers for newcomers. Keep the explanations coming – it’s easier to follow than most technical deep‑dives!

Looks solid, but seems overhyped.

Hey folks, love the optimism around 0x! The fee discounts with ZRX are a sweet perk for regular users. Also, the ability to trade NFTs without paying massive gas is a game‑changer. Let’s keep the vibe positive and share more use‑cases. The community thrives when we lift each other up!

Oh my gosh!!! This protocol sounds sooo amazing,, but also kinda confusing,,, why do we need both off‑chain and on‑chain??!! Maybe it’s just me, but the jargon is overwhelming…!!!

Totally agree that 0x brings a lot of flexibility to DeFi. It’s great to see an inclusive platform that supports ERC‑20, ERC‑721, and even ERC‑1155 tokens. The hybrid model gives developers room to innovate while keeping costs low. Let’s keep sharing projects built on this stack – it helps everyone learn!

Sure, save some gas, but you still need to trust relayers. 🙄

While the technical merits are clear, it's also important to consider the ecosystem's overall health. Definately, the community governance via ZRX adds a layer of decentralisation that many on‑chain DEXs lack. However, the reliance on off‑chain relayers introduces a point of failure that must be mitigated. Please keep an eye on the upcoming Layer‑2 rollouts – they could further enhance security.

The 0x Protocol epitomises a paradigmatic shift in decentralized exchange architecture, wherein the dichotomy between order‑book liquidity and automated market making is reconciled through a bifurcated off‑chain/on‑chain settlement paradigm; this convergence is underpinned by cryptographic primitives that guarantee immutability of signed orders whilst relegating state changes to the consensus layer solely during execution. From a systems‑design perspective, the off‑chain mesh network functions as a distributed ledger of intent, propagating signed order messages via a gossip protocol that ensures low‑latency dissemination across geographically disparate nodes. This architectural stratification yields a substantive reduction in gas consumption, as empirical analyses have demonstrated a 20‑30 % decrease relative to fully on‑chain AMM models when executing large‑volume trades. Moreover, the protocol’s support for ERC‑721 and ERC‑1155 standards facilitates composable NFT marketplaces, thereby extending the utility of decentralized trading beyond fungible assets. The governance token, ZRX, operates not merely as a mechanism for fee discounts but also as a conduit for on‑chain collective decision‑making, enabling token holders to vote on parameter adjustments such as fee tiers, relayer incentive structures, and protocol upgrades. Staking incentives further align economic interests by allocating a portion of transaction fees to participants who lock ZRX, thus fostering a virtuous cycle of liquidity provision and token appreciation. In contrast to AMM DEXs, which suffer from impermanent loss and price slippage under asymmetric demand, 0x’s order‑book model provides price discovery that mirrors traditional centralized exchanges while preserving decentralisation. The protocol’s extensibility is exemplified by the 0x Launch Kit, which abstracts away low‑level contract interactions and offers a plug‑and‑play front‑end for rapid deployment of bespoke DEXes. Additionally, the 0x API aggregates liquidity across the mesh, presenting developers with a singular endpoint that returns optimal routing paths, gas estimates, and transaction payloads, thereby lowering the barrier to entry for wallet integrations. The cross‑chain roadmap, currently targeting Polygon, Arbitrum, and Optimism, promises to alleviate residual gas constraints and broaden market participation. Future enhancements slated for inclusion encompass conditional order types, such as stop‑loss and TWAP, which will enrich the protocol’s order syntax and empower algorithmic traders. The confluence of these features positions 0x as a compelling infrastructural layer for the next generation of DeFi applications, particularly for institutional actors seeking deep liquidity without prohibitive transaction costs. Consequently, the protocol’s hybrid model may well become the de‑facto standard for high‑throughput, low‑cost decentralized trading.

Reading the deep‑dive you just gave really clarified how the off‑chain mesh operates. I appreciate the emphasis on cryptographic signatures; it reassures me that the order integrity is never compromised before settlement. The point about ZRX staking aligning incentives is crucial – it not only fuels liquidity mining but also creates a feedback loop that can sustain network health. Also, the mention of cross‑chain deployment resonates with the ongoing demand for cheaper transactions on Layer‑2 solutions. While the architecture sounds robust, I wonder how the protocol handles order‑cancellation spam, especially when malicious actors flood the mesh with low‑value orders. In practice, relayers often enforce fee thresholds or rate limits, which mitigates such abuse. Overall, the synergy between the mesh and on‑chain contracts appears to strike a pragmatic balance between decentralisation and performance.

Yo, all this hype about 0x being the future is just another layer of illusion the elites are feeding us! They say off‑chain order books are "decentralised", yet who controls those relayers? You got big players sitting behind the scenes, pulling strings, and we are left to believe it's all open‑source freedom. It feels like a clever smokescreen to keep us paying gas while they skim the fees in the shadows. Wake up, people – the protocol might just be another puppet in the grand crypto theater.

There’s definitely a kernel of truth in the concerns about relayer centralisation, but the ecosystem is actively working to decentralise the mesh network itself. By incentivising multiple independent relayers and allowing them to compete on fee structures, the protocol mitigates single‑point‑of‑failure risks. Moreover, the open‑source nature of the codebase empowers anyone to run their own node, fostering a more distributed order‑book landscape. So while vigilance is warranted, the trajectory points toward a healthier, more resilient infrastructure.

Let’s crank up the energy! 0x isn’t just a protocol – it’s a launchpad for creators to build the next big DeFi experience. Dive in, experiment with the Launch Kit, and show the world that low‑cost, high‑speed swaps are totally doable. The future is yours to shape, so grab that ZRX, stake it, and ride the wave of innovation!

Honestly, I think 0x is a game‑changer for everyday traders. The fee discounts make swapping feel cheap, and the ability to trade NFTs without burning through ETH is huge. If more wallets plug into the API, we’ll see a smoother experience for the masses.

Totally vibe with you – the API makes stuff super easy. I tried it in a testnet and it felt smooth af. Just a lil tip: double‑check the contract adresses before you go live, it saved me a bunch of headaches.

America needs its own decentralized exchanges, not some foreign‑run mesh.

Hey, I get the pride thing, but the beauty of crypto is its global nature. Sharing tech across borders only makes the ecosystem stronger for everyone.

0x really rocks! 🚀💰

Indeed, the protocol’s architecture is a symphony of cryptographic elegance, where each off‑chain whisper culminates in an on‑chain crescendo that reverberates across the blockchain universe. The drama of low‑gas, high‑speed execution is nothing short of poetic, and it propels DeFi into a new epoch of accessibility and sophistication.