MainnetZ (NETZ) is a blockchain platform built to run decentralized apps faster and cheaper than Ethereum. It promises 2000 transactions per second and 3-second confirmation times - numbers that sound impressive when you compare them to Ethereum’s 15-30 transactions per second. But here’s the catch: MainnetZ isn’t a household name. It doesn’t have the user base, developer activity, or exchange listings of projects like Polygon or BNB Chain. And its price has crashed over 99% from its peak.

What MainnetZ Actually Does

MainnetZ is a standalone blockchain that’s fully compatible with the Ethereum Virtual Machine (EVM). That means if you’re a developer who’s built a smart contract on Ethereum, you can drop it onto MainnetZ with almost no changes. Tools like MetaMask, Hardhat, and Solidity work the same way. That’s the main selling point. It’s not trying to reinvent the wheel. It’s trying to be a faster, cheaper version of Ethereum. Think of it like a toll road that promises fewer cars and quicker trips. But if no one’s driving on it, the road doesn’t matter. The project doesn’t publish a whitepaper, GitHub repo, or detailed technical docs publicly. That’s a red flag. Most serious blockchains make their code open and explain their consensus mechanism - whether it’s Proof of Stake, Proof of Authority, or something custom. MainnetZ doesn’t. We know it’s EVM-compatible. That’s it.NETZ Token: Supply, Price, and Market Reality

The NETZ token is the native currency of the MainnetZ blockchain. It’s used for paying transaction fees, staking, and possibly future governance. Here’s what the numbers show:- Circulating supply: 143.36 million NETZ

- Max supply: 1.1 billion NETZ

- ATH price: $0.161 (January 9, 2024)

- Current price (early 2026): Around $0.0009-$0.0013

- Market cap: Roughly $186,000 (CryptoRank) to $445,000 (BeInCrypto) - a massive range that shows how unreliable the data is

Where You Can Buy NETZ

You won’t find NETZ on Binance, Coinbase, or Kraken. It’s only listed on smaller, less-regulated exchanges:- LBank

- BitMart

- MEXC Global

- You can’t easily buy or sell NETZ without moving the price.

- If you need to cash out fast, you might not find buyers.

Why MainnetZ Isn’t Growing

There are over 250 blockchains competing for developers and users. Most of them are EVM-compatible. So why would anyone choose MainnetZ?- No developer tools: No official documentation. No SDKs. No tutorials.

- No ecosystem: No DeFi apps, no NFT marketplaces, no games built on it.

- No community: No Reddit threads. No active Twitter/X account. No Discord server with real engagement.

- No media coverage: BeInCrypto admits they “lack accurate trading data.” That’s not a review - that’s an admission of irrelevance.

Is MainnetZ a Scam?

It’s not a scam in the classic sense - no one’s been arrested, no one’s admitted to fraud. But it fits the profile of a “pump and dump” project that got attention briefly, then vanished. The team never revealed their identities. No LinkedIn profiles. No public interviews. No roadmap updates since early 2024. That’s not stealthy - that’s suspicious. The price spike in January 2024 likely came from a small group of insiders dumping NETZ on retail traders. Once the price hit $0.16, they sold. The market collapsed. Now, the few remaining holders are holding onto hope - or hoping someone else will buy in and push the price up again.

Should You Invest in NETZ?

If you’re looking for a long-term investment, the answer is no. If you’re looking to gamble on a low-liquidity, high-volatility token with no fundamentals, then maybe - but only with money you can afford to lose completely. Here’s the reality: MainnetZ has no product, no users, no developers, and no future. The EVM compatibility is real - but so is every other EVM chain that actually works. Polygon has 10,000+ apps. BNB Chain has millions of users. MainnetZ has… nothing. The only reason NETZ still trades at all is because some crypto traders chase any token with price swings. That’s not investing. That’s betting on a roulette wheel with no numbers.What Happens Next?

Without a team update, a public roadmap, or a single major partnership, MainnetZ will likely fade into obscurity. It’s already on the edge of being delisted from exchanges. If trading volume drops below $5,000 per day, even the smaller exchanges may remove it. There’s no evidence of active development. No GitHub commits. No new contracts deployed. No new wallets created. No new users. Just a token price bouncing between $0.0004 and $0.0013 - a ghost of a project that never lived. If you’re a developer, don’t waste your time. If you’re a trader, treat NETZ like a lottery ticket - not an asset. And if you’re just learning about crypto? Use MainnetZ as a lesson: look for teams, tools, and traction - not just technical specs on a website you can’t verify.Is MainnetZ (NETZ) a good investment?

No. MainnetZ has no active development, no real user base, and no ecosystem. Its price crashed over 99% from its peak, and trading volume is extremely low. It’s not a project - it’s a speculative token with no foundation. Only risk capital should be used, and even then, it’s not an investment - it’s a gamble.

Can I use MainnetZ for DeFi or NFTs?

Not practically. There are no known DeFi protocols, DEXs, or NFT marketplaces built on MainnetZ. While it’s technically possible to deploy smart contracts due to EVM compatibility, there are no tools, tutorials, or community support to help you do it. No one is using it, so there’s no reason to build on it.

Where can I buy NETZ tokens?

NETZ is only available on a few small exchanges: LBank, BitMart, and MEXC Global. You can only trade it against USDT. It’s not listed on any major platforms like Binance, Coinbase, or Kraken. Liquidity is very low, so buying or selling large amounts will likely move the price significantly.

Why is the price of NETZ so volatile?

The price swings because of low trading volume and lack of market depth. With under $20,000 traded daily across all exchanges, even small buy or sell orders can cause wild price movements. Some platforms report +420% daily gains while others show -14% drops - this inconsistency suggests data issues or manipulation by a small group of traders.

Does MainnetZ have a whitepaper or official website?

No public whitepaper, official website, or GitHub repository has been verified. The project provides no technical documentation, team information, or development roadmap. This lack of transparency is a major red flag for any blockchain project, especially one claiming to be a developer platform.

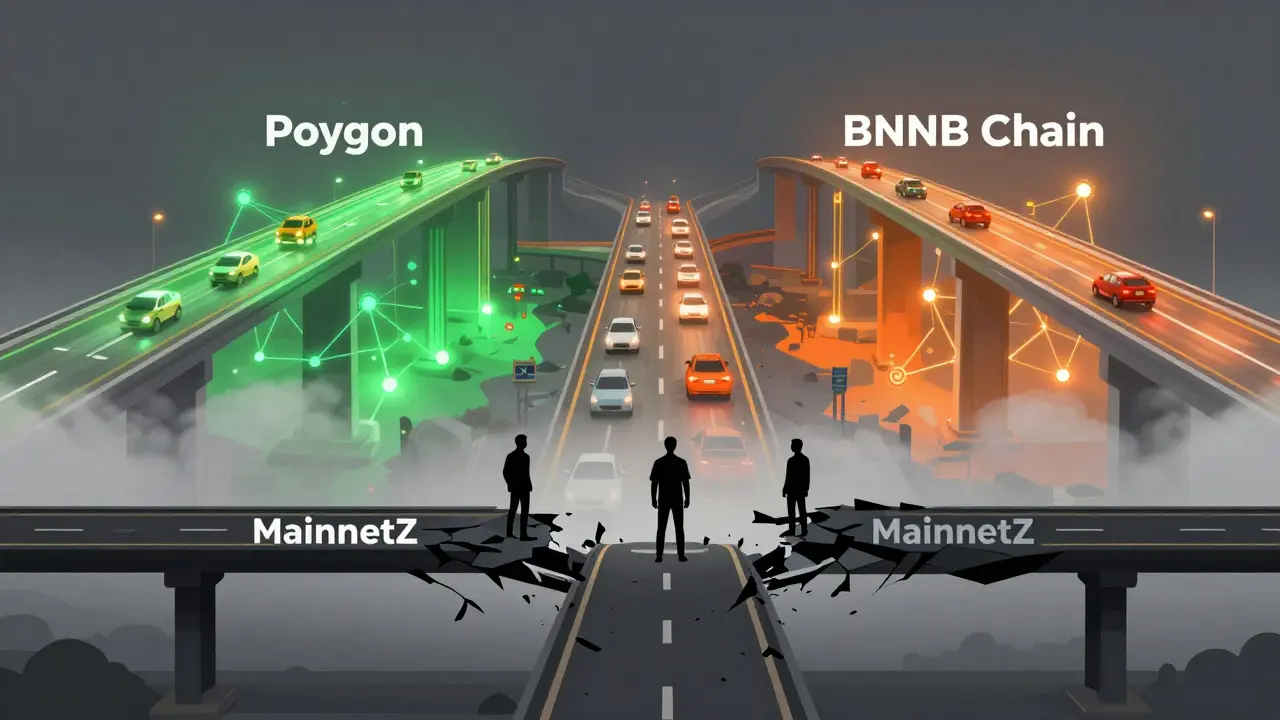

How does MainnetZ compare to Polygon or BNB Chain?

MainnetZ has no comparison. Polygon and BNB Chain have millions of users, thousands of apps, active developer communities, and billions in TVL. MainnetZ has none of that. Even though it claims similar EVM compatibility, it lacks the infrastructure, adoption, and support to be a real alternative. It’s not a competitor - it’s an afterthought.